When hunting for UK shares, most investors follow a strategy of either growth or income (dividends). Those targeting income tend to ignore growth, while growth-focused investors are less interested in dividends.

But there are some shares that play for both sides, delivering dividend income along with impressive capital gains. I’ve identified two that hit the ball out the park in 2025 – International Personal Finance (LSE: IPF) and OSB Group (LSE: OSB).

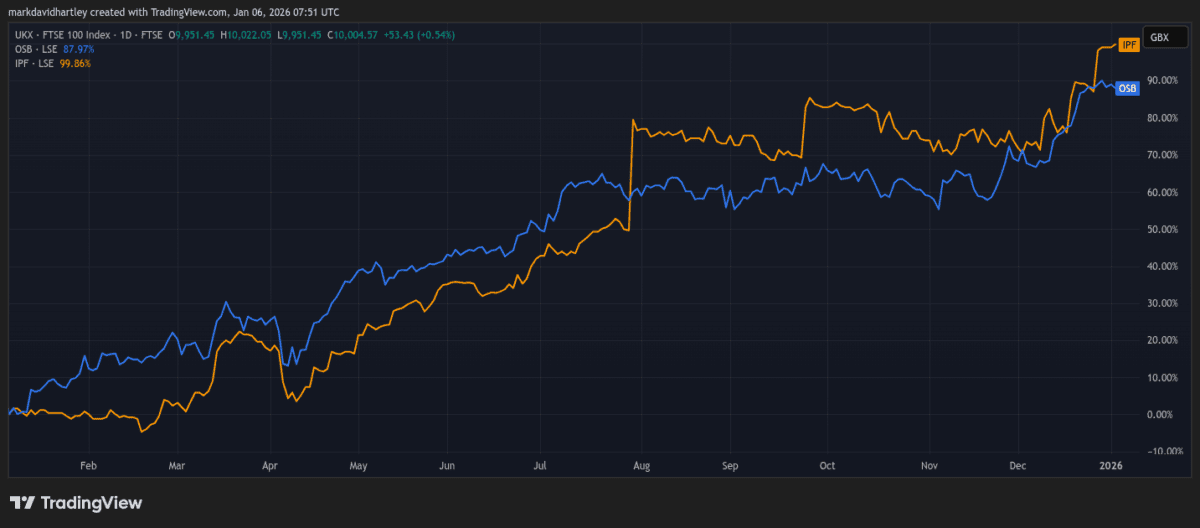

Combined, they delivered a 94.5% total return when accounting for both growth and dividends. That means a £5,000 investment split equally across both shares when 2025 began would be worth almost £10,000 today!

But what drove their success and can this continue in 2026?

The lesser-known asset manager

International Personal Finance operates home‑credit and digital lending businesses across several international markets, with London‑listed UK shares. The business enjoyed a spectacular year of growth in 2025, despite pressure on household budgets. The share price grew 78.5% and when adding dividends to the mix, it returned a near-100% total.

Despite a 6.4% drop in revenue in H1 2025, earnings jumped 57% as costs and impairments were tightly controlled. Profit margin improved from 5.3% to 8.9%, with earnings per share (EPS) up from 8.8p to 14p in the half.

But if a lower-rate environment transpires, there’s a growing risk of tighter regulation or political scrutiny for the personal finance sector. As a smaller lender, it’s more exposed than larger competitors if the government cracks down on high-cost consumer credit.

For patient investors, International Personal Finance’s combination of low valuation and improving profitability is attractive. However, its exposure to consumer health and regulation is risky, so position sizing and diversification matter when considering it.

The up-and-coming challenger bank

OSB Group’s a specialist lender focused on buy‑to‑let and niche residential and commercial mortgages. Despite a tough backdrop of higher rates and cautious landlords, it delivered what management called a “resilient” performance in 2025: modest loan book growth, strong capital ratios and an increased interim dividend.

The shares grew a moderate 60% but when adding dividends, its total return surged to almost 88%.

In H1 2025, the bank achieved a pre‑tax profit of £192.3m, down year‑on‑year but still generating a solid 13.7% return on tangible equity. It also reported a net interest margin of 2.3%, with retail deposits growing and a successful £578m securitisation improving funding efficiency.

But if interest rates drift lower, things could change. Although a softer rate environment reduces stress on existing borrowers, its margins could suffer if lending rates re‑price down faster than savings.

For long‑term investors, OSB looks like a promising option to consider right now. It took a hit when rates shot up but is well‑placed to benefit from a controlled descent — barring a slip into a deep recession.

Final thoughts

For investors saving for a home or retirement, it’s important to consider how falling rates can impact a portfolio. Certain UK shares have proved they can cope when rates are high and still stand to benefit if 2026 delivers the anticipated soft landing rather than another shock.

The above two examples reveal how strong businesses can come out of a tough year in good shape – but also how different their risk profiles are once policy starts to shift.