There are two FTSE stocks that have crashed over the past 12 months. As well as being British icons, both are in the fashion business. I wonder if the time has come to bag myself a bargain.

1. Dr Martens

Since listing in January 2021, Dr Martens (LSE:DOCS) has issued five profits warnings. Unsurprisingly, the company’s share price has fallen 84% since its IPO. Over the past 12 months, it’s down 51%.

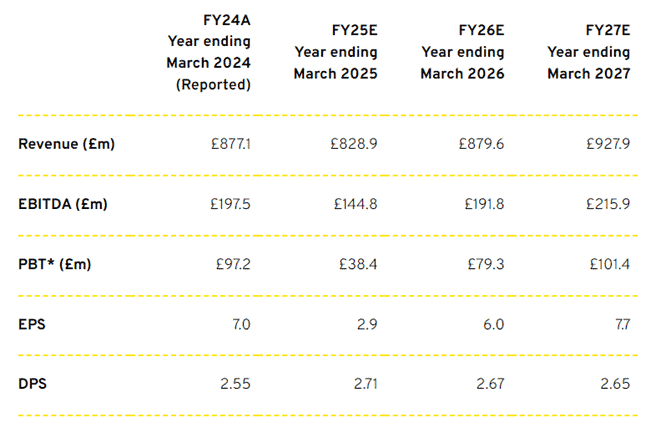

The company’s most recent downgrade cautioned that for the year ending 31 March 2025 (FY25), earnings before tax could be one third of what they were in FY24.

Should you invest £1,000 in Vistry right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Vistry made the list?

And analysts are forecasting earnings per share of just 2.9p in FY25 (FY24: 7p).

If correct, the shares currently have a forward price-to-earnings ratio of 24. This means they’re not cheap. But if the prediction for FY27 proves accurate, the shares are currently trading on a multiple of just 9.

For a company in the fashion industry, that would be something of a bargain.

And there are good reasons why Dr Martens’ fortunes could soon improve. Some of its problems appear to be temporary ones. The leasing of additional warehouse space and one-off costs incurred in upgrading its planning system are unlikely to be repeated.

But I’m concerned that the company may be caught in a ‘doom loop’ where it has to increase its prices to help offset the impact of falling sales. The result is a further reduction in turnover and the temptation to increase prices even more.

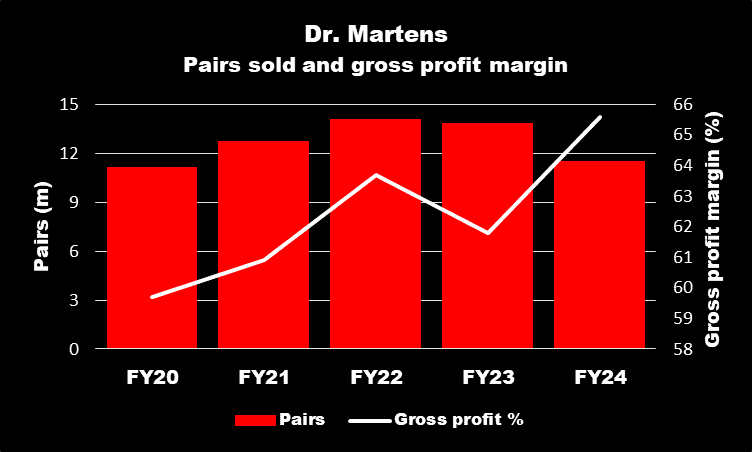

The chart below shows how the number of pairs of boots, shoes and sandals sold in FY24 was 18% lower than two years earlier. And over the same period, the gross profit margin has increased by 5.9 percentage points.

This doesn’t appear sustainable to me.

2. Burberry

By contrast, for the 52 weeks ended 30 March 2024 (FY24), Burberry Group (LSE:BRBY) reported a gross margin of 67.7% down from FY23’s 70.5%. And it also revealed a £126m (4.1%) drop in sales.

In my opinion, Burberry appears to be in a worse position than Dr Martens. That’s because its margin AND turnover are falling.

And the company is now warning that it could incur an operating loss during the first half of FY25. This is a huge reversal in fortunes for the company that reported a £223m operating profit for the first six months of FY24.

And to accompany the profit warning, the firm’s dividend was suspended.

Its share price tanked 16% on the day this bad news was released and it’s down 67% since July 2023.

But the company’s been around since 1856 and has come through many downturns before.

Also, Burberry’s CEO, who has only been in post for 11 days, has an excellent reputation forged in luxury fashion.

Plus, despite its woes, the company’s balance sheet remains healthy.

Time to buy?

However, these two case studies highlight how easy it is — excuse the pun — to fall out of fashion.

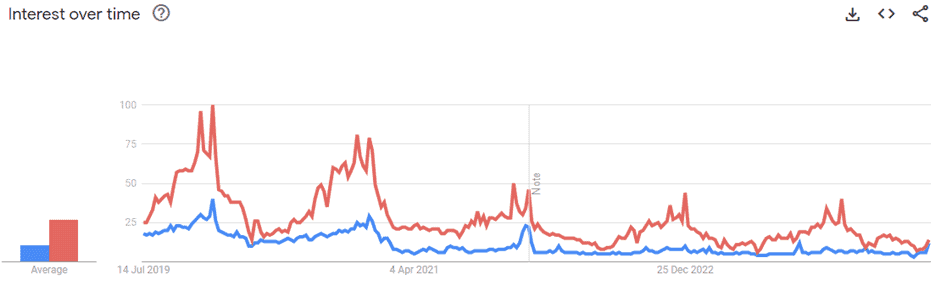

The chart below shows how Google searches for ‘Dr. Martens’ (red) and ‘Burberry’ (blue) appear to be in long-term decline.

For this reason, despite both being iconic British brands, I wouldn’t want to buy either stock at the moment. I’d like to see evidence of this trend reversing before parting with my money.