The Tiziana Life Sciences (LSE:TILS) share price is up 228% over 12 months. But, Tiziana stock is also down 38% from its July 2020 all-time high. Those numbers reflect the wild ride that Tiziana shareholders have been on in 2020 and into 2021.

Tiziana is a pharmaceutical company whose stated mission is to develop innovative drugs to treat Crohn’s disease, progressive multiple sclerosis, and hepatocellular carcinoma. On 10 March 2020, Tiziana announced it was investigating a potential treatment for patients with Covid-19, and in April 2020, Tiziana filed a couple of patents for Covid-19 treatments. This seems to have been the catalyst for Tiziana’s stock price action from 2020 to 2021.

Covid-19 treatment

The Tiziana share price fell from 265p to 75p in December 2020. Then it climbed to around 195p in mid-January, before falling back to around 100p now. I think that as public concern about the pandemic waned over the latter half of 2020, so did investor interest in Tiziana. When daily coronavirus infections started to rise in winter 2020, culminating in a national lockdown, the Tiziana share price rose again. It has fallen since mid-January which coincides with timelines for emerging from lockdown being released and the vaccination programme in the UK gathering pace. However, it is also worth mentioning that Tiziana graduated from the AIM market and moved onto the London Stock Exchange‘s main market on 20 January 2020.

Tiziana’s so far un-approved antibody-based treatments for Covid-19 might not be if the coronavirus pandemic ends. A similar treatment produced by a rival company is already approved for use against Covid-19, and perhaps investors fear that this will mop up all available demand. If investors are thinking along these lines, I believe they are missing something about the Tiziana share price prospects.

Tiziana product pipeline

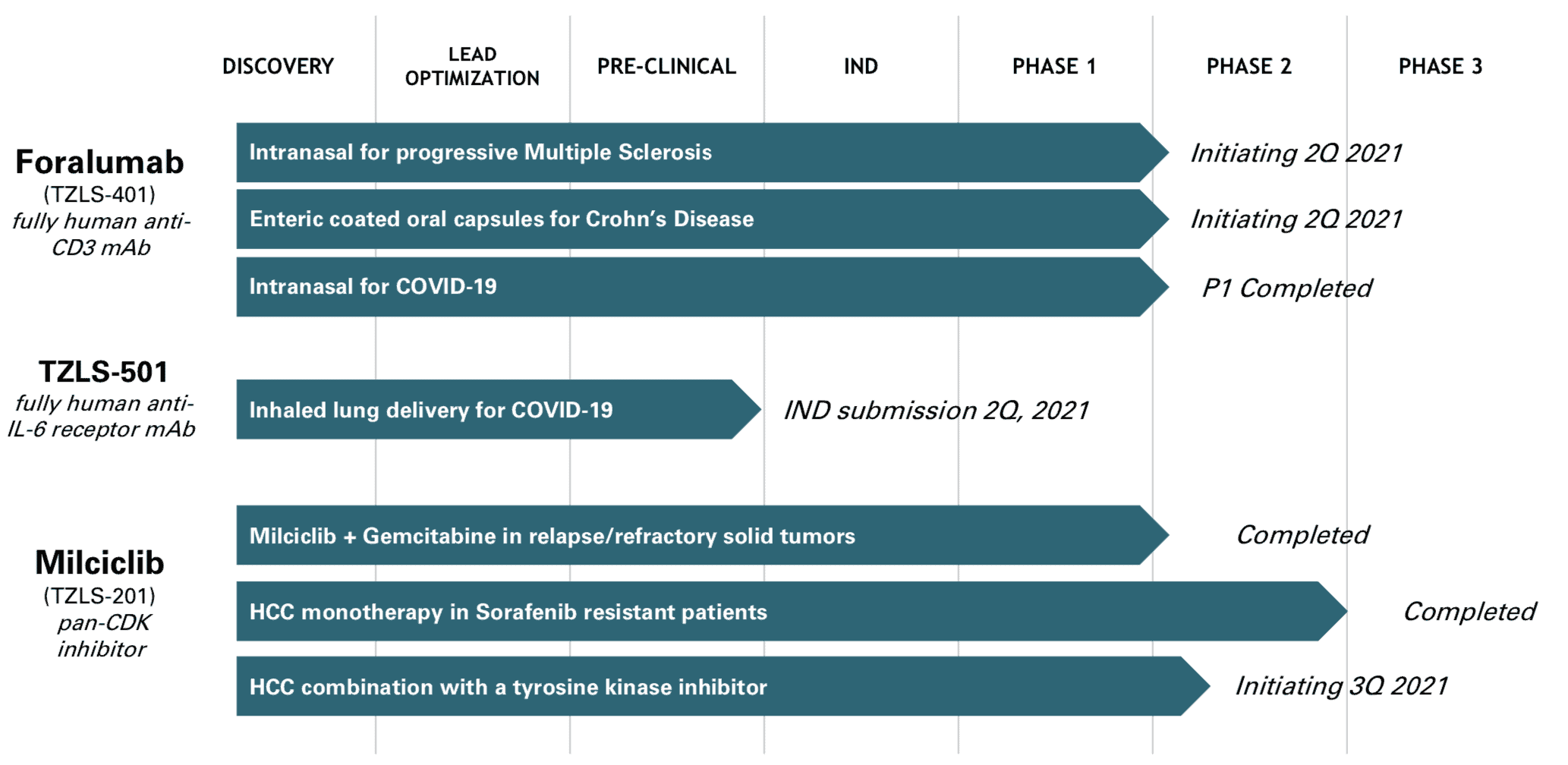

Tiziana is not selling any drugs at present and thus does not report revenue so continuing fund raises will be necessary. It does have three compounds in various stages of development for multiple indications. No phase 3 trials — typically the last stage to complete before approval for marketing a drug can be considered — have been started as yet. Tiziana is probably still years away from selling a drug, but it does have another potential path to profit.

Tiziana Life Sciences Pipeline

Source: Tiziana Life Sciences Investor Presentation

Tiziana has a revolutionary platform technology that enables oral, nasal, and inhaled administration of monoclonal antibodies. These typically need to be given by an IV infusion which is tough to do in the community. Tiziana, if successful, could bring treatments to market that can be picked up from a local pharmacy. That really would be a game-changer. Tiziana could get royalty income from other drugs companies by licensing this technology in addition to using it itself.

Tiziana share price

Early-stage pharma companies are always risky. Depending on the source, up to 90% of drugs don’t make it from phase 1 trials to market. I would not buy Tiziana shares at the moment. The company’s value is bound to its platform and the two drugs being investigated for delivery using it. I would rather wait until I see some phase 2 trial data to make a decision.

However, I do think the success or failure of the potential Covid-19 treatment is being over-emphasised. Treatments for Covid-19 will be required for some time yet. Also, the treatment has applications beyond Covid-19.