The downturn in the UK housing market has badly affected buyers and sellers alike. Not surprisingly, it’s also taken its toll on the share prices of those FTSE stocks with exposure to the sector.

As an example, take the three largest in the FTSE 100. Since May 2019, Persimmon (LSE:PSN), Taylor Wimpey and Barratt Developments have fallen 40%, 26% and 22% respectively.

But there are some encouraging signs that things are starting to pick up.

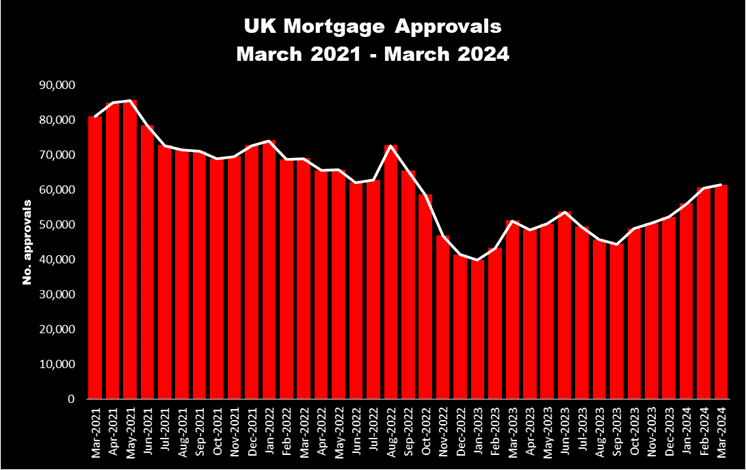

1. Mortgage approvals

In February, mortgage approvals were at their highest level for 18 months, according to data from the Bank of England. More encouragingly, as the chart below illustrates, they’ve now risen for six consecutive months.

At 61,325, they’re still 27.5% below their five-year monthly high of April 2021, but I think the recent month-on-month improvement shows confidence is slowly returning to the property market.

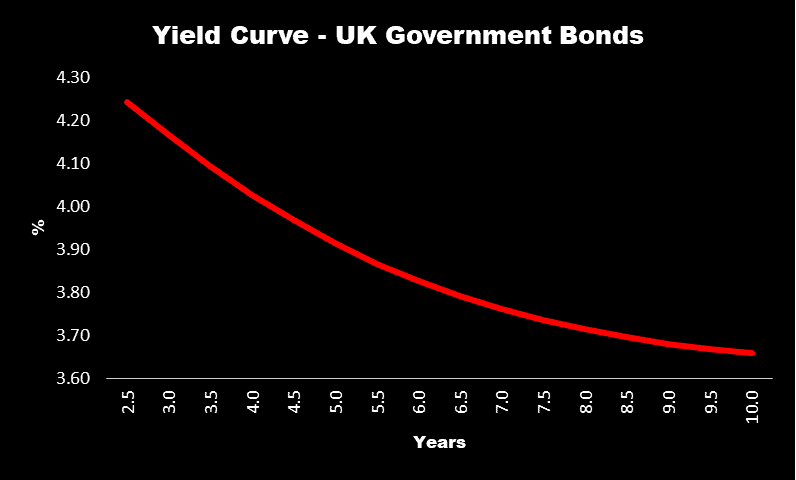

2. Interest rates

The latest yield curve for government bonds (see below) shows a steady decline for all redemption dates. This is driven by a market perception that interest rates are likely to fall from their current levels.

Gilts are important because they are the benchmark against which mortgage providers price their products. Falling yields suggests that home loans are likely to become cheaper. This should help boost the demand for new houses.

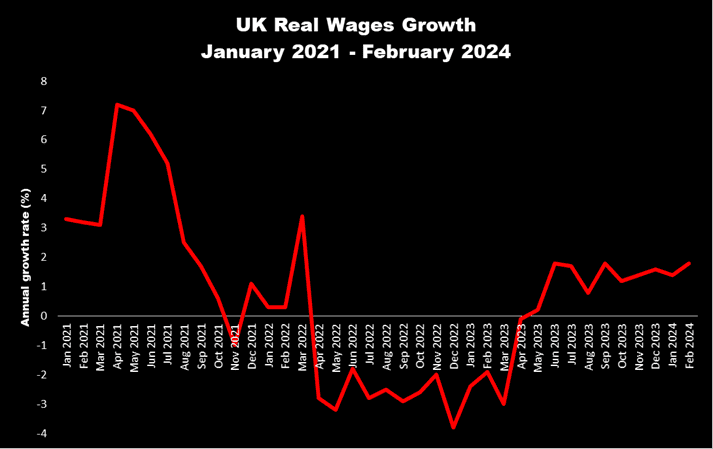

3. Incomes

The chart below shows how real (post-inflation) wages are starting to grow again.

This should make mortgages become more affordable and, for those looking to get on the property ladder for the first time, encourage them to buy.

One possible beneficiary

If I’m right that the green shoots of a recovery are starting to appear, then one company that should benefit is Persimmon. Indeed, its April trading update included some positive signs.

Net private sales per selling outlet were up 6% in the first quarter of 2024, compared to the same period in 2023. There are plans in place to open more sales offices which reflects the chief executive’s view that “trading over recent weeks has been encouraging with robust visitor numbers and enquires, giving us confidence for the remainder of the year”.

At 31 March, its order book was £1.14bn, compared to £970m a year earlier. The average selling price of these forward sales was 6% higher than at the start of the year.

The company’s operating margin is also expected to remain unchanged in 2024. This is particularly good news as building cost inflation was the principal reason behind the company’s operating margin falling from 27.4% in 2022 to 14% in 2023.

Of course, there’s no guarantee that the encouraging trends identified in mortgage approvals, interest rates and incomes will continue. And even if Persimmon builds 10,500 homes this year — at the top end of its expected range — this will still be 29% lower than its 2019-2022 average of 14,712.

But with its strong balance sheet, over 80,000 plots on which to build and a steadily increasing order book, I think the company’s well placed to benefit from the housing market recovery I’m anticipating.