Gold stocks have been among the strongest-performing UK shares in 2025. Gold prices have surged 52% in the year to date. And there’s good reason to expect bullion values to keep on climbing.

Here’s why I think gold mining shares remain top companies to consider.

Gold price boom

Demand for the precious metal is rocketing as investors search for safe havens. Indeed, latest data from the World Gold Council (WGC) shows that gold demand is reaching unprecedented levels.

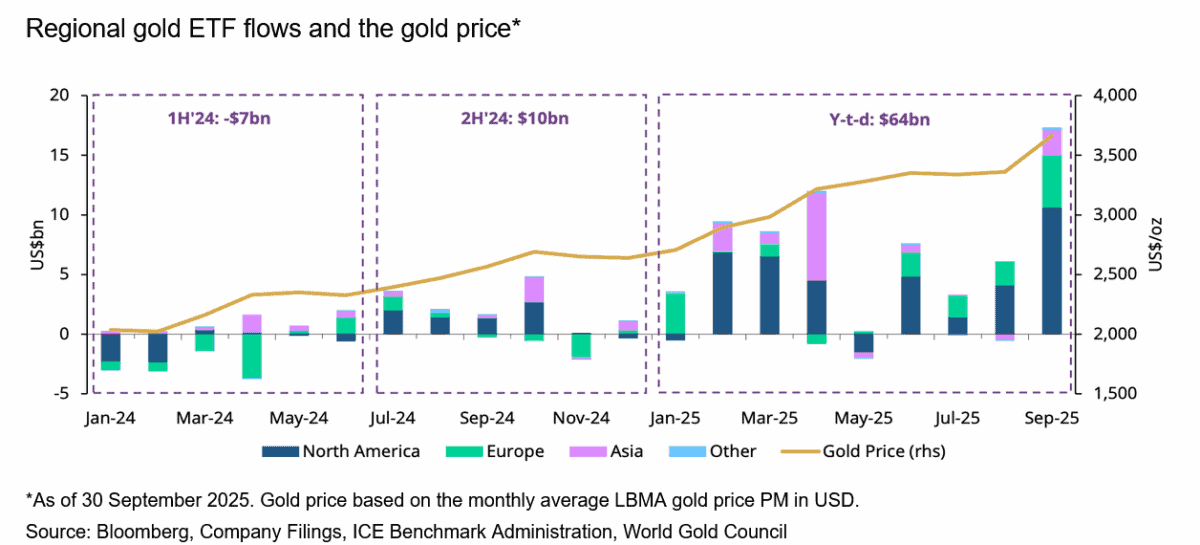

The organisation says that gold trading volumes averaged a whopping $388bn in September. This figure — which measures liquidity in futures, exchange-traded funds (ETFs) and over-the-counter (OTC) markets — represented a 34% month-on-month increase.

The WGC also says gold ETF inflows in September reached their highest monthly level on record. Fund holdings increased by 146 tonnes, significantly above the 53 tonnes recorded in August.

ETFs now hold 3,838 tonnes of the yellow metal. That’s fractionally below the all-time summit of 3,929 tonnes held in November 2020.

Looking good

There’s no guarantee that gold prices will continue rising, of course. But bullion demand continues to bubble and new record prices have been touched in October. As I type, it’s at fresh peaks within a whisker of $4,000 per ounce.

A push through this technically and psychologically important level could pave the way for further hefty gains. Significant factors that could drive gold through this level include rising inflation, economic turbulence, interest rate cuts, and worsening geopolitical tensions.

Political and economic turbulence in the US — on issues ranging from trade tariffs and central bank independence, to more recently government shutdowns — are also painting a bright picture for safe havens like gold.

A top gold share

I’ve bought shares in the L&G Gold Mining ETF to capitalise on this upswing. The fund — which holds a basket of 37 mining shares — has proved a lucrative buy for me, rising 79% in value since I opened a position in early April.

I’m considering increasing my exposure to gold stocks further by purchasing Endeavour Mining (LSE:EDV). It’s risen an even more impressive 112% since 1 January.

Buying an individual share like this is more risky than holding a basket of them with an ETF. Metals mining’s a notoriously unpredictable business, and problems at the exploration, project development and production phases can hammer earnings.

With my L&G ETF, these risks are nicely spread out. However, as Endeavour’s strong performance in 2025 shows, the potential for outsized returns can be higher with individual stocks. In the case of this FTSE 100 share, prices have been boosted by surging output (up 38% in the first half), strong margins, and robust cash flows that have led to dividend hikes and share buybacks.

A sharp pullback in gold prices could pull prices of mining shares such as Endeavour sharply lower. But with gold’s multi-year bull run accelerating, I think increasing the number of gold stocks in my portfolio is worth serious consideration.