My Stocks and Shares ISA portfolio took a bit of a pounding on Friday (21 February). This was after the US market sold off heavily due to concerns about growth and inflation.

Among the sea of red in my portfolio, however, there was one valiant riser: MercadoLibre (NASDAQ: MELI). Shares of the Latin American e-commerce and fintech giant rose 7% to $2,260, bringing the year-to-date return above 33%.

Why did it spike?

Latin America-based MercadoLibre is a mash-up of Amazon, eBay, PayPal, and Shopify. Last year, gross merchandise volume (GMV) on its e-commerce marketplace surpassed $50bn for the first time, while its logistics arm (Mercado Envios) handled almost 1.8bn items.

Meanwhile, there are now over 61m monthly active users on its fintech app (Mercado Pago). As well as being able to transfer money and pay bills and services, customers using Pago get attractive yields on deposits and access to credit.

The reason for the stock’s jump last week was the firm’s blowout Q4 results. Revenue grew 37% year on year to $6bn (96% on a constant-currency basis), which was slightly higher than Wall Street’s expectations. But earnings per share (EPS) of $12.61 demolished estimates for around $8.

In its shareholder letter, MercadoLibre said: “Retention and frequency on our marketplace are at record levels, as are payments and deposits per user in our digital account, and the number of merchants borrowing from us is higher than ever.”

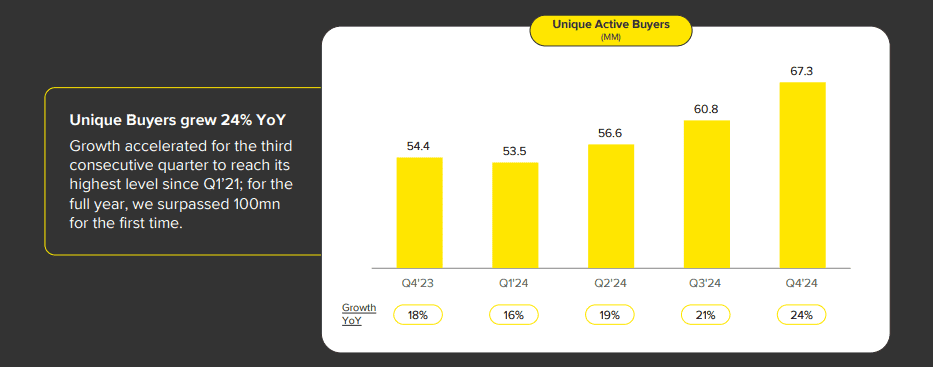

One figure that impressed me was that the number of people going to shop on its e-commerce platform is accelerating. Unique active buyers grew 24% to 67.3m in Q4, which was the third consecutive quarter of accelerating growth.

Risks

As bullish as I am on the future of the company, there are risks to bear in mind here. An inescapable one in the region is semi-regular economic instability. Argentina, for example, is still recovering from its crippling inflation crisis.

That said, MercadoLibre just keeps on getting stronger despite all the political and currency crises thrown its way. And despite the vast infrastructure challenges across Latin America, nearly half of its shipments in Q4 were delivered on the same or next day.

Another potential concern is the company’s rapidly expanding credit portfolio. It lends to both merchants and individuals, raising the possibility of rising non-performing loans if economic conditions worsen. As the firm scales its digital banking ambitions over the next decade, this will be something I’ll be keeping an eye one.

Of course, the company is aware of this risk. Last week, it said: “We will closely monitor the health of our credit portfolio, and if we detect any signs of deterioration, we will swiftly adjust and scale back as needed — just as we have done in the past.”

Valuation

The company is still in growth mode, so I prefer to look at the price-to-sales (P/S) ratio to quickly judge valuation. Right now, the P/S multiple is 5.5, which I don’t see as outrageous. Therefore, I think the stock is still worth considering for investors.

MercadoLibre is currently my second-largest holding. But I expect to keep holding for many more years as e-commerce and digital payments mushroom across Latin America. The firm is at the epicentre of these mega-trends.