The most recent figures (December 2023) show there are over 1.7m SIPPs (Self-Invested Personal Pensions) in the UK. With over £200bn of assets invested, they are clearly playing an important role in many people’s retirement planning.

But we are constantly being reminded that we are not saving enough. According to the Pensions and Lifetime Savings Association, a single person needs a post-tax income of £43,900 a year to have a comfortable old age. Although everyone’s financial circumstances are different, let’s assume this equates to an annual pre-tax income of £60,000 or £5,000 a month.

But, ignoring any State Pension that someone might receive, how much is needed in a SIPP to generate this kind of money?

Something to aim for

At the moment (9 January), the top 10 highest-yielding shares on the FTSE 100 are returning 6.5%. By coincidence, this is roughly the same as the long-term growth rate of the index, with dividends reinvested.

Using this figure, if someone doesn’t want to touch the capital in their pension pot, a SIPP would have to be worth £923,077 to generate £60,000 a year of dividends.

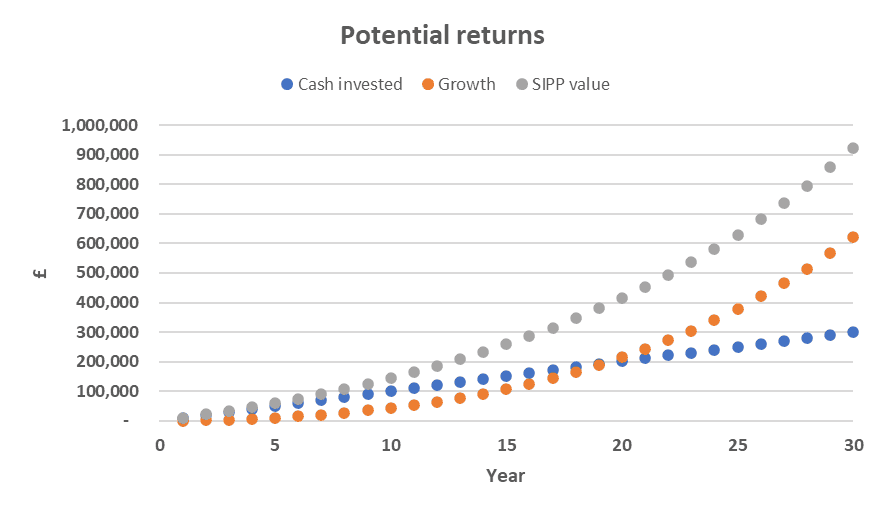

That’s a large sum. To get there, it would need an annual pension contribution of £10,044 for 30 years, growing at 6.5% per annum.

I suspect very few are likely to be in a position to afford this kind of money, especially younger investors. Therefore, instead of quoting specific figures that could be discouraging, I think we should be urged to put as much into our pensions as we can afford, for as long as possible.

That’s what I’m doing. I try to find reliable dividend stocks and reinvest the income received by buying more shares. This is known as compounding and increases the value of a pension pot much more quickly, particularly in later years, as illustrated below.

An option

One income stock that I think’s worth considering is Land Securities Group (LSE:LAND).

It’s presently yielding 6.3% but analysts are expecting the group to increase its dividend by 9.4% over the next three years. On this basis, by March 2028, they are forecasting a forward yield of 6.9%.

The group’s legal status is that of a real estate investment trust, which means it must pay dividends equal to 90% of its annual qualifying profit to maintain certain tax advantages.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Admittedly, its generous yield has been helped by a falling share price. The pandemic resulted in more people working from home and fewer going out to shop. With its portfolio heavily weighted towards offices (52% of income) and shopping centres (39%), the group suffered.

Although these threats have diminished, the commercial property sector remains cyclical in nature. To try and mitigate this risk, the group plans to invest £2bn+ in residential developments over the next five years. However, this is likely to add to the group’s debt pile, which is already high. This is something to keep an eye on.

Positively, the group owns some flagship developments and its occupancy level is at a decade-high 97.7%. It says its properties are “effectively full”. Also, it’s achieving a 10% uplift on new lettings and renewals.

There are plenty of high-yielding passive income stocks available at the moment. And I think Land Securities Group is one that deserves to be considered for inclusion in a well-diversified SIPP.