Jet2 (LSE:JET2) shares have pulled back sharply in recent weeks after the company warned that annual earnings are likely to land at the lower end of market forecasts.

Management pointed to a continuing trend of customers booking much closer to departure, which reduces forward visibility and clouds short-term earnings expectations.

However, despite these near-term uncertainties, there are reasons to believe the stock may be undervalued and worth considering for investors.

To the end of August, flown package holiday customers grew just 2%, while flight-only passengers increased 17%. Average package holiday pricing has remained modest, while flight-only yields have become increasingly attractive.

Forward bookings remain lower than usual, prompting Jet2 to trim its planned winter capacity slightly from 5.8m to 5.6m seats. While this represents a 9% increase compared to last winter, it wasn’t what the market wanted to hear.

Speaking to the market, chief executive Steve Heapy said flexible capacity management, combined with award-winning service, will provide a strong foundation for long-term growth.

Nonetheless, what we’re seeing is a stock trading a lot lower.

Valuation stands out

From a valuation perspective, the numbers are compelling. With a market-cap of £2.66bn today, Jet2’s net income is roughly 1.1 times its enterprise value, adjusted for net cash.

The EV-to-EBITDA ratio stands at just 0.83 — that’s materially lower than peers such as IAG (3.8) or TUI (1.7). This is all possible because Jet2 has a fortress-like balance sheet and a net cash position that’s expected to strengthen, potentially reaching £2.4bn in 2027.

The balance sheet strength provides both resilience and flexibility, supporting ongoing fleet expansion and operational investment.

Despite the challenging macroeconomic backdrop in the UK, earnings are expected to grow steadily, with EPS forecast to rise from 207p in 2025 to 254p in 2027.

That said, risks remain. Labour costs are rising — the company anticipates a £25m annual increase due to changes in the UK Budget — while oil prices and consumer confidence could affect margins. For now at least, lower jet fuel prices represent a supportive trend.

Ongoing investments

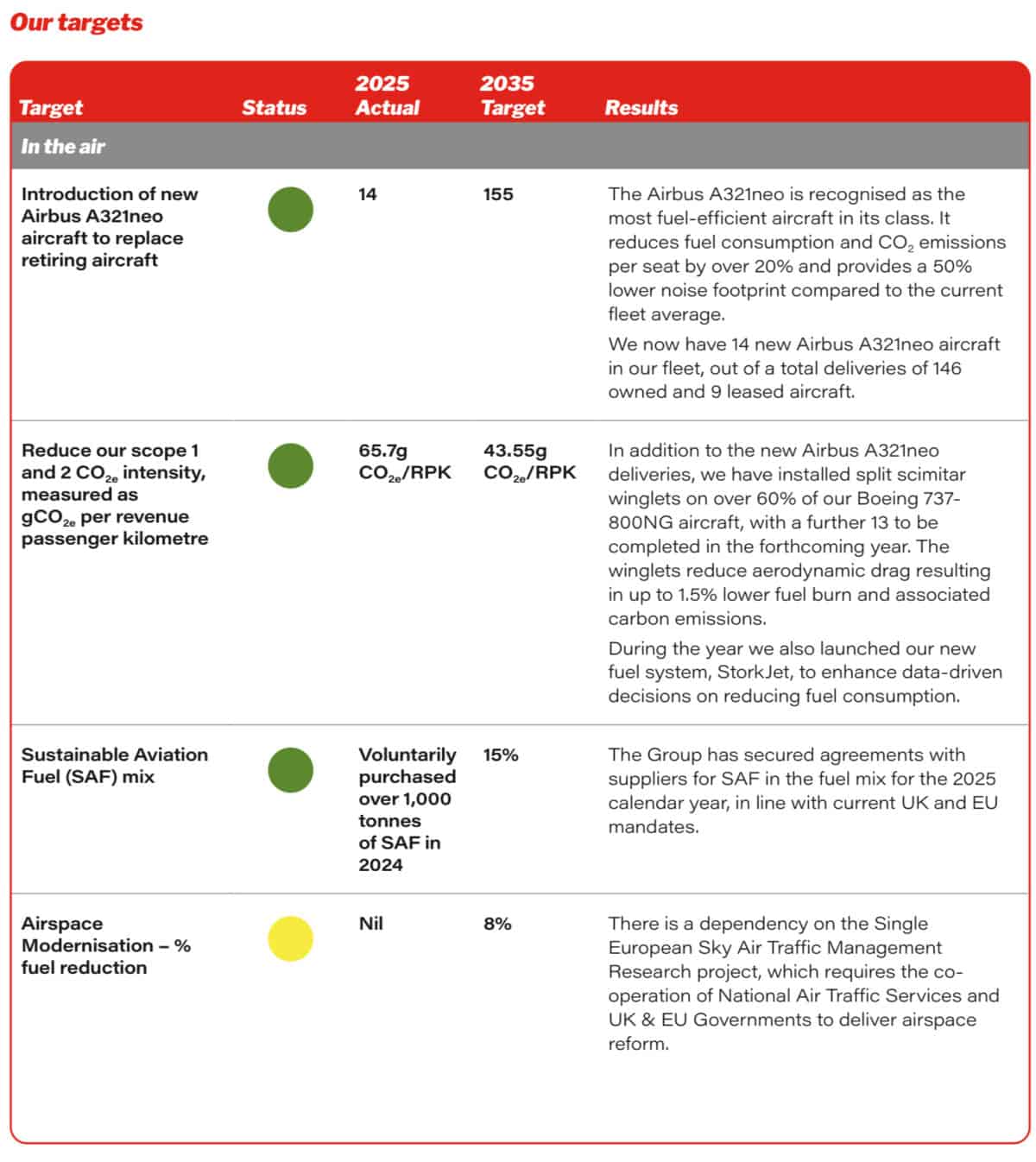

Operationally, Jet2’s investing in its fleet with a total commitment of 155 Airbus A321neo aircraft by 2035. These aircraft offer 20% greater fuel efficiency and a 50% lower noise footprint than older models, while gradually replacing Boeing 737s and retired 757s.

In the long run, this should allow Jet2 to become a more efficient player in the sector. It currently has one of the oldest fleets — around 13.8 years on average.

The bottom line

Despite these challenges, Jet2 remains a highly profitable business with an excellent balance sheet. What’s more, the valuation metrics suggest the market may be overlooking the stock.

For long-term investors, this combination of strong fundamentals, ongoing fleet modernisation, and undemanding metrics mean it’s one to consider for their portfolios.

Moreover, it’s now 48% below the average share price target.