ISAs remain one of the most powerful tools for building passive income, because every penny of interest, dividends, and capital gains is completely tax free. But with cash rates drifting lower, relying on a Cash ISA alone makes it increasingly difficult to generate meaningful income.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Crunching the numbers

So how much would I need invested in an ISA to earn £2,317 a month? That’s equates to £27,804 a year – roughly 75% of the average UK salary – enough to meaningfully replace part of a full-time income.

Using the 4% rule, which already accounts for inflation, a portfolio would need to be worth around £700,000 in today’s money to generate this income.

Put another way, this is the purchasing power you’d want at age 65; you don’t need £700k sitting in your account today. Instead, disciplined investing over the years builds a portfolio that grows to this target in real terms, adjusting naturally for inflation along the way.

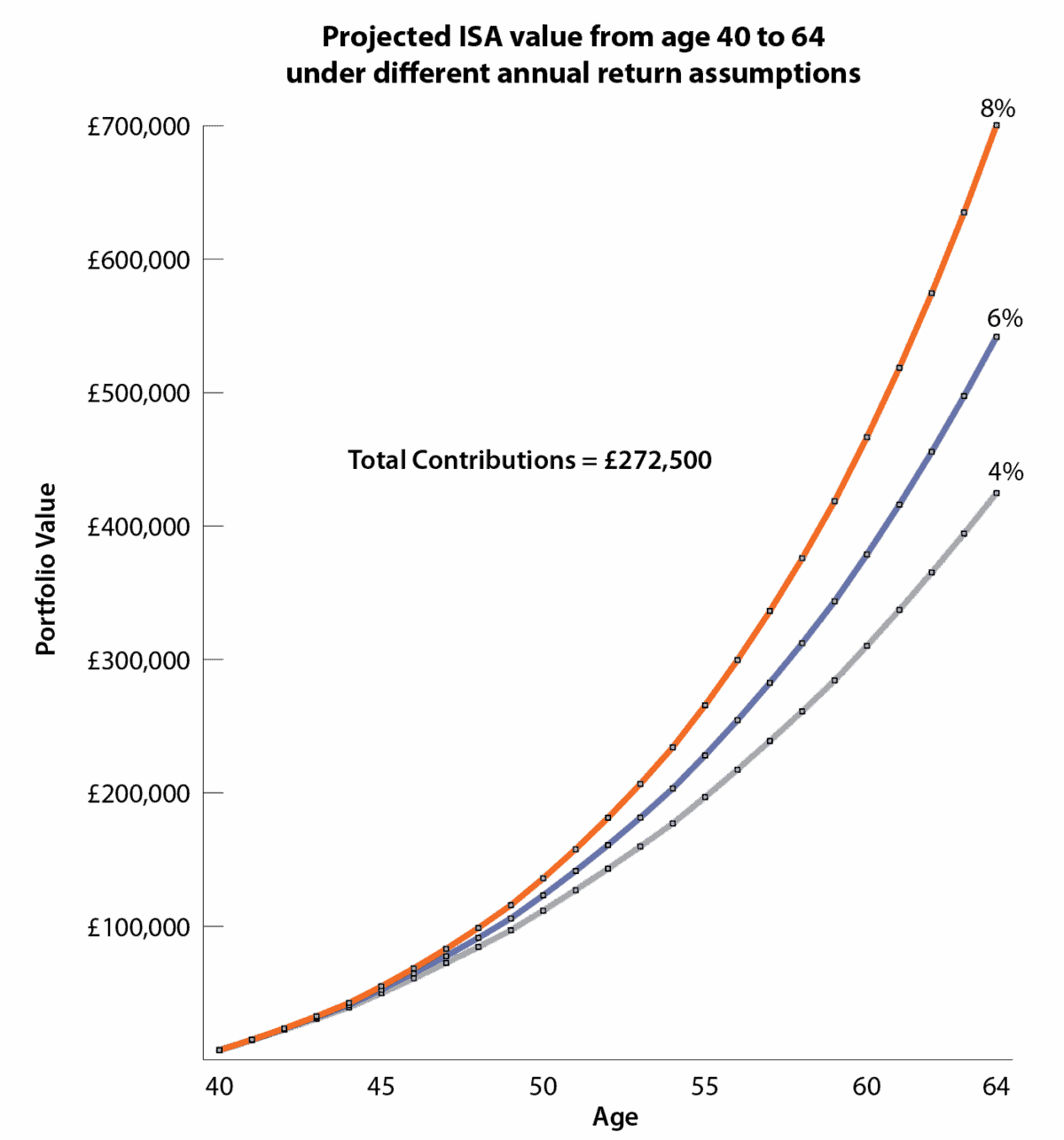

The chart below shows how tiered contributions totalling £272,500 over a 25-year investing horizon (age 40 to 64) could build an ISA portfolio under three different annual return assumptions.

- 4%: a cash-like baseline where progress is steady, but even disciplined contributions fall well short of the £700,000 target in real terms.

- 6%: a balanced long-term return that builds a substantial pot, but still leaves a noticeable gap to fully replace 75% of the average salary.

- 8%: a stronger equity return where compounding accelerates in later years, allowing the portfolio to reach the £700,000 target by age 64.

Chart generated by author

Growth stock

Many investors assume that building passive income means owning high-yield shares from day one. I don’t take that view. During the contribution phase, long-term growth can be far more powerful – especially when dividends are reinvested.

That’s why Prudential (LSE: PRU) earns a place in my Stocks and Shares ISA. Its current dividend yield of around 2% isn’t the attraction. Instead, I see it as a compounding growth opportunity across in Asian markets, where insurance penetration remains in the low single digits. The region’s protection gap is estimated at well over $100trn, providing a structural backdrop for decades of growth.

In 2025, the shares are up around 75%, making the company the strongest performer among its FTSE 100 insurance peers. Even after that rally, I’d argue the stock remains underappreciated, partly because lingering concerns around China continue to dominate the narrative.

The insurer’s capital-light model gives it significant flexibility. Between 2024 and 2027, the group expects to return more than $5bn to shareholders, combining steady dividend growth with a sizeable share buyback programme. More broadly, Asia’s expanding middle class is driving rising demand for financial protection, savings, and health products – services many Western investors take for granted.

The main risks are regulatory or policy changes in China, currency swings, and uneven economic growth across Asia, which could cause short-term volatility. Nevertheless, in my opinion, these factors don’t alter the long-term growth thesis.

Bottom line

Reaching a £700k target over a 25-year investing horizon requires not only discipline and patience, but also a focus on growth opportunities that the market may be overlooking. Prudential is an example that illustrates this approach, which is why it features in my Stocks and Shares ISA – though it’s far from the only stock I have my eye on.