Passive income is why I hold Legal & General (LSE: LGEN) shares. The FTSE 100 insurer yields over 9%, backed by long-term cash flows. With a flat share price but steady capital generation, could this be a stock to grow your passive income over time?

Patience is key

I’ve always seen investing as a game of patience. Chasing the next AI growth stock might be exciting, but it won’t help me sleep at night.

My rule is simple: stack the odds in my favour, then let compounding do the heavy lifting.

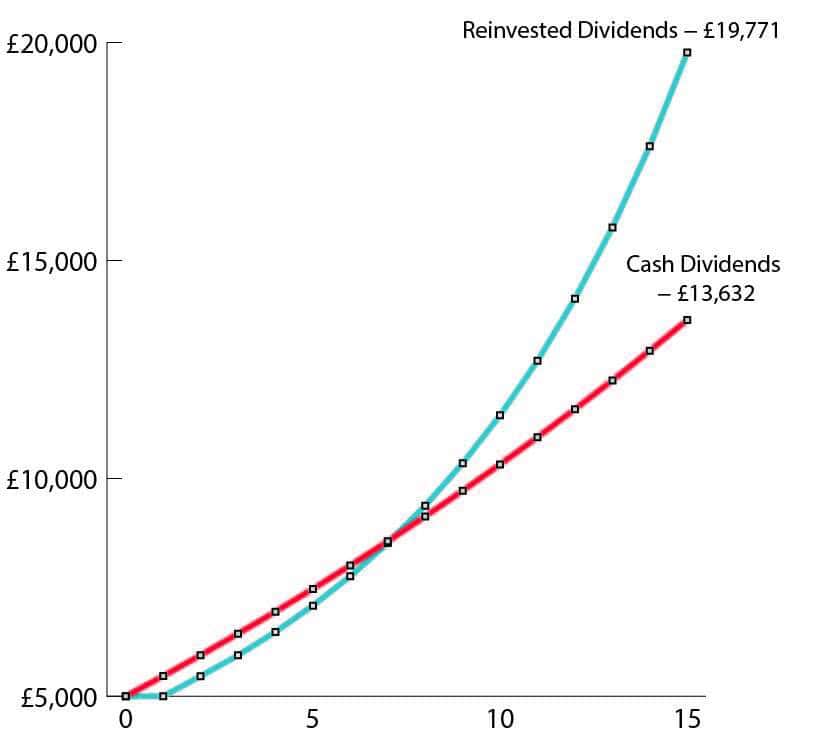

The chart below shows why. Even with zero share price growth, the stock’s strong yield could nearly quadruple my initial investment in 15 years, based on a conservative, yet realistic, 3% annual growth in dividends per share (DPS).

Chart generated by author

Dividend sustainability

It’s no good picking stocks based on headline yields, only to see the dividend cut later. I remain confident in the medium-term outlook for this dividend.

Solvency II operational surplus generation (OSG) is the key metric. This measures the surplus capital generated by the business to fund both future growth and shareholder payouts.

OSG in 2025 is expected to grow 5%, comfortably higher than the 2% growth in DPS. In addition, following the sale of its US protection business, the company will buy back £1bn of its own shares next year. This will reduce the cash cost of the dividend by £100m, further supporting future OSG growth.

Risks

Even strong dividend stocks carry risks. A slowdown in economic growth or rising inflation could limit demand, putting pressure on revenue and cash generation.

These same macro pressures could also affect the value of the company’s £86bn bond portfolio, particularly if a recession hits next year.

A recession could push up borrowing costs for many of the businesses it invests in. With rising credit risk, investors would demand higher bond yields. When yields rise, the market value of existing bonds falls.

Taken together, these factors could impact the company’s ability to sustain its dividend.

Future growth

The insurer’s cash cow is pension risk transfer (PRT). Pension trustees rely on the company to help derisk their final salary pension schemes. This is a highly lucrative and expanding market. Over the next decade, the total addressable market is predicted to reach £1trn.

Last year, the business wrote £10bn of PRT deals globally. In the UK alone, it has visibility on or is actively pricing £42bn of new deals over the next 12 months, nine of which exceed £1bn.

Between 2024 and 2028, it forecasts writing £50bn-£65bn of PRT deals in the UK alone.

Bottom line

A long-term share price chart of Legal & General doesn’t exactly inspire confidence at first glance. Nevertheless, I have owned the stock for years not only for the headline yield but because of dividend reliability and growing cash generation.

Over the past decade, total shareholder returns have reached a respectable 83%. Looking ahead, the dividend appears well supported by strong cash generation, underpinned by the insurer’s high-quality, growing businesses.

For patient investors, this mix of steady growth and reliable income could offer a pathway to a sustainable passive income stream.