The FTSE 100 index of shares has risen sharply in 2025, pulling its yield in the other direction. A 12% increase in the year to date has dragged the Footsie‘s average dividend yield to 3.3%.

That’s at the lower end of the index’s 3%-4% long-term average.

Yet despite this, the FTSE 100 remains a great place to go shopping for a passive income in my opinion. Here are two high-yield blue-chips I think demand serious consideration today.

Dividend hero

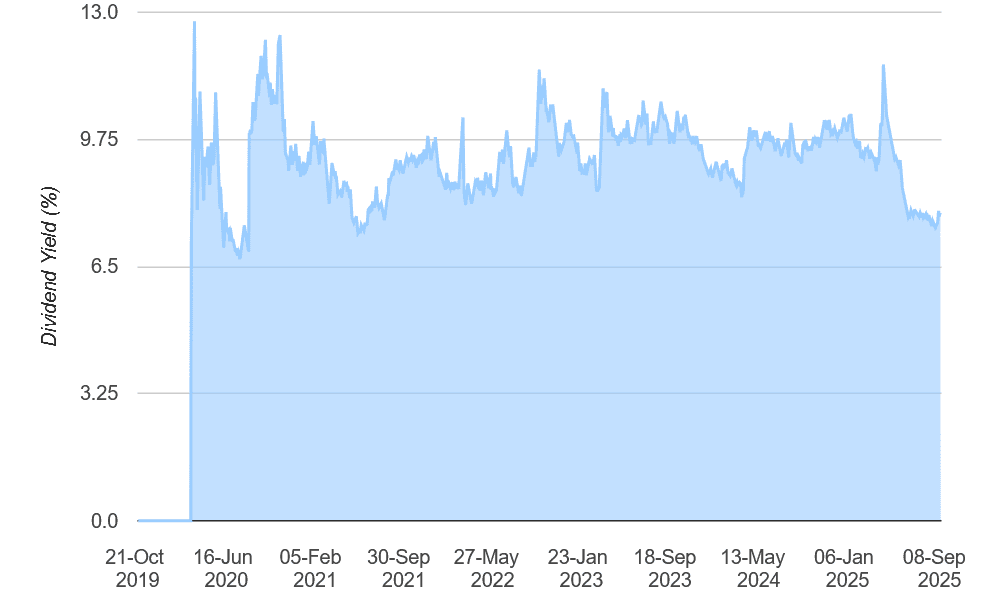

At 7.9%, the dividend yield on M&G‘s (LSE:MNG) shares is currently the fifth-highest on the Footsie. That’s despite them soaring around 28% in value since 1 January.

The former Prudential company has a long record of providing large dividend yields, as the chart shows. It’s raised cash rewards every year since it listed on the London Stock Exchange in 2019 too.

This reflects the company’s formidable cash flows, underpinned by the steady fees it receives from its asset management arm and premiums from its insurance business. Its operations are also capital-light, giving it more money to return to shareholders.

M&G ended the first half with a Solvency II capital ratio of 230%, up 7% from December. This reassures me it’s in good shape to keep its progressive and generous dividend policy motoring.

Can it continue being a strong passive income generator over the longer term though? I’m confident it can, even though intense competition across its product segments is a constant threat to profits and therefore dividends.

M&G has substantial demographic trends to capitalise on, with ageing consumers driving demand for its investment, pensions and protection products. The company, which has been around since 1931, has significant brand recognition to leverage to make the most of this opportunity too.

I’m also encouraged by M&G’s ongoing and fruitful push into overseas markets, and especially those in fast-growing Asia. Some 58% of assets under management and advise (AUMA) are now from international customers, up from 37% just five years ago.

A recovery share

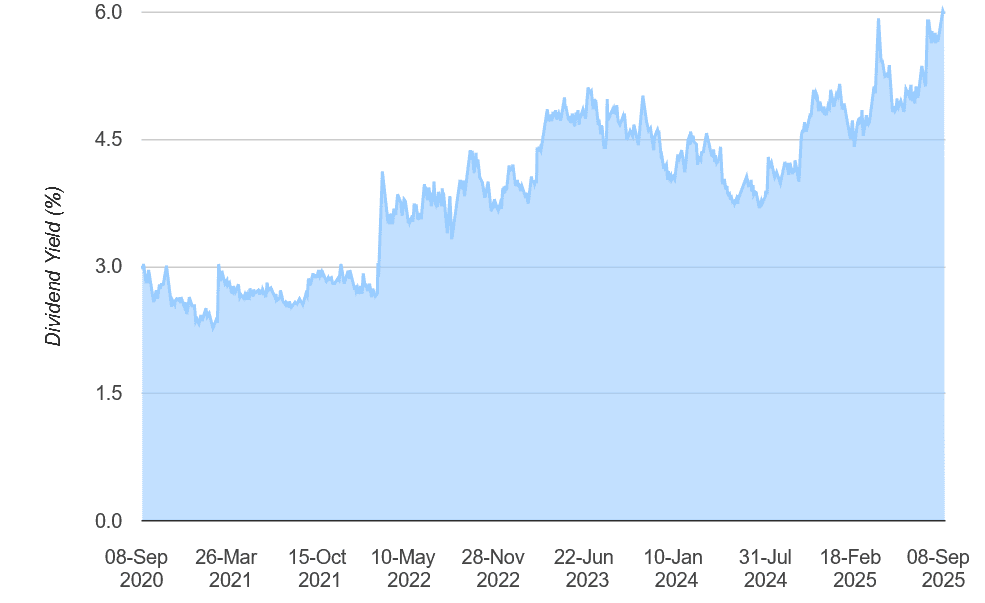

Packaging manufacturer Mondi (LSE:MNDI) hasn’t historically been a lucrative pick for dividend chasers. But sustained share price weakness — the company’s fallen 14% in value in 2025 alone — has pumped its dividend yield up to attractive levels, at 6%. This makes it one for further research, in my opinion.

The boxmaker’s been under the cosh of late as tough economic conditions have damaged demand. As a consequence, it’s kept ordinary dividends frozen for two years, although in 2024 it did pay a special dividend following the sale of its Russian assets.

With fierce tariffs impacting global trade flows, things could remain tough for Mondi. I’m also mindful that the firm’s net debt-to-EBITDA ratio has risen recently (to 2.5 times as of June from 1.5 times a year earlier) due to rising capital expenditure.

However, falling interest rates could feed through to improving revenues and profits from this point on. Mondi, which also remains highly cash generative, has expanded capacity at key projects to capitalise on an industry upturn too, while it’s also acquired rival Schumacher’s assets in Western Europe to grow revenues.

It’s not out of the woods yet. But I think investors with higher risk tolerance may want to give Mondi a serious look as a potential recovery stock.