Salesforce (NYSE:CRM) is a US stock poised to reshape the artificial intelligence (AI) landscape with its Agentforce platform, leveraging its strong foothold in enterprise solutions to drive a new era of AI-powered business transformation.

Salesforce’ Agentforce is one of the first manifestations of agentic AI. These are systems that can operate with a degree of autonomy, making decisions and taking actions to achieve goals independently.

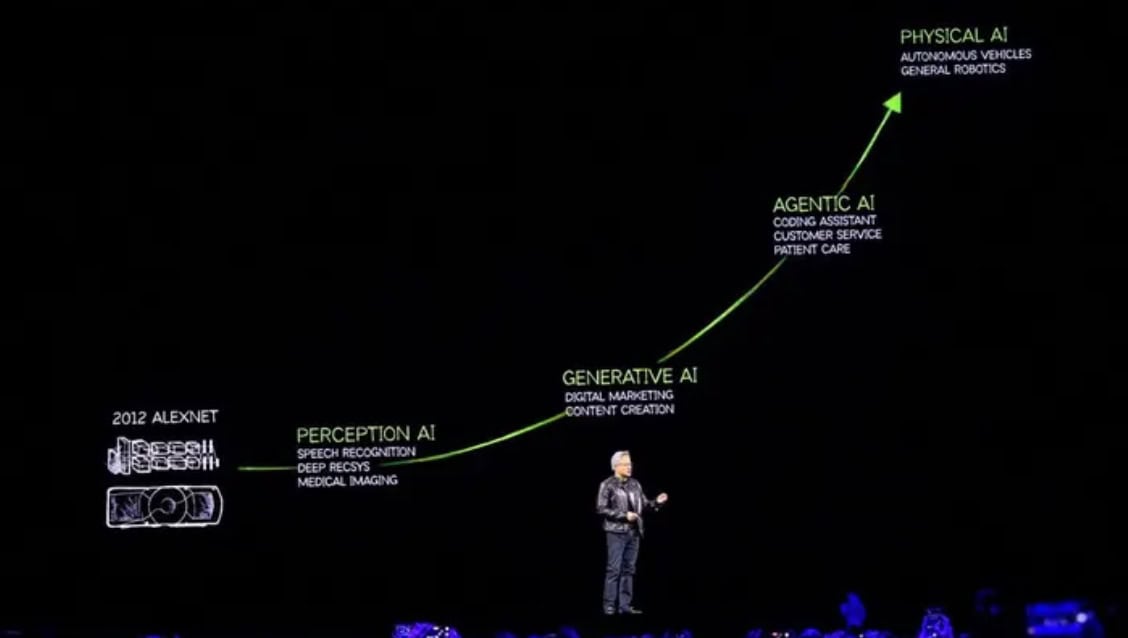

It sounds cool. But the market got even more hyped about agentic AI recently after Nvidia boss Jensen Huang shared an image detailing the progression of this technology.

What is Agentforce?

Agentforce represents a significant evolution beyond traditional chatbots. It offers autonomous AI agents capable of understanding intent, accessing real-time data, and executing complex tasks across sales, service, and marketing functions.

What sets Agentforce apart is its unified platform that integrates agents, data, applications, and metadata, enabling enterprises to deploy scalable, proactive AI systems. The recent launch of Agentforce 3 introduces enhanced observability through a command centre, supports open standards like model context protocol (MCP), and connects seamlessly with over 30 partners.

Entrenched market position

Salesforce will also benefit from its entrenched position in enterprise workflows and its extensive partner ecosystem. And this means Agentforce will represent an upsell on their current subscription and not a wholly new investment.

What’s more, early adopters have reported meaningful improvements. Engine cut customer case handling times by 15%, 1-800Accountant automated 70% of peak tax season chat engagements, and Grupo Globo improved subscriber retention by 22%. These results highlight how Agentforce can enhance productivity and customer experience at scale.

Cheaper than its peers

From a valuation perspective, Salesforce currently trades at a forward price-to-earnings (P/E) ratio of 22.87. That’s slightly below the information technology sector median of 23.73 and well under its own five-year average of 40.18. This suggests a more conservative market valuation despite its AI leadership.

The forward P/E-to-growth (PEG) ratio stands at 1.31, below the sector median of 1.87. This also indicates that the stock may be undervalued relative to its expected earnings growth, which consensus estimates place between 10% and 15% annually through 2029.

The bottom line

However, the thesis isn’t without its risks. Salesforce faces stiff competition from tech giants like Microsoft, Google, and Oracle, all aggressively investing in enterprise AI. The success of Agentforce hinges on execution and widespread adoption. Failure to deliver measurable ROI could weigh on the stock.

Additionally, the complexity of integrating AI agents at scale brings challenges around security, governance, and compliance that Salesforce must manage carefully. This isn’t a unique problem, however. It’s industry wide.

Despite this, it’s one of my favourite US stocks to buy at the moment. In fact, it’s become one of my largest holdings in the past three months. The valuation isn’t too demanding and that’s unusual in the current market. It’s certainly worthy of consideration.