My plan for getting rich from investing in UK stocks is so simple. First, open a Stocks and Shares ISA. Second, buy reliable dividend-paying stocks and reinvest the dividends for the long term. Hunting for triple-digit return stocks in the next big thing is not necessary to build real wealth. In fact, reducing the tax paid (legally) on modest and sustainable returns can make me a rich man as well.

Tax-free Stocks and Shares ISA

The single biggest decision I made that improved my investment return was to open and use a Stocks and Shares ISA (Investment ISA). Any gains made on stocks or funds bought inside such an ISA are completely tax-free. Interest and dividend income do not attract any tax either.

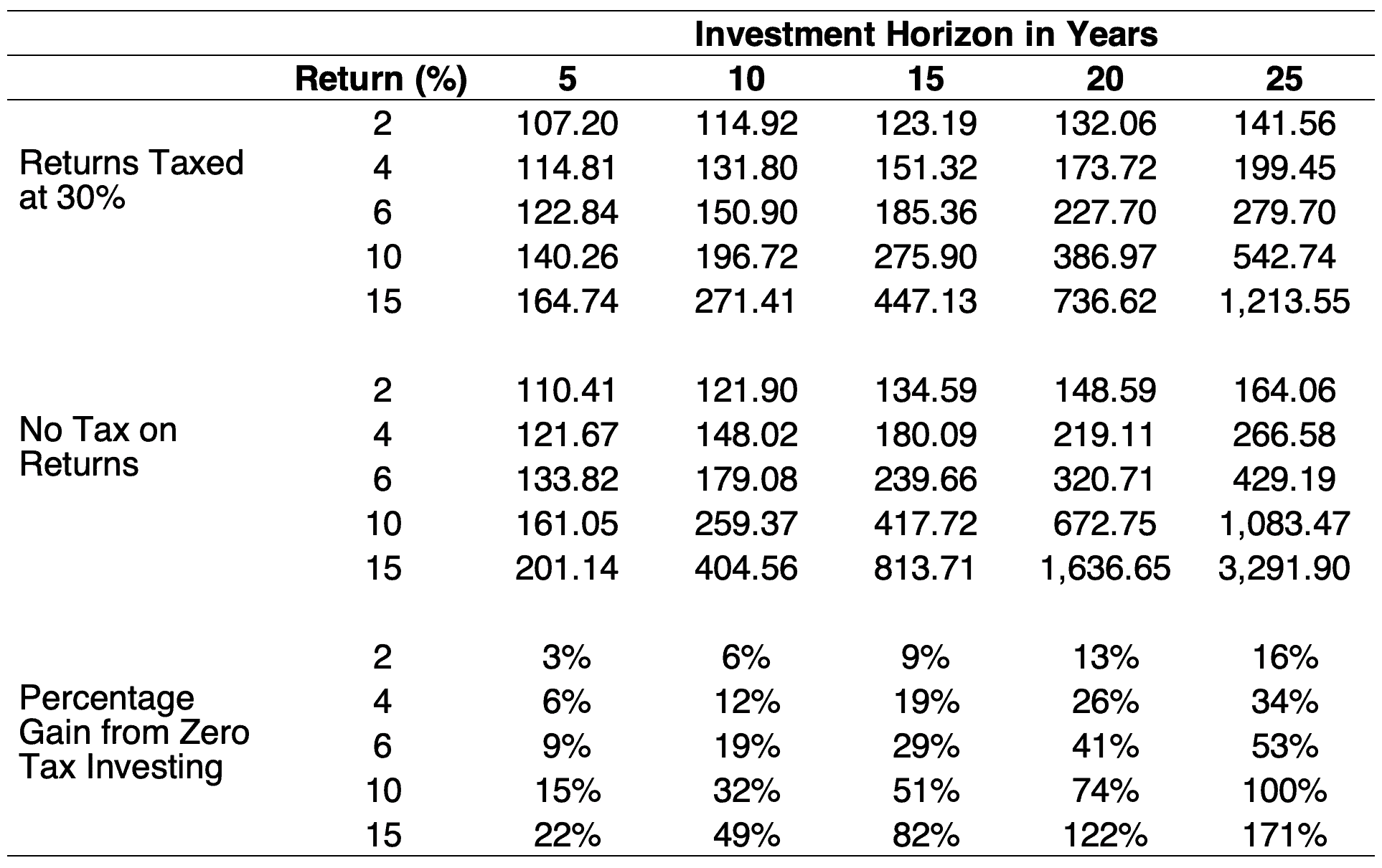

In the table below, the results of investing £100 at various returns and time horizons with and without a 30% tax rate are compared. The higher the investment return, and the longer the investment, the bigger the impact of tax-free investing.

For example, an investment earning 15% for 25 years with zero tax ends up being worth 171% more than if returns were taxed at 30% annually. Investing in a zero-tax environment is the easiest way to supercharge returns.

UK dividend stocks

Growth stocks have their place in my portfolio, but I won’t shun dividend-paying stocks. Jeremy Siegel, a finance professor, found that investing in slower-growing, dividend-paying companies often outperformed backing the high-growth, new and exciting ones. The explanation offered is that investors pay too much for shares in fast-growing companies because they overestimate future growth. Furthermore, dividend yields are low on growth stocks, which limits the number of shares accumulated through reinvestment of dividends.

Reinvesting dividends is the critical factor in determining investing success in the long run, reckons Siegel. I agree with him. Those that disagree may point to a chart of the FTSE 100 (full of big dividend-paying companies), which has barely gone anywhere in years.

However, those charts do not usually consider dividend reinvestment. A £10,000 investment in the FTSE 100 at the start of 1986 would have grown to about £54,000 by 2020 without dividend reinvestment. But, the same investment with dividend reinvestment would have grown to about £196,000. Dividend reinvestment almost doubled the annual average return from 5% to 9%.

Long-term, tax-free, dividend reinvestment

The core of my tax-free Stocks and Shares ISA portfolio consists of UK dividend hero stocks like Diageo, GlaxoSmithKline, and Unilever. I reinvest all the dividends I receive, meaning I buy more of the stocks that paid the dividend. Companies that have got to the stage where they can return cash to shareholders in the form of dividends, or share buybacks, might be considered dull. But the long-term investment returns on offer from these types of companies are not.