According to Warren Buffett, the time to buy shares is when other investors aren’t interested. Not when they’re trading at over 30 times revenues and up 150% since the start of the year.

That’s the situation with Palantir Technologies (NYSE:PLTR) though. And the share price is surging again after the company’s Q3 earnings report.

A quality business

Palantir’s a quality business with an outstanding product. The company’s been working with the US government since 2005 and has been a key part of military intelligence.

Should you invest £1,000 in Legal & General right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Legal & General made the list?

Its software allows organisations to bring together their data and use it to generate all kinds of insights. But the scope for growth within government contracts is limited.

Recently though, Palantir’s been expanding its focus. The firm’s started working with corporations, which has massively increased its addressable market and boosted growth.

The business has legitimate artificial intelligence (AI) credentials. And based on the most recent evidence, companies are falling over themselves to sign up for its products.

Growth

The latest earnings result showed 30% revenue growth, with sales to the US government up 40% and US commercial up 54%. But that wasn’t the real highlight, in my view.

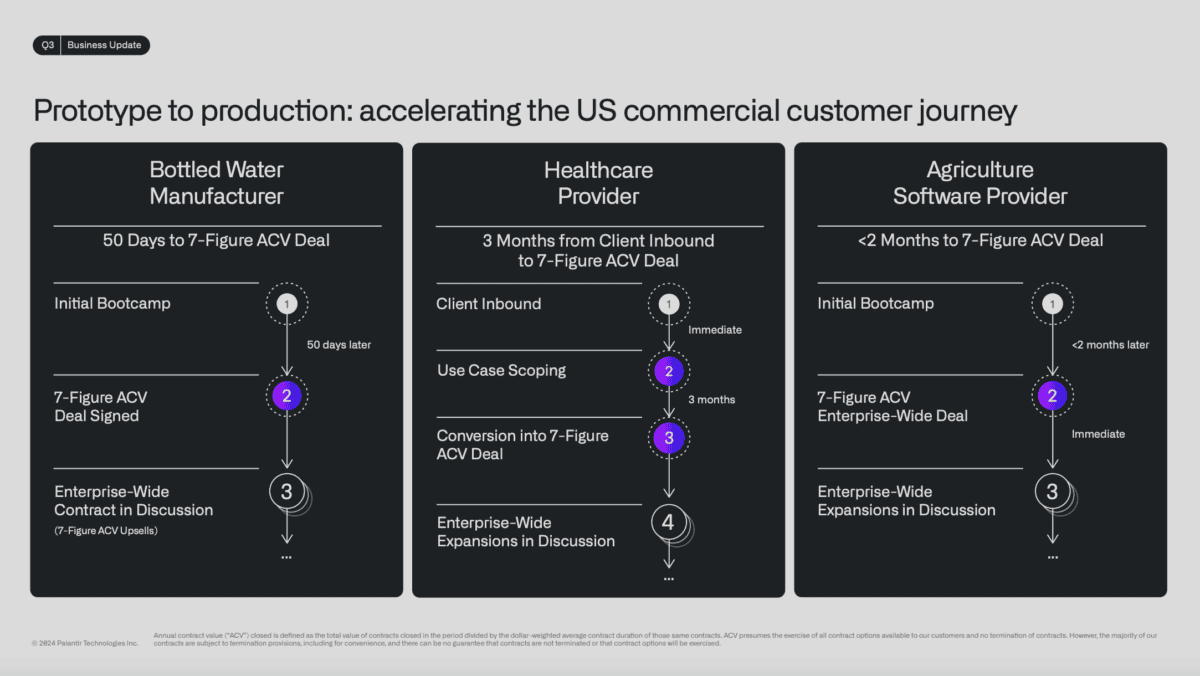

At this stage, the key for Palantir is signing up customers. And it is doing this in large numbers (Q3 featured more 104 deals worth more than $1m each) and across a range of industries.

These include manufacturing, healthcare and software. Importantly, the speed at which they signed up after an initial ‘bootcamp’ – typically less than two months – is impressive.

Source: Palantir Q3 2024 Business Update

This indicates that businesses think they need to have Palantir’s products as part of their infrastructure. And that’s a strong indication there might be more to come.

Can the stock keep going?

Investors might be wondering whether Palantir’s shares can continue their impressive run. I think they can – the product looks so strong that I expect customer growth to keep going.

The risks are clear though. A price-to-sales (P/S) ratio of around 36 is high even by Palantir standards and this means the stock could fall sharply if the company has a bad quarter.

Palantir P/S ratio since IPO

Created at TradingView

Ultimately though, what matters for investors is free cash flow. And based on the expectations for the rest of the year, that’s going to be around 1% of the current market-cap.

Again, that means there’s a lot expected in terms of growth. But I certainly wouldn’t be willing to bet against both the business and the stock having a bright future.

An AI stock to consider

AI is still in its early stages and there’s a lot that’s unclear. But Palantir’s clearly leading the pack when it comes to building the products that make a legitimate difference to its customers.

The issue is that the stock’s currently expensive, but I think the share price could go a lot higher before it falls. I don’t think investors would be mad to consider buying this at all.