High-yield shares can be attractive. But whether or not I think they are depends in part on the sustainability of the yield – and also the valuation implied by the share price. Recently I have been weighing some pros and cons of adding a FTSE 250 stock to my ISA that yields 9.9%.

This would mean that, for every £1,000 I invested now, I would hopefully earn just under £100 in dividends each year.

Whether that ends up happening in practice, though, would depend on what occurs in future with the company’s dividend. No dividend is ever guaranteed, after all.

Financial services specialist

The FTSE 250 company in question is abrdn (LSE: ABDN), the financial services provider.

With a 30% share price fall over the past 12 months alone, and 47% over five years, the City clearly has concerns about the company’s attractiveness.

On the plus side, abrdn has a well-known brand (albeit one whose value I think has been reduced with the bizarre removal of most of its vowels), a large customer base and operates in a market in which I expect to see high long-term demand.

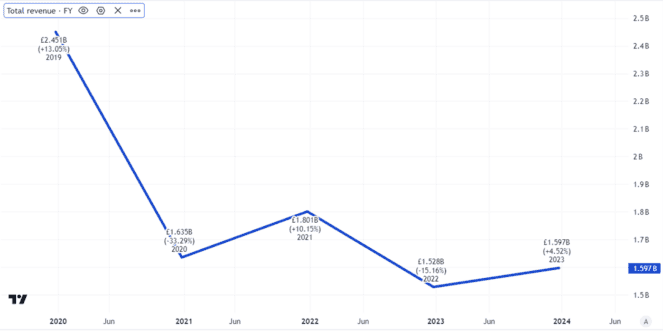

Despite that, the company has certainly been facing challenges. Revenues have fallen for the past two years in a row, for example.

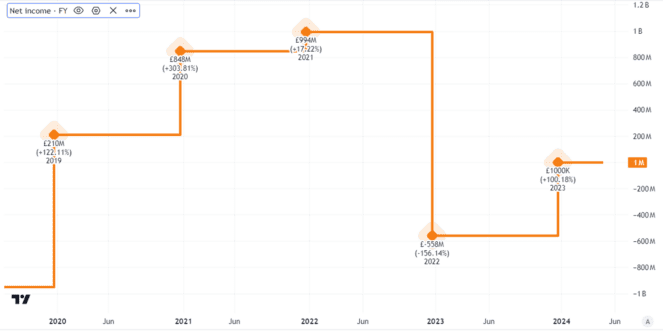

Also worrying, looking at the company’s net income in recent years, there have been some dramatic swings. Some years have seen sizeable losses.

That raises questions about how well the company has been translating its business assets into financial performance.

Can the dividend survive?

Last year, for example, the FTSE 250 business made a post-tax profit of just £12m.

What does that mean for dividend sustainability?

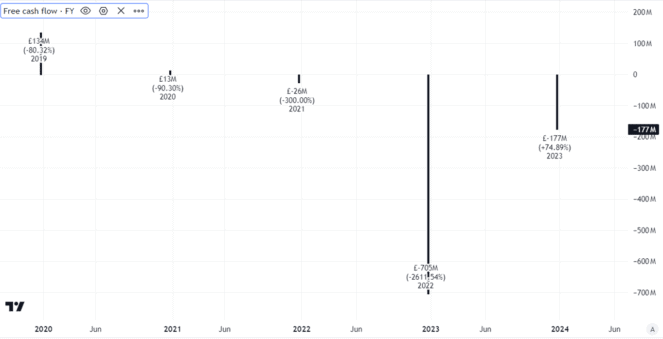

Arguably, earnings are not the key thing to look at. They are an accounting measure, but dividends are basically funded out of cash flows. So often, looking at a company’s cash flows can be more informative about how well covered a dividend is than looking at its earnings.

Here again, though, the picture has been inconsistent.

In fact, abrdn’s free cash flow picture is not only inconsistent but rather alarming. The business has strengths but in some recent years it has seen significant cash go out of the door rather than come in.

The annual dividend per share was cut by almost a third in 2020.

Since then it has been maintained. But given the inconsistent business performance I am concerned about the medium-term sustainability of the FTSE 250 company’s dividend.

No plans to buy

Clearly, management is aware that it faces challenges.

The firm is cutting costs and aims “to sustainably restore our business to a more acceptable level of profitability”. The first quarter saw positive net flows, meaning clients are putting more money in than they are taking out.

But there is obviously a lot of work to be done and how that goes remains to be seen. So, for now, I will not be buying, despite the juicy dividend yield.