The last six months has been challenging for BP (LSE: BP.) shareholders (which include me), with its share price down 29%. Although such declines are never pleasant, now is not the time for me to panic and sell out.

Underperforming relative to peers

It’s common knowledge that the company’s share price has underperformed relative to its peers. That explains why it sits on a lowly forward price-to-earnings (P/E) ratio of 7.2.

Since Murray Auchincloss took over as CEO in September 2023, he has sent out a clear tone that the company will remain primarily an oil and gas producer for many decades yet.

Nevertheless, despite this stance it remains heavily invested in what it refers to as ‘transition growth engines’ (TGE). This includes EV charging, electrification, biofuels, and hydrogen.

Last year, TGE generated $1bn in EBITDA (earnings before income tax, depreciation, and amortisation). It wants to grow this to be between $3-4bn EBITDA by the end of the decade. The market is clearly sceptical whether it can achieve this. Last year, for example, EV charging lost $300m.

Share buybacks

Over the past few years, a stable of its quarterly presentations has been growing share buybacks. However, in its Q3 update (on the 29 October), it threw a spanner in the works by casting serious doubts on its ability to deliver $14bn of buybacks by 2025.

In some respects this is not surprising. It was easy to make such promises when oil was $80; less so when it’s $70.

Scaling back on buybacks may actually turn out to be a blessing in disguise. Over the past few years, it has bought back a fifth of its entire stock. But at what cost? The balance sheet has weakened with net debt rising to stand at $24.2bn. In addition, the share price is down. I am beginning to question whether buybacks are still the optimal way for it to maximise shareholder value.

Opportunity

For me, BP remains a well-run company, with a compelling investment proposition. I remain firmly grounded in the long-term opportunity.

I look across the pond to what Warren Buffett is doing. He bought a huge chunk of shares in exploration and production (E&P) producer Occidental Petroleum back in 2022. Its share price is down 30% in two years. But he is not selling his oil holdings, and neither am I.

The energy transition is real. But when net zero will become a reality is anyone’s guess. In the meantime, oil consumption globally continues to rise.

Ironically, building out green infrastructure requires significant quantities of hydrocarbons. On top of that we are witnessing an explosion of onshoring of manufacturing capability in the US, which is driving oil demand.

As the AI revolution accelerates, demand for energy, particularly natural gas, will explode. Data centres, cloud providers, and the like are highly energy intensive.

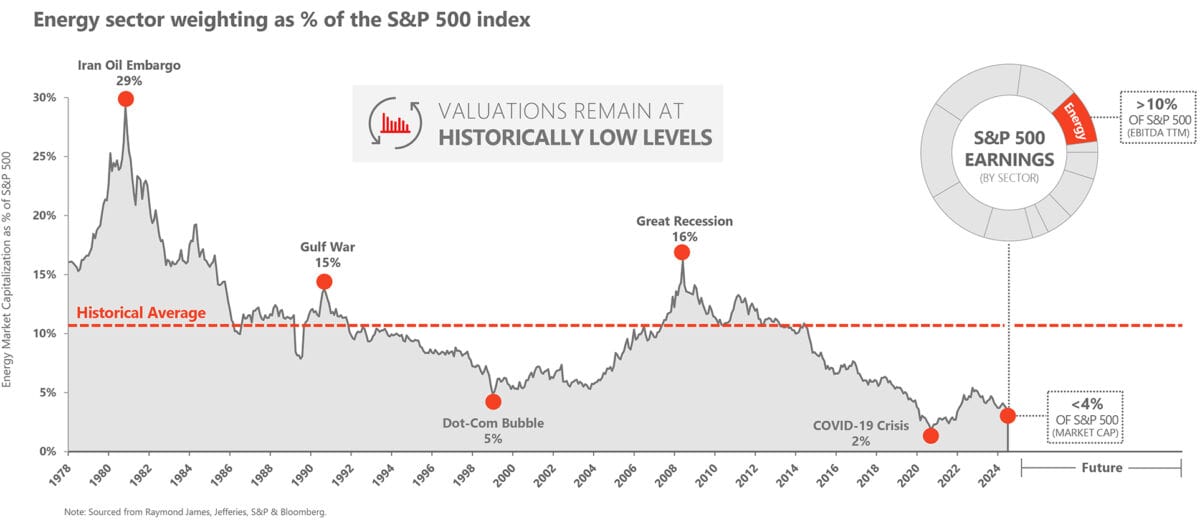

The following chart from E&P producer Devon Energy sums up the opportunity to me. With demand for energy growing, I find it hard to believe that the combined value of the oil and gas sector will only account for 4% of the S&P 500 in the future.

Source: Devon Energy

As BP shares trade at a two-year low, I couldn’t resist picking up a few more for my Stocks and Shares ISA.