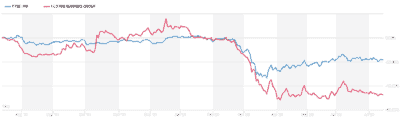

The Lloyds (LSE: LLOY) share price has been one of the FTSE 100’s biggest losers following the Covid-19 outbreak. The Black Horse Bank has fallen much harder than the broader blue-chip index since late February as the UK economy has tanked.

And there’s plenty of reasons why Lloyds could continue to sink in value in 2020 and beyond. I reckon this is a share that should be avoided at all costs after the stock market crash.

A weak economic rebound

The biggest threat to the Lloyds share price in the near term is the prospect of a slow economic recovery. Official data released on Monday suggests this is exactly what’s happening. The ONS reported that UK GDP rebounded just 1.8% in May. This is much worse than the 5.5% rise that brokers had been forecasting.

Following the data, Tom Stevenson, an investment director at Fidelity International, said: “Hopes of a V-shaped recovery are fading fast, and I suspect we’re looking at something resembling far more of a ‘W’ — a series of improvements and relapses, before a proper recovery takes hold.”

Rising competition threatens the Lloyds share price

Clearly, Lloyds will find it tough to generate any sort of revenues growth in the current climate. It faces a significant increase in the amount of bad loans on its books too. The last thing it needs right now is rising competitive pressures. But that’s exactly what it’s getting as the challenger banks flex their muscles.

The challengers have shaken up the industry like no-one could have expected, thanks to their ambitious growth plans and cutting-edge technologies. Digital Banking Report reckons these new entrants should continue to grow their market shares at an electrifying rate too. It expects them to grow their customer bases to around 100m within the next five years. This compares to a figure of 40m today.

Challengers, such as Monzo and Starling Bank, have built up formidable war chests to do battle with established operators like Lloyds. No wonder market commentators expect them to continue fragmenting the industry at a spectacular rate.

Rock-bottom interest rates

The British economy is in for a rough ride during the first part of the 2020s, at least. So you should expect the Bank of England to keep interest rates parked around current record lows of 0.1% in a further blow to Lloyds’ ability to create profits.

The Bank of England base rate never got anywhere near the 5% recorded before the 2008/2009 financial crisis during the last decade, much to the detriment of Britain’s banks’ bottom line. If anything, they look like receding even further given the current economic outlook. Threadneedle Street is publicly flirting with the idea of introducing negative interest rates as it battles the Covid-19 fallout. Today’s GDP data has only raised the likelihood of a ‘minus’ reading before too long.

There’s no shortage of brilliant FTSE 100 stocks to buy today, some of which are dealing at rock-bottom prices following the market crash. So, in my opinion, there’s no reason to take a dangerous gamble with the Lloyds share price today.