Earlier this week, Nvidia (NASDAQ:NVDA) surprised investors again by posting some very strong quarterly results. Nvidia shares jumped around 5% on the news, hitting new all-time highs in the process. Yet gains quickly reversed, with the stock now back at the price before the results were released. Despite it being the artificial intelligence (AI) poster child, I think there are some points regarding valuation that investors need to note.

Comparing price to earnings

Let’s start with the classic measure of value, the price-to-earnings ratio (P/E). This compares the share price to the latest earnings. When looking at most UK stocks, I use a figure of 10 as a benchmark for fair value. Naturally, high-growth tech stocks will have a bigger figure. This is mostly down to the fact that investors expect future earnings to grow at a fast pace. So they are happy to pay the current price, even if the earnings today make it seem a bit overvalued.

So to tweak my benchmark, I’ll use the Nasdaq 100 average. The current P/E ratio for the index is 30.17. Nvidia has a P/E ratio of 109. That probably has raised some eyebrows.

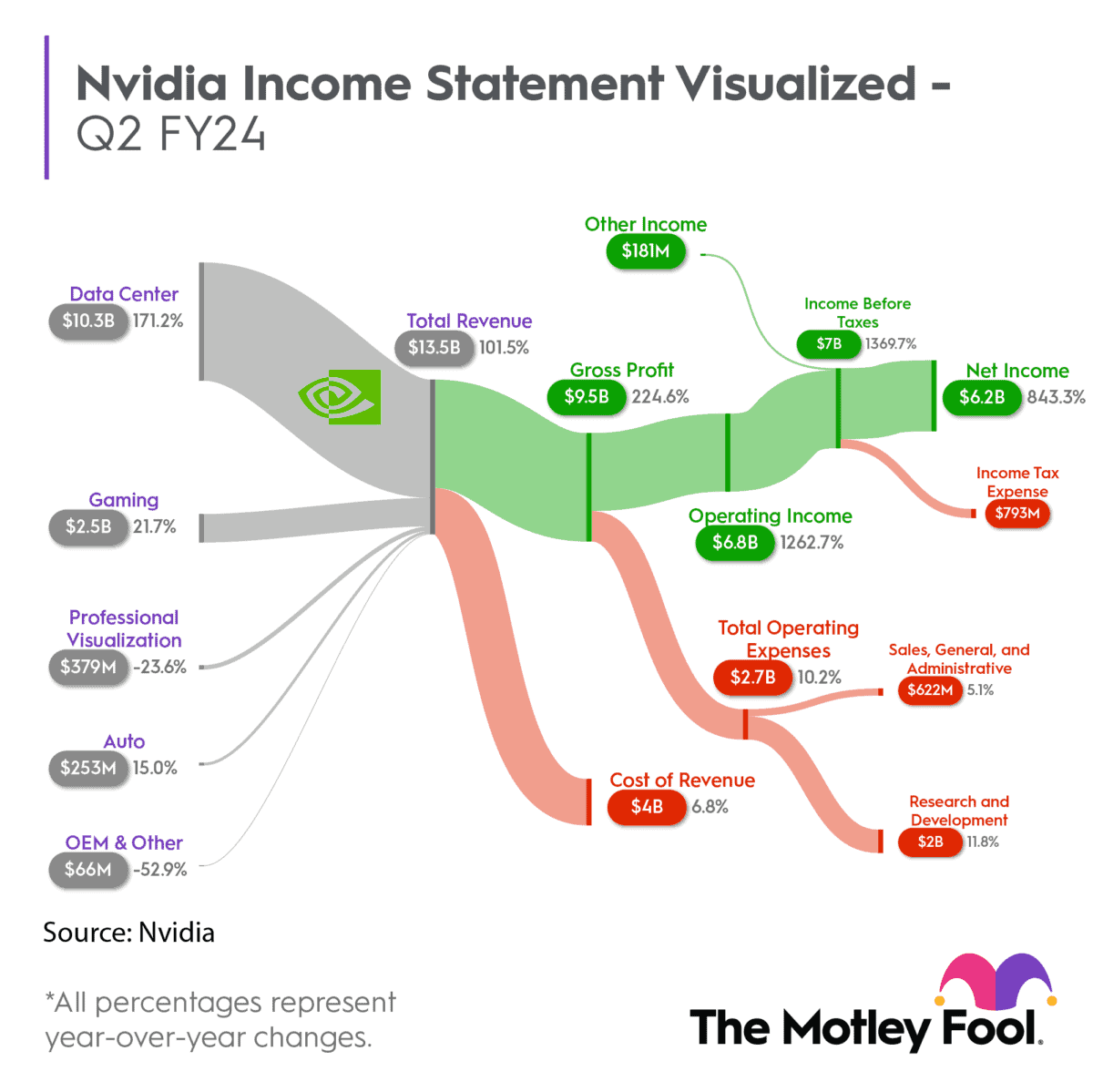

What concerns me a little here is that earnings are increasing, but not fast enough. For example, earnings per diluted share for the quarter were $1.18, up 22% versus last quarter. This should help to reduce the P/E ratio. Yet the share price is increasing at such a pace that even with higher earnings, the ratio is still very elevated.

Some will argue that future earnings will continue to grow at a rapid pace, making a ratio of 109 not excessive. I’m not so sure.

Others in the same sector

Another way to assess value is to compare Nvidia with competitors. In terms of the semiconductor space, I’d say Advanced Micro Devices and Intel are the two other main players in the sector.

On the one hand we have Nvidia that has just hit all-time highs and is up 163% this year. In comparison, AMD stock is up 5% over the past year, with Intel actually down 7% over the same time period. Neither stock is close to all-time highs.

If an investor believes in the future of AI and the role of this sector in facilitating the hardware and software for it, I don’t think just Nvidia is going to benefit. Both AMD and Intel should enjoy higher profits in years to come.

Yet I don’t feel these stocks are as hyped up or pumped by retail investors half as much as Nvidia right now. So either option could be a better way of finding value as an alternative to Nvidia shares.

Not a party pooper, just realistic

I don’t want this to come across that I’m outright bearish on Nvidia. The company is great, growing fast and very profitable. A couple of years down the line I’d expect the share price to be higher than it is now. Yet in terms of purchasing today, I feel it looks a bit rich. On that basis, I do think investors should consider investing, but only when we see a correction lower in the stock.