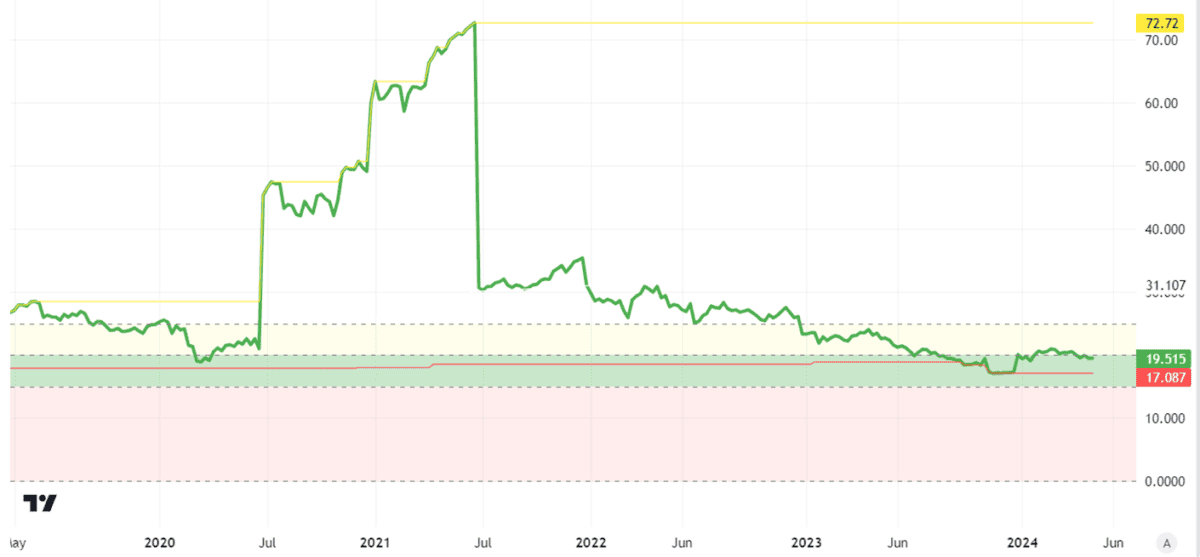

As an investor, the idea of long-term share price gain appeals to me. Along the way, though, I would be more than happy to pick up some passive income in the form of dividends. One FTSE share I have been eyeing as a potential buy for my ISA has fallen 13% in the past five years. That is not exactly the stuff of investor dreams!

But it has grown its dividend annually for over three decades, placing it firmly in the ranks of the Dividend Aristocrats. On top of that, the share price fall means that it now trades on a price-to-earnings (P/E) ratio of 20. That is lower than it has often been in the past.

Great business model

Just because a P/E ratio is lower than it used to be does not in itself mean that a share is attractively valued, however.

That depends partly on the prospects for the business – and also on its current valuation seen objectively, regardless of what it may have been in the past.

The FTSE 100 business I have in mind is Diageo (LSE: DGE). It is the force behind a host of drinks, from Guinness to Johnnie Walker, and also spreading into non-alcoholic tipples such as Seedlip.

Why do I like it?

I expect the market for alcoholic beverages to remain huge, even though it does face challenges such as declining consumption among younger age groups in many markets.

Diageo owns a host of premium brands, giving it price power. Its distribution network is extensive, giving it commercial advantages.

Strong dividend track record

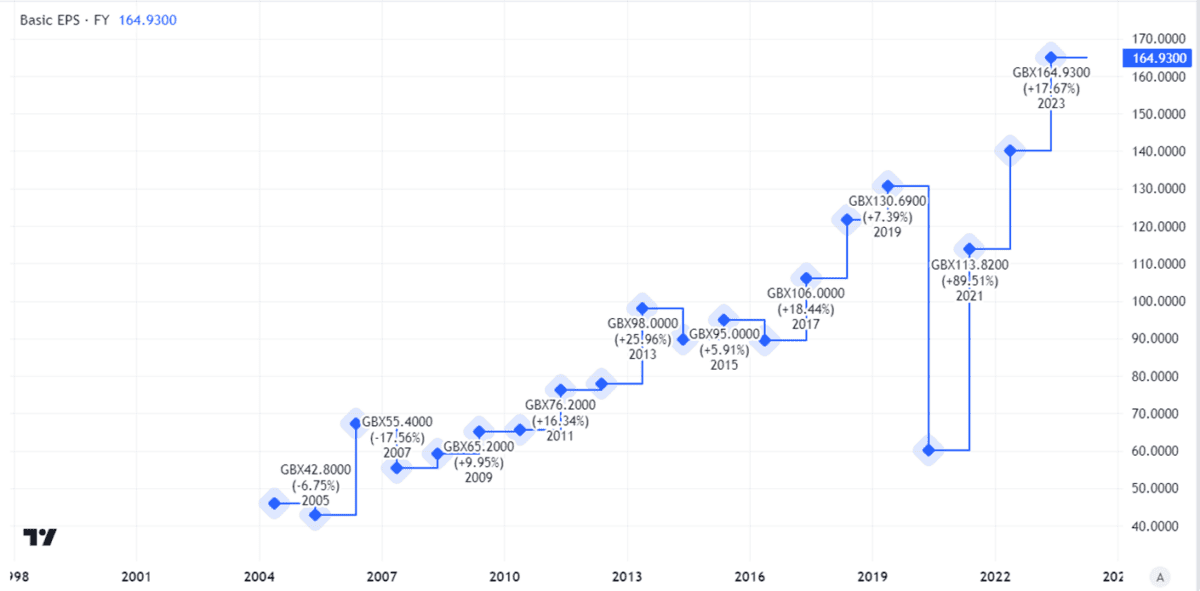

That combination of attractive attributes for the FTSE company is reflected in its long-term track record when it comes to earnings.

I think the long-term growth in basic earnings per share tells its own story.

Can that continue?

Only time will tell. The Footsie company does face challenges, both strategically in the long term and more tactically in the near term. Recently, for example, softer sales in Latin America have hurt performance.

If the global economy performs weakly, that could be the canary in the coal mine for poorer sales performance, hurting profits.

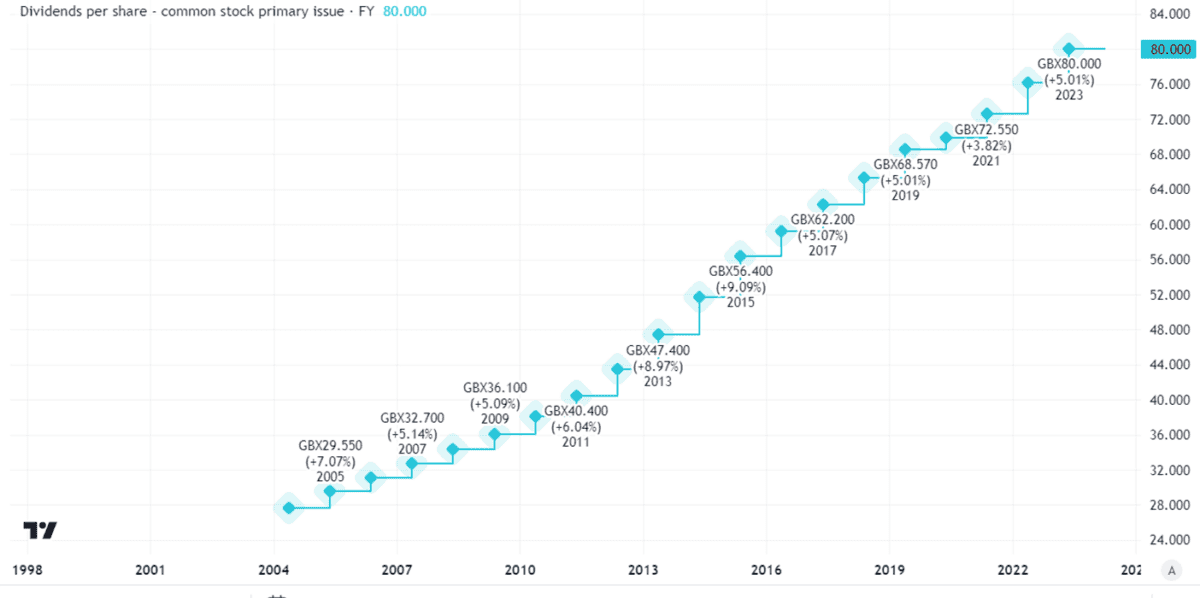

Nonetheless, Diageo’s proven business model has helped it deliver a stunning run of dividend growth over decades.

The dividend remains well covered, and I expect the business to make efforts to keep increasing it annually.

I’m tempted to buy

The yield at the moment is 3.0%.

That is hardly spectacular. I think it is decent, but it is below the FTSE 100 average.

Still, I am tempted to buy. Diageo has a proven business model I think looks set to continue delivering over the long run. The dividend growth has been impressive – and I think it could continue.

Diageo is not top of my ISA shopping list right now. But, if I had spare cash to invest, I would be happy to buy this FTSE 100 share.