If someone had invested £10,000 in Tesla (NASDAQ:TSLA) stock in the middle of December, it would now (7 April) be worth £4,650. That’s a loss of just over 53%.

By contrast, even after the recent pullback, the same amount invested last April would have increased by 64%.

And that was the point I was trying to make when I last wrote about the electric vehicle (EV) company. I argued that the Tesla stock price has, over the past five years or so, ebbed and flowed. And even though the post-Trump bubble couldn’t be justified, I said there was no need to panic when the company’s shares started to fall. I thought it was time to get a sense of perspective.

And now…

However, this belief was challenged by two events last week. First, on 2 April, the company reported a disappointing Q1 2025. Compared to the same period 12 months ago, deliveries were 13% lower at 336,681. It was the worst quarterly performance since spring 2022.

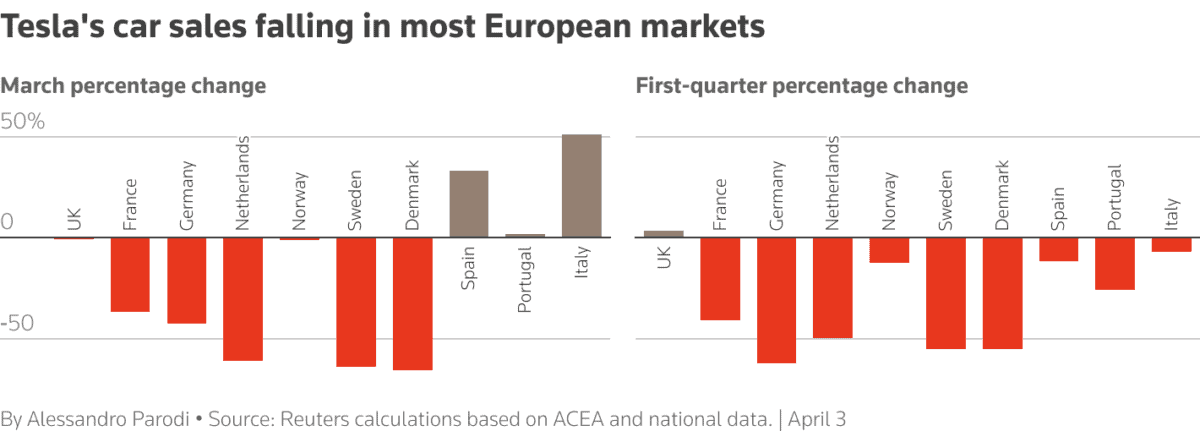

Crucially, it’s now fallen behind BYD for the first time. And closer to home, sales are falling in many of its key European markets.

The second concern I have – in common with many other investors, I’m sure – is the impact of President Trump’s decision to impose a 25% tariff on cars imported into the United States.

In simple terms, this could be a good thing for Tesla. No doubt Americans will buy more of their (cheaper) ‘own’ cars. However, other governments are likely to retaliate. This should concern Tesla’s shareholders because the company sells more cars overseas than it does in America.

As is often the case with global supply chains, the situation’s more complicated because the group has factories in Germany and China. These countries might be reluctant to penalise domestic production, despite expressing their horror at Trump’s tariffs. But whatever they decide, I believe a ‘trade war’ isn’t in anyone’s long-term interests.

What now?

Nobody knows what’s going to happen over the coming days and weeks but even with the recent pullback in the stock price, Tesla’s shares are still expensive.

Looking at adjusted earnings per share over the past four quarters ($2.42), the stock’s now trading on 94 times historic earnings. But to be honest, this is largely irrelevant. In my opinion, using conventional valuation techniques, the company’s always been overvalued.

However, questions remain as to whether Elon Musk’s entry into politics has damaged the brand. Anecdotally, I suspect more Democrats are likely to buy EVs than Republicans.

There are also reports that his support of Trump is the reason behind falling sales in Europe, although it’s impossible to know for sure. In my experience, some who claim to be boycotting a particular product or service were, conveniently, never going to buy in the first place.

But if I was a shareholder, I’d be worried that much of Tesla’s valuation appears to be built around its self-driving capabilities. It’s viewed as a tech stock rather than a car maker. However, BYD gives away a similar technology, including its ‘God’s Eye’ system, for free.

Despite the company repeatedly proving its critics wrong and having a very loyal customer base, I don’t want to buy any Tesla stock. There’s too much uncertainty surrounding the company to make me want to part with my cash.