One common plan at the start of the year is to invest. But while many people see any given year as the one in which they will start buying shares, such plans can fall by the wayside even before January is out.

A common reason for that is lack of funds. There always seem to be other demands on our money.

But in fact, it does not necessarily take a large amount of money to start buying shares. Here is how an investor could do so this January (in fact this week), in three steps.

Step 1: setting up a dealing account

When the moment comes to actually buy shares, there needs to be a way to do so. Reviewing the options for how to buy and sell can take time and so can setting up an account.

So I think it makes sense to start by deciding on the share-dealing account or Stocks and Shares ISA that suits an individual’s needs best and get the ball rolling.

Step 2: understand some key concepts of investing

Next I think it makes sense to understand some basic concepts about what makes for good investing.

For example, consider Apple (NASDAQ: AAPL). The company’s share price has soared over time. Indeed, it has more than tripled in the past five years alone.

On top of that, the tech giant is massively profitable.

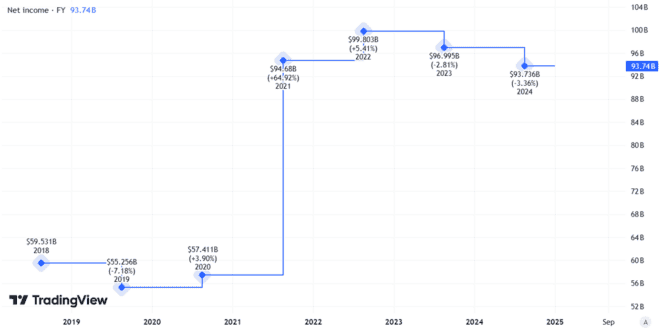

In recent years, the company’s annual net income has been not far off $100bn, which I find a staggering number.

Created using TradingView

However, notice that in the chart above the net income – while still enormous – has actually declined.

That could reflect risks such as growing competition from more competitively priced Asian phone companies, as well as increased costs from disrupted supply chains. I think both remain risks for Apple’s profits.

Still, at the right price I would like to own the share. Its target market is huge and it enjoys what Warren Buffett (a big Apple shareholder) calls a ‘moat’: competitive advantages such as its brand and proprietary technology.

But before I start buying shares in what I think is a great business, I consider whether it might also be a great investment. In large part that can depend on what I pay for the share. A great business is not necessarily a great investment.

So, from day one investors need to understand some basic concepts of valuation.

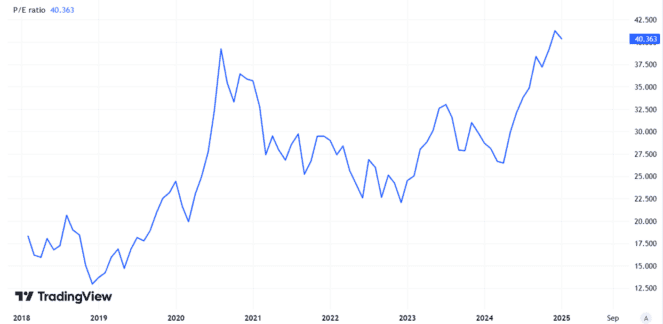

For example, Apple’s share price is currently 40 times annual earnings per share. That is too high for my taste and explains why I have no plans to buy the share. It is also close to its highest level for years.

Created using TradingView

Step 3: start building a share portfolio

Having got to grips with such concepts, I think a new investor could be ready to make a shopping list and start buying shares.

One simple but important risk-management principle is diversification and £500 is enough to spread the choices over several different shares.

Now the key question is: which ones?