With consumers relying more on online marketplaces such as Amazon to purchase products, businesses have begun to rely less on brick-and-mortar stores in favour of selling online. Subsequently, ecommerce stocks have seen some incredible growth.

The lockdowns imposed by Covid-19 have only further accelerated this trend, due to both the reduced traffic of customers and higher fixed costs (rent, security, and sanitation).

While selling products online can drastically reduce expenses for businesses, it does introduce a few new problems that this secret ecommerce stock helps to solve.

Products for online retail have two primary requirements. They need storage space, and access to a logistics network for fast and efficient delivery to the customer, both of which are provided by Warehouse REIT (LSE:WHR).

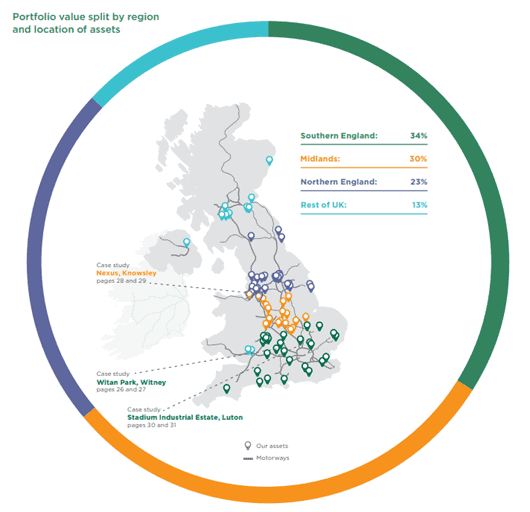

This ecommerce stock owns and manages 95 industrial warehouses across the UK close to infrastructure hubs.

As it stands, the demand far exceeds the supply of storage space in prime locations, which has led to an exponential growth in rental incomes for warehouse operators.

Furthermore, real-estate firm Savills has estimated that every additional €1bn of online sales will require an additional 775,000sqft of warehouse space

Warehouse REIT primarily operates Tier-3 warehouses strategically placed in economically buoyant areas, close to transport links and large conurbations.

These warehouses are typically small in scale – less than 100,000sqft – but still addresses a wide diversity of smaller and larger businesses, including the likes of John Lewis and Amazon. By focusing on smaller-scale storage facilities the firm has been able to dodge its larger competitors that focus on large-scale warehousing.

The ecommerce stock has a fairly simple business model. It acquires existing warehouses in prime locations that have depreciated in value due to poor maintenance. After injecting additional capital to refurbish the properties, Warehouse REIT leases them out to businesses.

Since its IPO in 2017, the business has been performing exceptionally well. Revenue has increased by nearly four times from £6.57m to £30m, and due to the low costs involved with managing the warehouses after refurbishment, around 70% of that is pure profit.

As the firm’s revenue is entirely dependent on the businesses using their facilities, it’s important to take a look at the occupancy rates and lease durations.

As of March 2020, the occupancy rate stood at an extraordinarily high 93.4% up from 92% a year prior!

The average lease duration is a more muted but still a respectable 5.2 years up from 4.6 in 2019. While I would ideally like to see this figure closer to 8+ years, the rising trend does provide confidence that management are heading in that direction.

With warehousing facilities unable to keep up with demand, I believe the market conditions are extremely favourable to this ecommerce stock, allowing for a rare combination of potentially explosive returns paired with a 5.7% dividend yield.