Taking a Stocks and Shares ISA from £20,000 to £1m is ambitious but theoretically possible. For example, if an average growth rate of 12% a year could be sustained for 35 years, a seven-figure portfolio would result.

In fact, since September 2020, the share price of the FTSE 100’s Endeavour Mining (LSE:EDV) has grown by an average of 13.4% a year. If that rate held steady, someone could become an ISA millionaire within 32 years.

However, a double-figure growth rate is the exception rather than the norm. And past performance shouldn’t be relied upon to predict future returns.

An asset for uncertain times

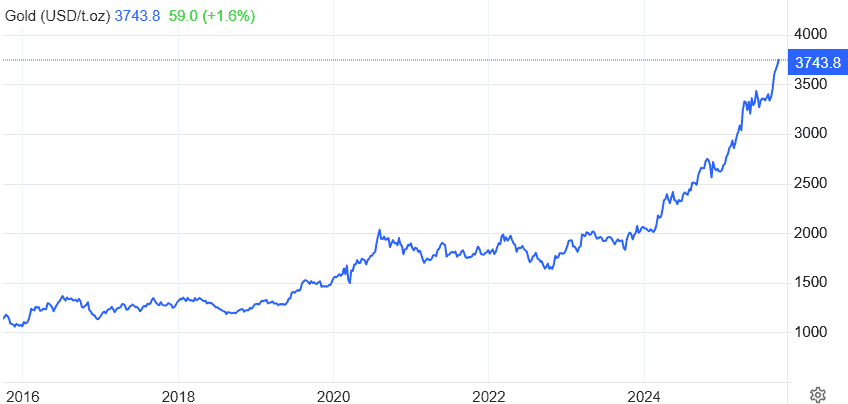

But Endeavour, one of the world’s leading gold producers and the largest in West Africa, has achieved this feat on the back of soaring prices. During times of economic uncertainty, investors tend to swap other financial assets for gold.

As the table below shows, the average price received by the group during the second quarter of 2025 was 62% higher than in the last quarter of 2023. Over this period, costs have also risen but less quickly. The group claims to have the fourth-lowest all-in sustaining cost in the industry (AISC). The result is higher earnings and a soaring share price.

In 2024, through a combination of share buybacks and dividends, Endeavour reckons it returned $251 to shareholders for every ounce of gold it produced. For the first half of 2025, the equivalent figure was $338.

| Quarter | Realised gold price ($/oz) | AISC ($/oz) |

|---|---|---|

| Q4 2023 | 1,945 | 947 |

| Q1 2024 | 2,041 | 1,186 |

| Q2 2024 | 2,287 | 1,287 |

| Q3 2024 | 2,342 | 1,287 |

| Q4 2024 | 2,590 | 1,141 |

| Q1 2025 | 2,783 | 1,129 |

| Q2 2025 | 3,150 | 1,458 |

Taking advantage

To try and capitalise on this interest in the precious metal, the World Gold Council, the trade body for the industry, has made a documentary called Elton John: Touched by Gold. During the film, the famous singer describes the metal as “timeless” as well as representing something that’s “inspirational, awe-inspiring and joyous”.

Anyone who has invested in Endeavour over the past few years will probably agree with Sir Elton. But I doubt whether a 26-minute “exclusive access” documentary featuring lots of gold boots, glasses, and jewellery – as well as his collection of gold discs — will have much of an impact on prices. Economists reckon global bank demand and inflation, particularly in the US, will have more of an influence.

But there are challenges that Endeavour must deal with. As the chart below shows, prices can be volatile. If gold starts to fall, there’s likely to be a significant pullback in the group’s share price.

In addition, mining is operationally challenging, particularly in rural Africa where its principal assets are located. Currencies on the continent can also fluctuate significantly and, if they go in the wrong direction, could adversely impact earnings.

Looking ahead

However, at the moment, there’s no sign of a slowdown in gold prices and most observers believe the rally’s not over yet.

The current (26 September) price is around $3,750. And due to geopolitical concerns, tensions between President Trump and the US Federal Reserve, and “robust” central bank purchases, UBS is predicting $3,800 by the end of 2025 and $3,900 by mid-2026.

Deutsche Bank is more bullish and reckons it could break through the $4,000-barrier sometime in 2026. Industry experts appear to agree that current market conditions make a sharp correction unlikely.

On this basis, as a long-term hedge against global uncertainty, I reckon Endeavour Mining is a stock to consider.