£25,000 invested in Rolls-Royce (LSE:RR) shares three years ago would now be worth around £210,000. Hurts to say that because I did have a sizeable Rolls-Royce holding, which was reduce for a house purchase. Nonetheless, I’m thankful for having some exposure to this 738% rally.

What’s behind the rally?

The remarkable bounce in Rolls-Royce shares stems from a combination of strategic leadership, operational improvements, and favourable market conditions. CEO Tufan Erginbilgiç, who took the helm in 2023, spearheaded a transformative era for the company, focusing on aggressive cost-cutting, efficiency gains, and strategic investments.

In 2023, Erginbilgiç launched a comprehensive restructuring programme, streamlining operations and optimising procurement. These efforts paid off in 2024, with Rolls-Royce reporting a 16% revenue increase to £17.8bn and a 57% jump in operating profit to £2.5bn, surpassing expectations.

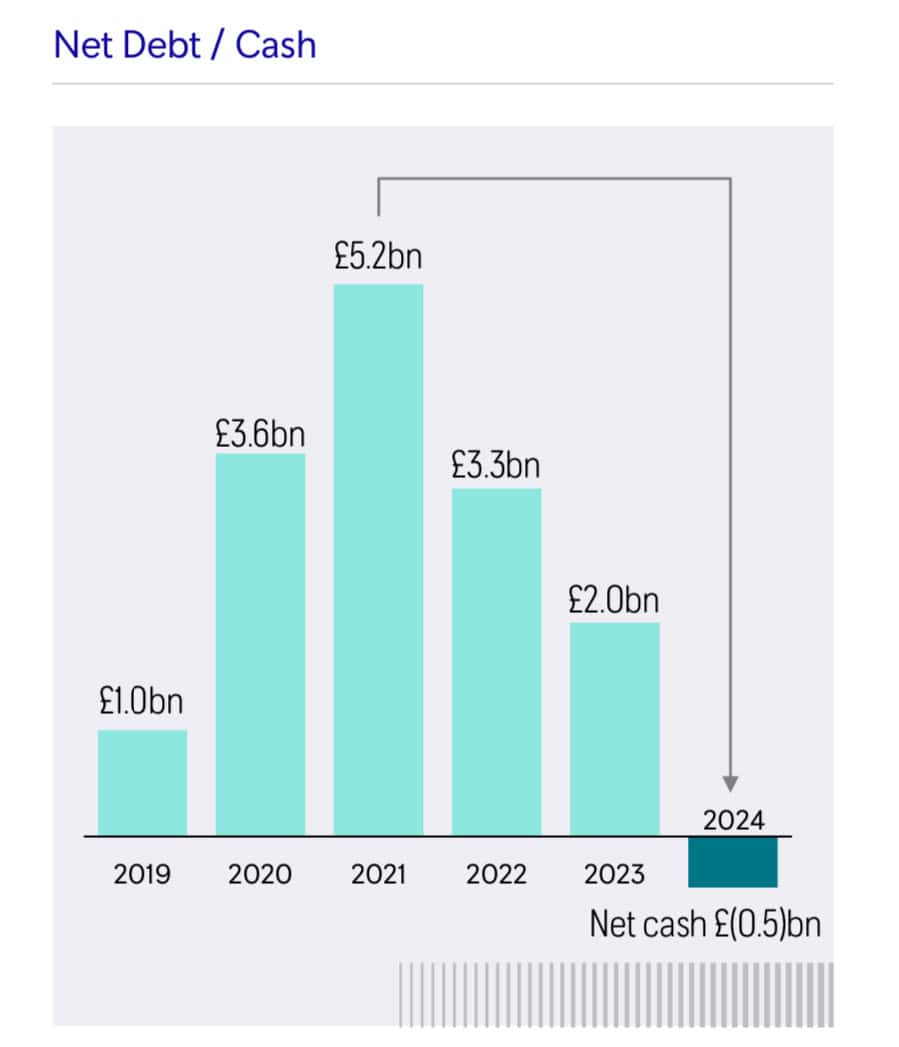

The company also reduced its net debt significantly. Net cash stood at £475m at the end of 2024. This compares to a £2bn net debt position at the end of 2023.

The post-pandemic recovery of the aerospace sector played a pivotal role, with large engine flying hours reaching 80-90% of 2019 levels by 2024. Rolls-Royce also secured major defence contracts, including a £9bn deal with the UK Ministry of Defence, further boosting investor confidence.

Defence stocks have surged since Donald Trump’s return to office. His demands for NATO members to raise defence spending have created a favourable environment for European defence companies, with the Datastream euro area defence index climbing 25% since his inauguration.

What’s more, in February, Rolls-Royce announced a £1bn share buyback and reinstated dividends, marking its first payouts since the pandemic. These moves, combined with a strong outlook for 2025, have cemented its position as a top-performing FTSE 100 stock.

Are things still looking up?

Things are undoubtedly looking up for Rolls-Royce, with business booming across all sectors. The company has seen a remarkable post-pandemic recovery, driven by strong performance in civil aviation, defence, and power systems. In light of the above, its defence revenue is projected to grow at an 11% compound annual growth rate (CAGR) through 2029.

Meanwhile, its operating margins are expected to rise from 14.2% to 15.9%. Additionally, Rolls-Royce’s small modular reactor (SMR) initiative has generated significant excitement. Developments have positioned the company as a leader in next-generation nuclear technology.

However, the stock’s forward price-to-earnings (P/E) ratio of 31.9 times suggests it may appear expensive. That’s especially compared to the broader market, particularly as it exceeds the FTSE 100 average. But General Electric, a key competitor, trades at a higher forward P/E of 35.8 times. This suggests Rolls-Royce’s valuation isn’t an outlier in its niche sector.

One risk to consider is the company’s reliance on civil aviation earnings, which were acutely highlighted during the pandemic. Any future disruptions in the aerospace sector could impact Rolls-Royce’s performance, despite its current momentum. Investors should weigh these factors carefully as the stock continues its upward trajectory.

Personally, I’m a little hesitant to add to my position at this elevated level. Nonetheless, I think it’s an excellent company. I wouldn’t be surprised to see more catalysts.