Since 7 March, the Aston Martin Lagonda (LSE:AML) share price has fallen nearly a third. Fears that President Trump’s 25% tariff on foreign cars will affect sales have understandably spooked investors. And the chances of a global recession appear to have increased.

American exposure

In terms of volume, 32% of the British icon’s 2024 sales were made through dealers in the Americas. Although a breakdown of vehicle sales by country isn’t available, we do know that £591m of revenue (37.3%) came from the United States.

Proportionately, this is slightly more than some of its rivals, but it’s not massively different. For example, Ferrari (NYSE:RACE), generated 28.8% of its top line in America.

But setting aside the recent uncertainty surrounding import taxes, the share price of Aston Martin’s rival has performed much better.

This makes me think investors have more concerns than just tariffs. And a look at the 2024 accounts for the British and Italian car makers is illuminating. It’s a bit like comparing oil and water.

Getting into the detail

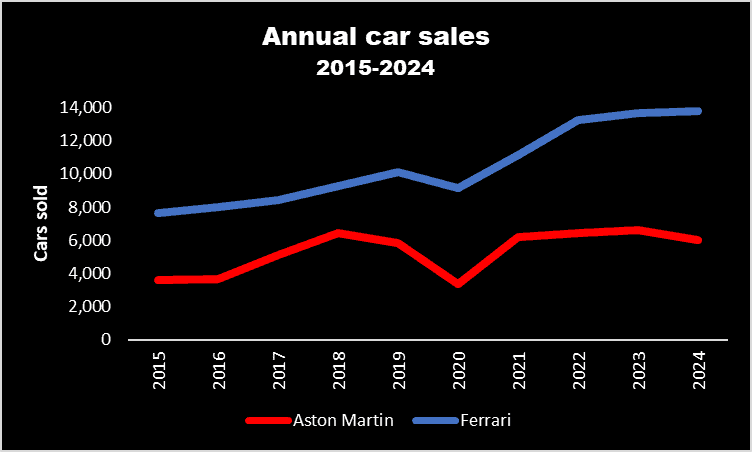

Aston Martin sells fewer cars than Ferrari and, concerningly, the gap between the two is growing.

Also, the Italian sports car maker commands a higher average selling price and gross profit margin. In my opinion, this is a strong indication that its models are seen as being more desirable. In theory, this means it should suffer less from Trump’s tariffs.

However, to strengthen its balance sheet, the British marque has recently secured additional investment from its largest shareholder. Also, prior to Trump’s announcement, it was expecting a better 2025, largely on the back of the first deliveries of its new Valhalla model.

And at the time of announcing its 2024 results, the company reconfirmed its medium-term targets. By 2028, it aims to have annual revenue of £2.5bn and a gross profit percentage in the ‘mid-40s‘.

| 2024 performance | Aston Martin | Ferrari |

|---|---|---|

| Vehicles sold (no.) | 6,030 | 13,752 |

| Revenue (£m) | 1,584 | 5,519 |

| Revenue per vehicle (£) | 262,670 | 401,343 |

| Gross profit margin (%) | 36.9 | 50.1 |

| Profit/(loss) after tax (£m) | (324) | 1,261 |

| Profit/(loss) per vehicle (£) | (53,648) | 91,725 |

| Earnings per share (pence) | (38.9) | 6.99 |

What I think

But despite its beautiful cars, amazing brand and loyal customer base, I don’t want to invest in Aston Martin. It may have a price-to-book (PTB) ratio of less than one but it remains loss-making. Since floating in October 2018, it’s reported losses of nearly £2bn. And it’s a long way from selling enough vehicles to be profitable. In these circumstances, it’s difficult to value a company, and I wouldn’t be surprised if the stock had further to fall.

The company also appears to be lagging some its peers when it comes to fully electrifying its range. Its first full EV isn’t expected before 2030. BY contrast, Ferrari’s is due to be launched later this year. Having said that, the UK government has just announced plans to let smaller manufacturers continue to produce petrol cars beyond the current 2030 deadline, so that should help ease the pressure to ‘go green’.

However, despite the Italian company’s faster transition to EVs — and its superior financial performance — I don’t want to buy its stock either.

Its shares currently change hands for an eye-watering 44.7 times its 2024 earnings per share (EPS) of €8.46. For 2025, analysts are expecting EPS of €9.11. Even so, this implies a forward price-to-earnings ratio of 41.5. And it has a PTB ratio of over 17.

A bit like its fabulous cars, this is far too expensive for me.