Could we soon see growth return to the FTSE 350? Well, let’s start by highlighting the dire performance of the UK stock market in recent years.

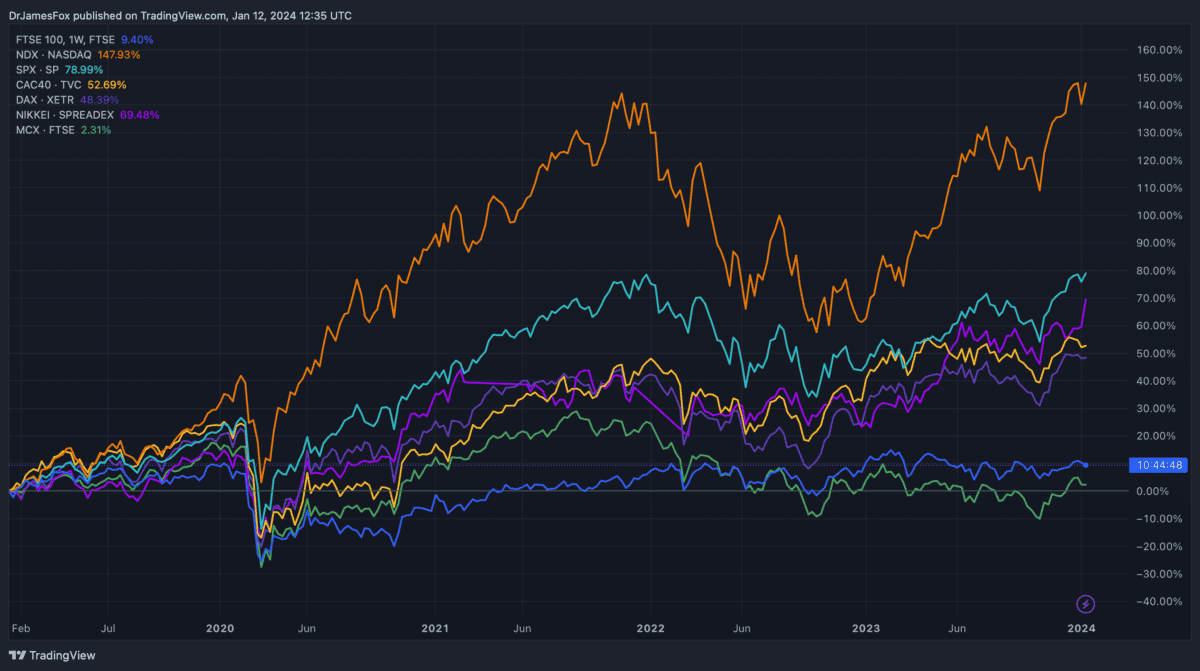

Below, I’ve compared the FTSE 100 (dark blue) and the FTSE 250 (green) with other major indices, including the Nasdaq, S&P 500, CAC40, DAX, and the Nikkei.

As we can see, the FTSE 100 and FTSE 250 are almost flat over the five-year period. Meanwhile, the other indices have grown at least 50% over the five years. The tech-heavy Nasdaq has more than doubled in value.

What does this mean?

Uncertainty isn’t good for stocks, and that’s evident when we look at the UK stock market.

The prolonged ambiguity surrounding Britain’s departure from the European Union introduced volatility and hesitancy among market participants.

This uncertainty, coupled with Britain’s slow economic growth in recent years and political upheaval, has impacted stock performance.

Investors and funds alike, cautious amid concerns about trade disruptions, regulatory changes, and the broader economic landscape, haven’t favoured the index.

And this is still the case. Particularly with interest rates rising, investors have been tempted away from risk assets, and have favoured government bonds and cash.

Things are changing

I’m by no means a perennial optimist on the state or future of the UK economy. For one, we’re experiencing developing world issues including falling life expectancy and long-term sickness as well as other issues including low levels of workforce participation.

However, there have been some positive long-term forecasts of late. These reflect the underlying strength of the UK economy and, according to one, the UK could become Europe’s largest economy within 15 years.

Moreover, a near-term boost will likely come in the form of falling interest rates. As rates fall, capital tends to move away from bonds and cash towards stocks, thus pushing up their values. Some of this change is priced in, but not all of it.

Valuations are low

There’s tons of hidden potential on the FTSE 350. Stock valuations are low compared to their peers in the US, although that does reflect the lower growth expectations in the UK.

Just look at UK banks. Barclays, Lloyds and NatWest trade with forward price-to-earnings ratio around 30-50% under the global average. While this does reflect recession concerns, the more positive longer-term economic picture isn’t factored in.

And that’s the case if we look at the index more broadly. Below, we can see the discount that the FTSE 100 has versus its American and global peers.

| Index | Price-to-earnings (P/E) ratio |

| S&P 500 | 22 |

| World index | 18.5 |

| FTSE 100 | 10 |

Being paid to wait

It’s by no means a given that UK stocks will surge this year. But these valuations suggest the index will see some upward moment — but that might not be for a while.

However, there’s another positive. Companies with low, or depressed, share prices tend to have higher dividend yields. So that means I can still earn money while I’m waiting for my stocks to reach their potential.

In short, I don’t see these opportunities coming around too often. Now could be a great time to pick up undervalued stocks, and hold them until their potential is realised.