Thanks to the power of compounding, investing in dividend shares can be the fast-track to building significant wealth in a Stocks and Shares ISA.

Compounding involves reinvesting all the dividends one receives to buy more shares. More shares mean more dividends, and over time this snowball effect can supercharge long-term portfolio growth.

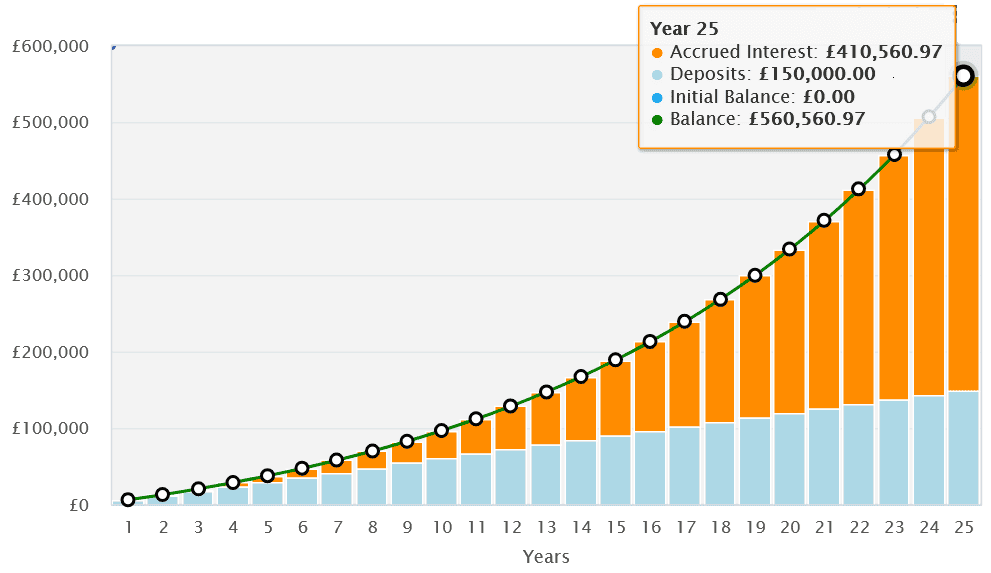

Let’s say an investor puts £500 monthly into a Stocks and Shares ISA, reinvesting dividends along the way. Thanks to the compounding effect, they’d have a portfolio worth £560,561 after 25 years, comprising deposits of £150,000 and three times as much as this — £410,561 — in investment returns. That’s based on an average annual return of 9%.

There are thousands of dividend-paying shares, funds, and trusts to choose from in the UK alone. Here are two to consider that help investors balance reward and risk.

Flowing dividends

Utilities like water companies and energy suppliers are also famed for their dividend resilience. Why? The essential services they provide guarantee a steady cash flow they can distribute to their shareholders.

The iShares S&P 500 Utilities Sector UCITS ETF (LSE:IUUS) offers an attractive way to play this defensive market. It holds shares in 31 utilities companies Stateside, including specialist businesses like NextEra Energy and American Water Works, along with multi-utility suppliers such as Consolidated Edison and Ameren.

Utilities are considered lower risk, though they also have their own unique problems. The sector is highly regulated and, while current rules allow the company and shareholders to make healthy returns, things can change over time.

However, the sector still enjoys a lower risk profile than more cyclical sectors. And in the case of this ETF, its diversification across utilities companies can reduce the impact of any incoming regulatory changes in one area.

Dividends are automatically reinvested in the fund for growth. It’s delivered a total average annual return of 10.4% since 2020.

FTSE 10 heavyweight

M&G (LSE:MNG) has also been a powerful passive income provider over the years. Since it was spun out of Prudential in 2019, annual dividends have consistently risen. They’ve also delivered payouts far higher than the UK blue-chip average.

This trend looks set to continue, too. Predictions of dividend growth for 2025 leave it with an 8% forward dividend yield, more than double the FTSE 100 average of 3.5%.

Asset managers like this enjoy capital cash generation. With a global customer base of 5.1m, has built a Solvency II capital ratio of 203%. This gives it the financial base to remain one of the FTSE index’s highest-yielding shares.

The company operates in a sector which, due to the rising importance of financial planning, is tipped for strong and long-term growth. Boosted by its formidable brand power, I’m expecting M&G’s profits and dividends to rise steadily in this climate.

A mix of capital gains and rising large dividends means M&G shares have delivered a terrific average annual return of 17.1% since 2020. Future returns could be impacted by interest rate fluctuations. But with inflation steadily receding, I’m expecting the firm to keep delivering healthy returns.