There are plenty of reasons why we’d want to earn a passive income. We may just want to supplement our income, or maybe we’re looking to move away from full-time work. Of course, that’s our decision.

And in the current market, passive income’s become something of a hot topic. With elevated interest rates, we can get better returns on our savings. And with the UK stock market in a state of slumber, we can receive excellent yields.

So with that in mind, here’s an easy strategy to generate a ton of it within a Stocks & Shares ISA.

The simple way

If we’re investing money in stocks and we want to earn a passive income, the simple way is to invest in those that pay a dividend. Some of these companies pay dividends annually, and some more frequently.

Dividends are by no means guaranteed. It can pay me to look at the company’s track record for dividend payments or look at the dividend coverage ratio. Essentially, I want to know the company earns more money than it pays to shareholders.

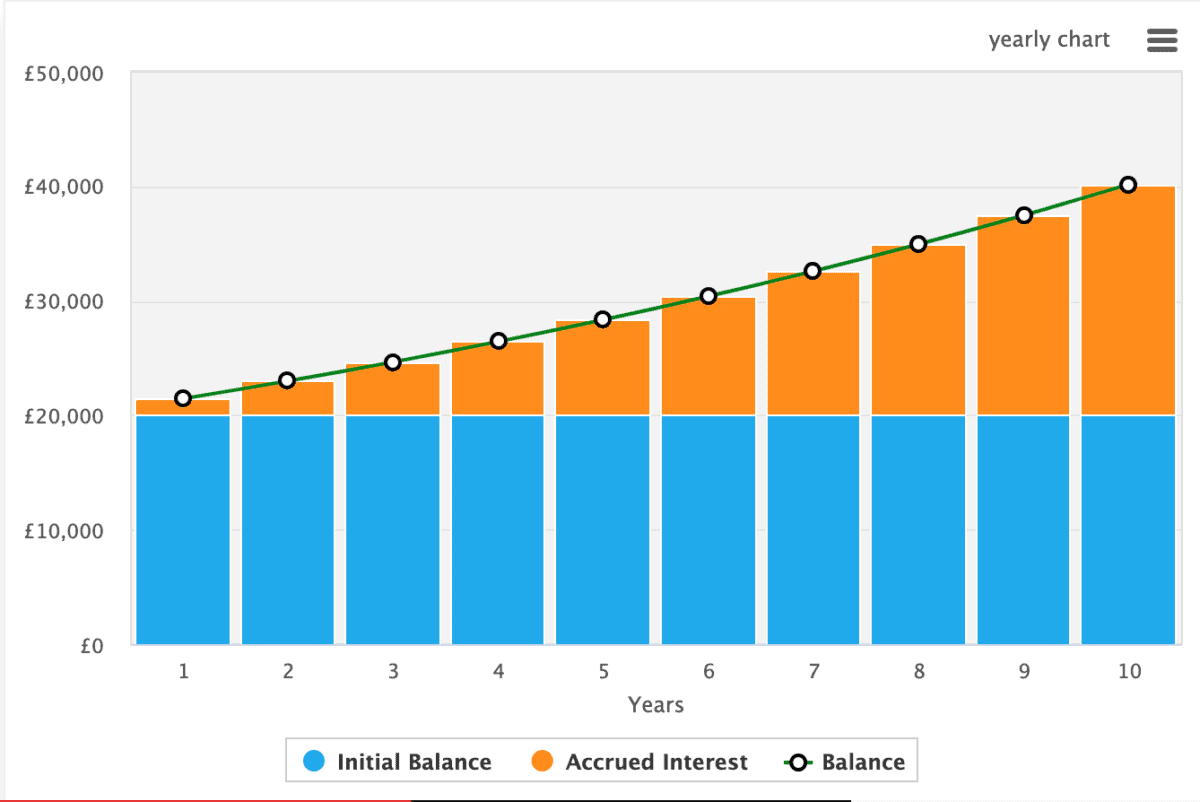

However, this is where I need to make a decision. Realistically, £20,000 invested in dividend stocks could only really generate around £1,400 annually. If I’m not happy with £1,400 a year, then I’ll need to reinvest year after year.

For example, if I were to reinvest my 7% for 10 years, I’d double my money. And with £40,000 I could generate £2,800 a year.

Of course, all long-term investment strategies work better if I’m continually adding money to my portfolio. Just contributing an extra £200 a month could make a huge difference.

A big hitter

Big dividend yields can often be a warning sign. When share prices fall, dividend yields push upwards. So if investors start pulling out of a stock because its fortunes are changing, the dividend yield could start to look very attractive.

At first glance, investors might be sceptical of Nordic American Tankers (NYSE:NAT) and its huge 12.2% dividend yield. And it’s certainly the case that the dividend coverage ratio could be stronger — it’s currently around 1.27.

However, I think Nordic American’s earnings estimates are starting to look a little conservative. That’s because the tanker sector’s booming. In fact, we may be at the start of a multi-year supercycle.

Tanker companies, notably those with relevant and modern fleets, are benefitting from a shortage of supply originating from the pandemic when the industry cut back on new vessel orders. Making things worse is the fact that there are less than half as many shipyards today as there were 16 years ago.

Compounding issues again are a drought in Panama and attacks on vessels transiting the Bab el-Mandeb — the Red Sea route. Both of these events mean vessels need to reroute, meaning longer periods at sea and fewer available vessels for leasing.

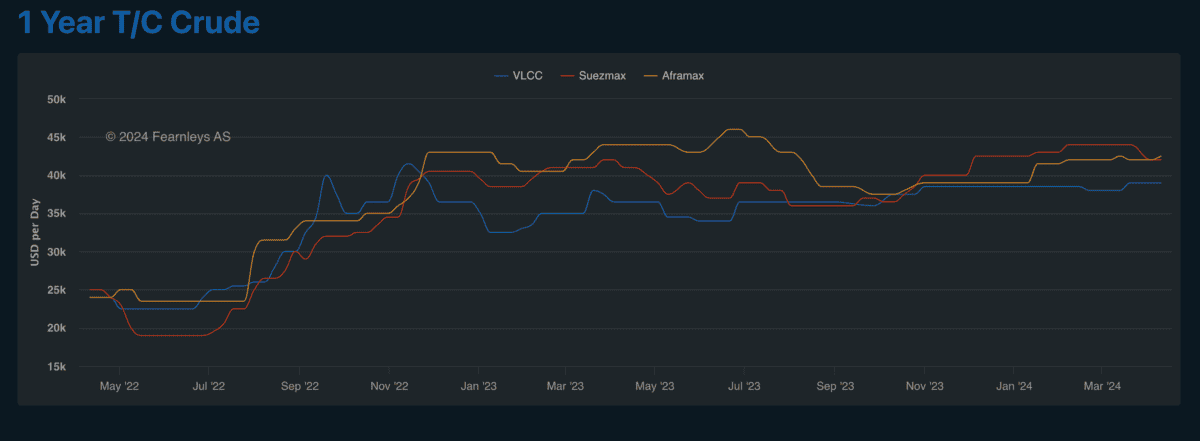

Leasing rates have unsurprisingly shot up. In fact, the cost of leasing Suezmax vessels — Nordic only operates Suezmax tankers — has doubled in recent years. Of course, the longed-for end to hostilities in the Middle East and the drought in Panama would likely result in a significant fall in achieved day rates. But the broad supply and demand dynamics are positive.

In short, I’m confident Nordic’s earnings are enough to cover its sizeable dividend. Moreover, the quarterly nature of the dividend makes it a great passive income pick.