Phoenix Group (LSE:PHNX) shares have proved an exceptional investment for dividend investors for more than a decade.

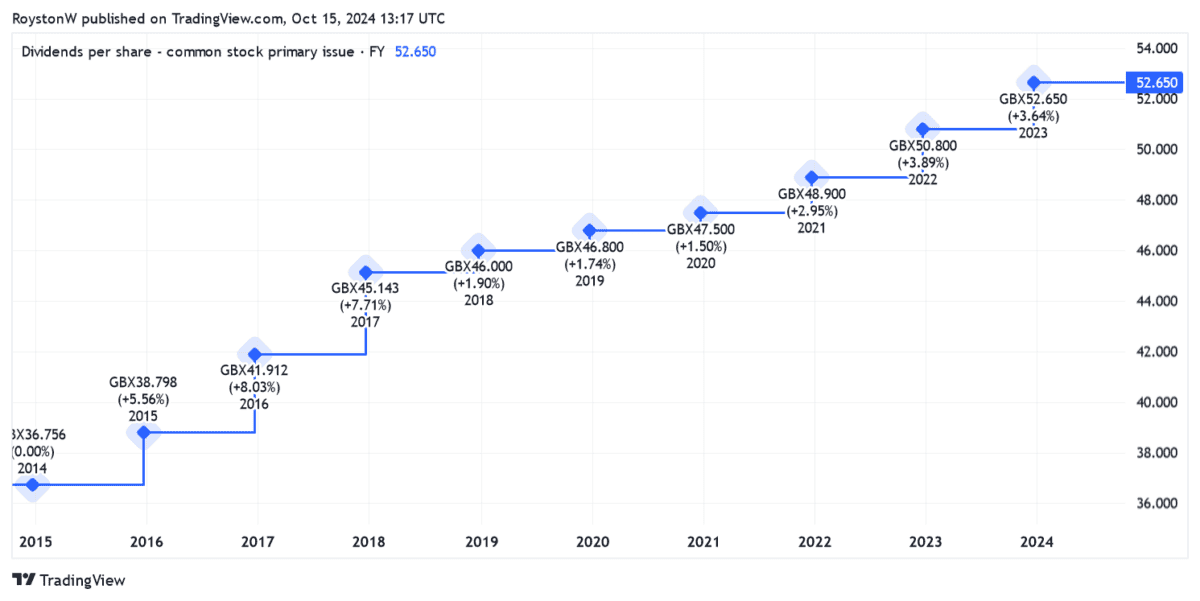

Shareholder payouts have marched steadily higher in that time. And the yield on the FTSE 100 company has long beaten the index average of 3% to 4% during the period.

Past performance is no guarantee of future returns. But encouragingly for income chasers, the City’s community of analysts are expecting dividends from Phoenix shares to keep marching skywards.

Should you invest £1,000 in Associated British Foods right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Associated British Foods made the list?

So how much passive income could I make with a £10,000 investment today?

11.1% dividend yield

Phoenix’s long track record of generous and growing dividends reflects its commitment to having a healthy balance sheet. Even when earnings have fallen — which has occurred three times in the past five years — cash rewards have marched steadily higher.

Last year, the Footsie firm raised the shareholder payout 4% to 52.65p per share. And as the table below shows, dividends are tipped by City brokers to keep rising through to 2026 at least:

| Year | Dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| 2024 | 54p | 3% | 10.4% |

| 2025 | 55.6p | 3% | 10.8% |

| 2026 | 57.3p | 3% | 11.1% |

As you can see, the dividend yields on Phoenix shares are subsequently two to three times larger than the FTSE 100 average.

And even if dividends fail to grow beyond 2026, I could still make a four-figure monthly dividend income with a lump sum investment.

Compound gains

Let’s say that I have £10,000 that’s ready to invest. If broker forecasts are accurate, this would net me:

- £1,040 in dividends in 2024

- £1,080 in dividends during 2025

- £1,110 worth of dividends in 2026

If dividends remained locked at 2026 levels, during the next decade I’d enjoy £11,100 in dividends. Over 30 years, I’d make a £33,300 in passive income.

That’s not bad, I’m sure you’ll agree. But it’s not as much as I’d make by reinvesting my dividends, or compounding my returns.

A huge passive income

If I used this common investment strategy, I would — after 10 years, and based on that same 11.1% dividend yield — have made £22,208 in dividends. That’s more than double the £11,100 I’d otherwise have made.

On a 30-year basis, the difference is even starker. With dividends reinvested, I’d have made a passive income of £291,653. That dwarfs the £33,300 I’d have generated without reinvestment.

With my £10,000 initial investment added, my portfolio would be worth a staggering £302,653 (assuming zero share price growth). With a 4% annual withdrawal, I’d have £12,106 of passive income, which equates to £1,009 a month.

Bright outlook

That said, I’m expecting Phoenix’s share price and dividends per share to rise strongly over this timeframe, too, a scenario that would give me an even bigger second income.

I expect profits here to balloon in the coming decades, as the UK’s booming elderly population drives demand for pensions and other retirement products.

If it can maintain a strong balance sheet, Phoenix could continue paying large dividends while investing for growth, too. Encouragingly, its Solvency II ratio is a formidable 168%, according to its latest financials.

The company faces significant competitive pressures that could blow earnings and dividends off course. But all things considered, I think Phoenix shares are worth a very close look right now.