A £30,000-a-year passive income would be life-changing for the vast majority of Britons. After all, the average earning is a little over £39,000. That’s just £32,000 after tax.

With that in mind, a £30,000 passive income from a Stocks and Shares ISA — which is shielded from tax — would almost double the average take-home salary.

It’s enough to replace a large chunk of a salary, cover everyday living costs, or create genuine financial flexibility.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Getting started

But very few investors start with the kind of portfolio that can generate £30,000 a year. Most begin with nothing more than a monthly contribution and a long-time horizon.

That’s where compounding — not just of dividends, but of sensible investment decisions — does the heavy lifting.

Rather than focusing on income from day one, many successful ISA investors spend years prioritising growth. Regular contributions, reinvested returns, and patience can turn modest beginnings into a substantial pot.

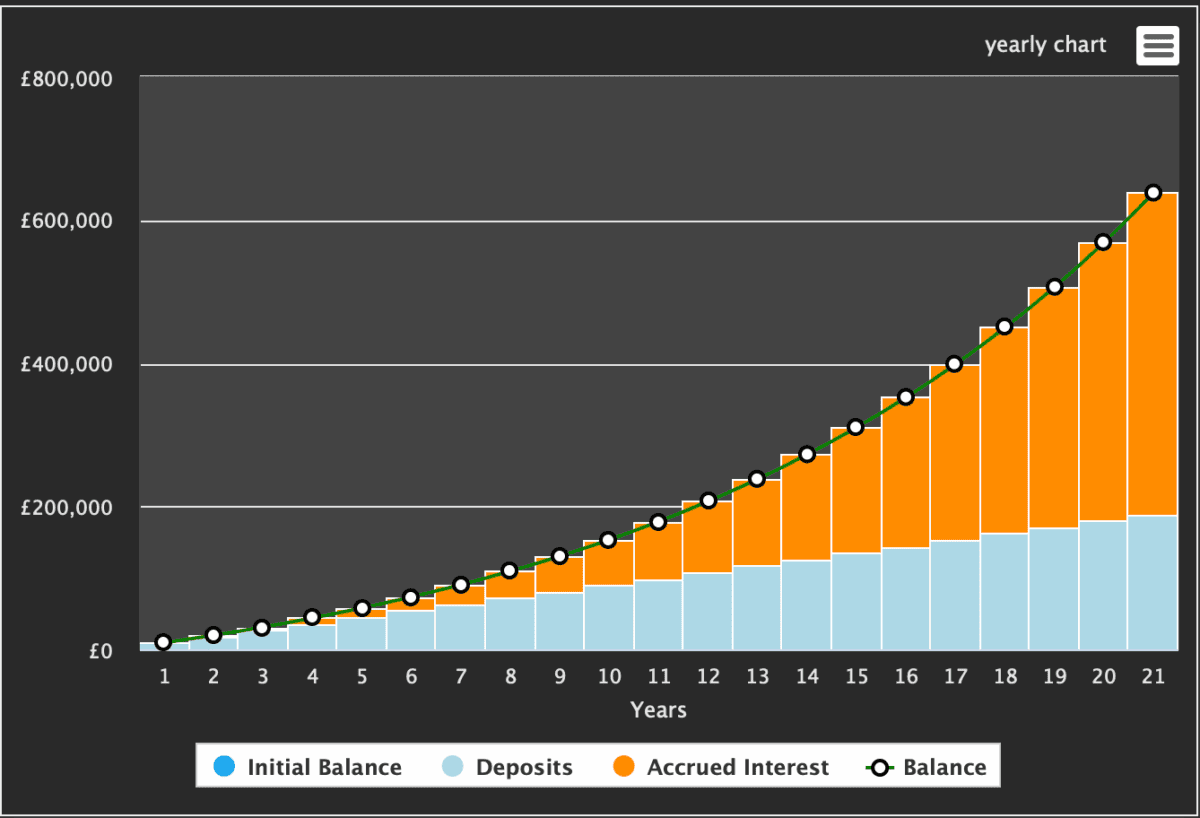

A £750 monthly investment earning an average 10% annual return, for example, could grow to more than £600,000 over 21 years. Increase the time frame, or the contribution, and the numbers begin to snowball. But of course, not everyone can achieve that 10% annual return. A lower percentage means it will take longer.

Only once the ISA has reached a meaningful size does income really come into play. At that stage, the question shifts from “how fast can this grow?” to “how reliably can this pay out?”

In theory, £30,000 can be generated with a portfolio worth £600,000 with an average yield of 5%. The sustainability of the yield depends on lots of things. As share price and dividend yields are inversely correlated, it can be hard to get a sustainable yield above 5% in a buoyant stock market. In downturns, that might be easier.

Knowing where to invest

For most Britons, the most pressing issue is where to start investing. It’s not easy to know where to put your money.

Like most of my colleagues at The Motley Fool, I believe a portfolio of well-researched stocks is the best way to beat the market.

One company that catches my eye is Jet2 (LSE:JET2). The company’s clearly undervalued relative to its peers, and currently trades around 4.5 times net income when adjusted for net cash.

The company trades around 6.3 times forward earnings — not adjusted for cash — which is already cheaper than most of its peers. But as referenced, it’s this net cash position that makes a huge difference. The market-cap’s £2.5bn, but the net cash position is around £800m.

Looking forward, we can see that revenue’s expected to surge but earnings remain flat. This represents higher costs associated with setting up a new base at Gatwick in addition to fleet renewal costs.

However, this should set up the company for much stronger earnings growth from around 18 months’ time.

Despite my bullishness, I’m aware a jump in jet fuel prices would materially impact profitability. Likewise, higher employment costs (such as another lift to the Minimum Wage) won’t benefit the business.

Nonetheless, I’m still very confident that this business can take my portfolio higher. Analysts are too with an average share price target 49.9% above the current level.

It’s definitely worth considering as an investment opportunity.