While they’ve been volatile at times, Scottish Mortgage (LSE: SMT) shares have been a great investment for my portfolio. I own the shares in several different accounts and in every account, I’m sitting on solid, double-digit gains.

Today, I remain bullish on the shares (and think they’re worth considering for those who don’t own them). Here’s why I continue to believe they’re a good long-term investment.

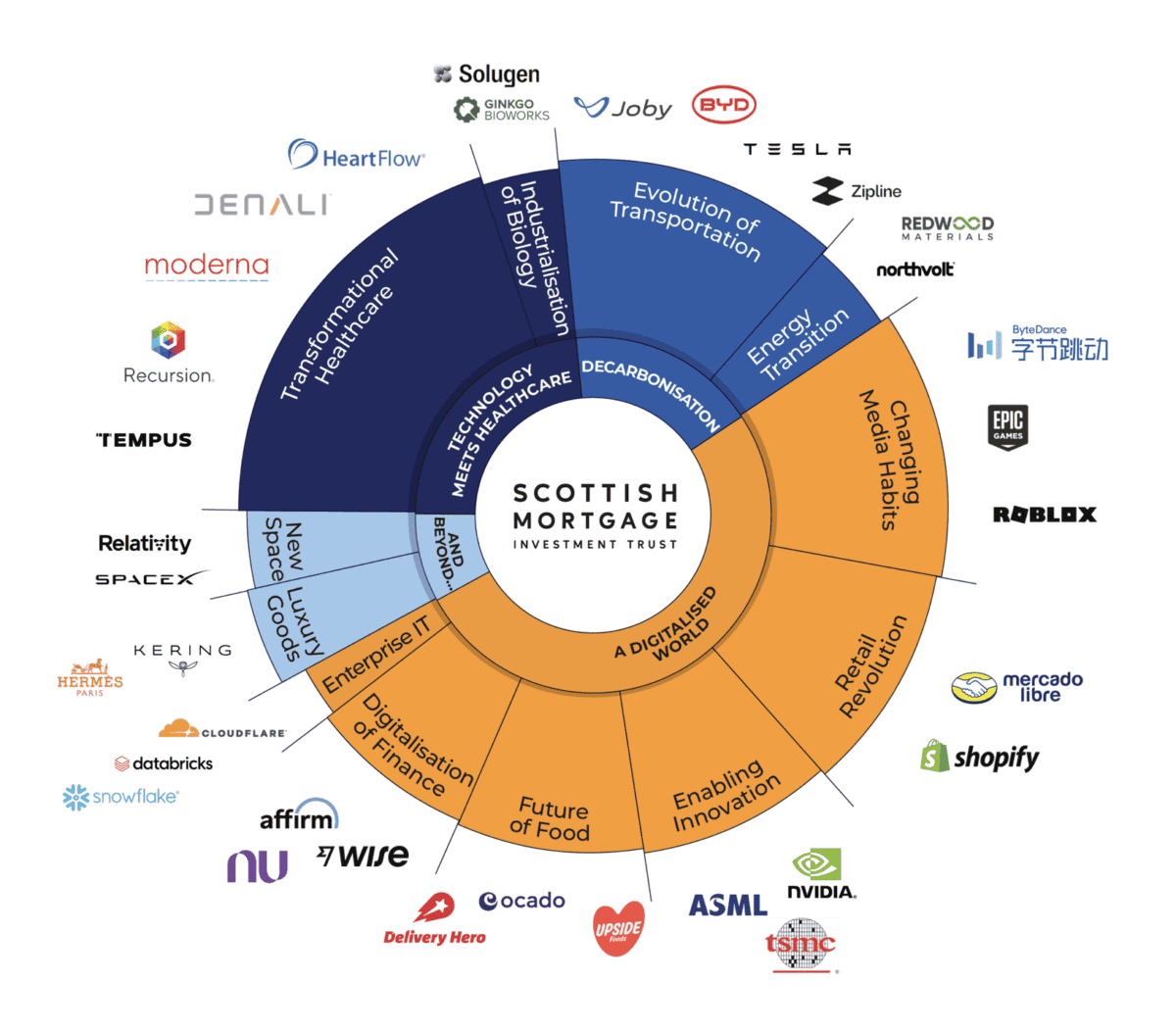

Exposure to growth industries

Let’s start with the fact that the investment trust provides exposure to growth industries. With this product, I get exposure to industries such as online shopping, semiconductors, electric and self-driving vehicles, financial technology (FinTech), artificial intelligence (AI), and more.

These kinds of industries are driving the technology revolution we’re experiencing today. And they’re creating a lot of lucrative opportunities for investors in the process.

I expect this trend to continue. Looking ahead, the world is only going to become more digital.

Investments in scalable companies

The next thing I like is that the trust offers exposure to a lot of really scalable companies. This is valuable – history shows that scalable companies often turn out to be excellent investments.

An example of such a company in the portfolio today is Shopify (NASDAQ: SHOP). It operates a powerful e-commerce shopping platform that allows retail brands to easily sell their products online (without having to worry about things like website development, cybersecurity, payments, etc).

In theory, the growth potential here is limitless. That’s because Shopify’s platform can accommodate a vast number of merchants – from small start-ups to large enterprises – without a proportional increase in its own operational costs.

Of course, a consumer spending slowdown is a risk, as is competition from other internet companies such as GoDaddy. In the long run. However, I expect the company to get much bigger (it could also be worth considering as a long-term investment).

It’s worth noting that Shopify has been landing some big-name clients recently. Some examples here are Gymshark, SKIMS (Kim Kardashian’s shapewear brand), and Alo Yoga.

Trading at a discount

Finally, I like the fact that the trust is trading at a near-11% discount to its net asset value (NAV). This essentially means that I’m getting exposure to a lot of great tech companies at a double-digit discount.

That’s appealing to me. With this trust, I’m actually getting growth and value.

A higher-risk investment trust

Now, I’ll point out that Scottish Mortgage is higher up on the risk spectrum within the investment trust universe. This is due to the fact that it has a strong focus on innovative growth businesses, which tend to be riskier investments.

On its website, it says: “The returns we aim to produce for shareholders will appeal to many, but the road travelled in achieving them may not.” In other words, this product – with its high level of volatility – is not for everyone.

I’m comfortable with the risk level here, however, as I have kept my position quite small at about 3% of my overall portfolio. With a position of that size, I can benefit from any potential share price gains without having to worry too much about downward share price volatility.