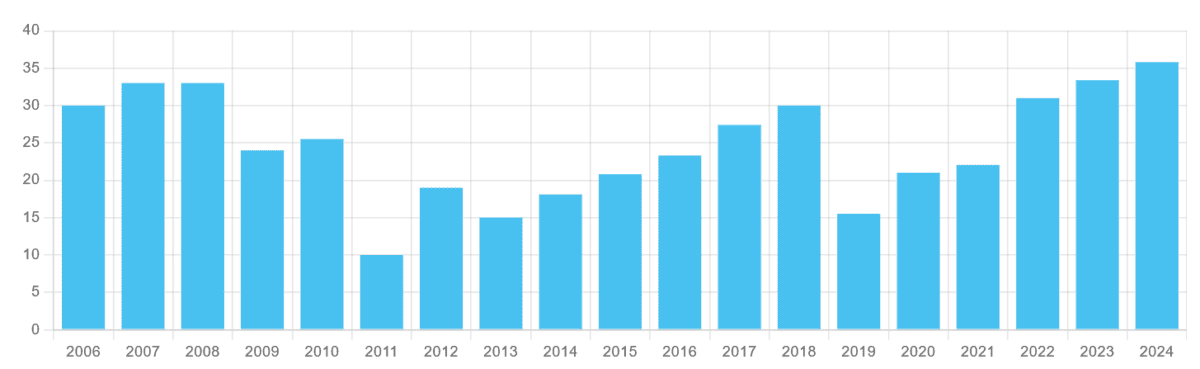

Aviva‘s (LSE:AV.) been one of the FTSE 100‘s standout shares for large and growing dividends since 2014. This success follows substantial restructuring in that time to mend the balance sheet and bolster profits.

Like many UK shares, the financial services giant slashed dividends during the height of the Covid-19 pandemic. But dividends have risen sharply in the aftermath. And they’re tipped to continue increasing this year and next by City analysts.

Dividends are never guaranteed, however, regardless of past performance. So how realistic are current estimates? And should dividend investors consider buying the Footsie firm for passive income?

Should you invest £1,000 in Games Workshop right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Games Workshop made the list?

The forecasts

| Year | Dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| 2024 | 35.43p | 6% | 7% |

| 2025 | 37.90p | 7% | 7.5% |

| 2026 | 40.49p | 7% | 8% |

As you can see, the dividend yield on Aviva shares moves to eye-popping levels over the next two years. In fact, at 8% for next year, this is more than double the current FTSE 100 average (3.6%).

Let’s first look at dividend cover to see how well predicted payouts are covered by anticipated earnings. As an investor, I’m searching for a reading of 2 times above. At these levels, a company could still meet broker forecasts even if profits get blown off course.

Unfortunately, Aviva doesn’t score especially highly on this metric. Earnings are tipped to rise strongly over the period, by 13% and 9% in 2025 and 2026 respectively. But dividend cover still stands at just 1.4 and 1.5 times for these years.

Having said that, it’s not time to throw the towel in on Aviva just yet. Regardless of whether cover’s robust or flaky, it’s also important to consider the strength of a company’s balance sheet when assessing future dividends.

Here, Aviva performs much more encouragingly. As of September, its Solvency II capital ratio was a whopping 195%.

This is thanks to the impressive cash generation of its general and life insurance operations, which benefit from steady premium collections, and the firm’s asset management business generates recurring management fees. It also reflects the capital-light nature of Aviva’s operations.

The verdict

On balance then, I think Aviva’s in good shape to meet current dividend forecasts and is worth investors considering. The business has a great track record of delivery despite weak dividend cover. I see no reason for this to come to an end.

In fact, I’m optimistic it’ll keep delivering large and growing dividends beyond the forecast period.

Given the highly competitive sector it operates in, investors can’t take anything for granted. Additionally, shareholder returns may underwhelm over the medium-to-long term if interest rates remain at elevated levels.

Yet there’s plenty for investors to be optimistic about, in my opinion. Aviva’s pivot towards capital-light businesses bodes well for future cash flows, while earnings could rise as cost-cutting measures and strategic investments (like the acquisition of Direct Line) take effect.

It also has considerable scope to grow profits and dividends as the growing number of elderly people in its markets — combined with a rising need for financial planning — drives demand for its wealth, protection and retirement products.

I own Aviva shares in my portfolio for passive income. I intend to hold on to them for the long haul and think other investors should consider doing likewise.