I love shopping for undervalued UK stocks. So I’m delighted that the FTSE 100’s packed with brilliant bargain shares as I draw up a shopping list for October.

Here’s one dirt cheap Footsie share I’m considering adding to my Stocks and Shares ISA. I also have my eye on this low-cost exchange-traded fund (ETF).

Franklin FTSE India UCITS ETF

Problems in the Chinese economy have impacted demand for emerging market shares over the past year. But of course China isn’t the only way investors can target big returns from Asian economies.

Should you invest £1,000 in Greencoat Renewables Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Greencoat Renewables Plc made the list?

I’m considering adding the Franklin FTSE India UCITS ETF (LSE:FLXI) to my ISA next month. As the name suggests, it provides excellent exposure to Asia’s third largest economy.

The rate of economic growth in India’s hard for me to ignore. GDP’s tipped to rise 6.7% to 6.8% in 2025 and 2026 respectively by the World Bank. That’s more than double the 4% to 4.1% increase predicted for China.

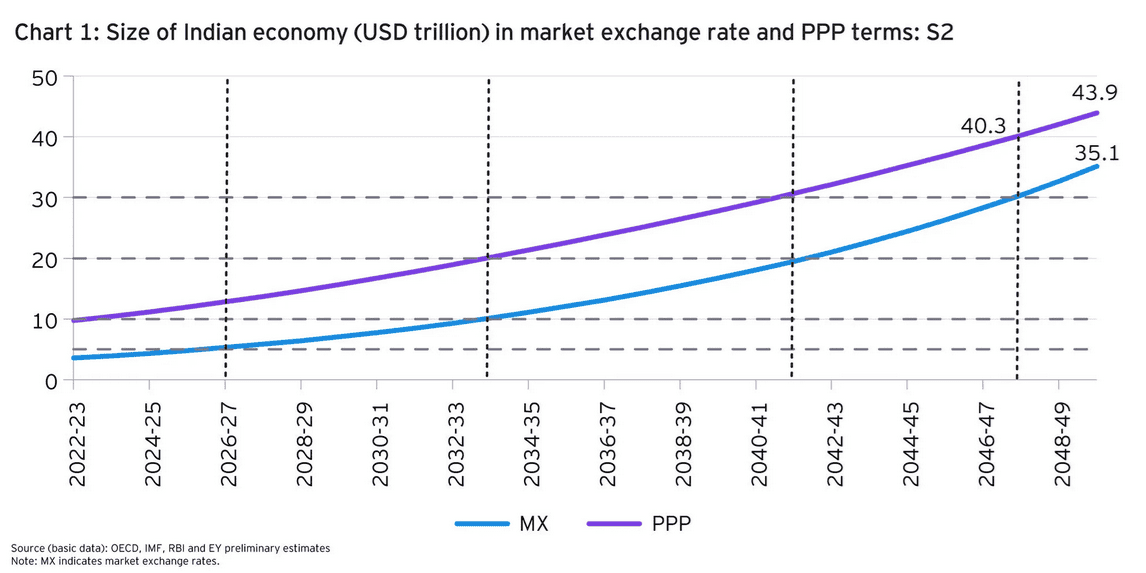

Investing in India isn’t just a short-term strategy though. EY Club expects the economy to grow to around $35trn by the late 2040s, in purchasing power parity (PPP) terms. That compares to below $5trn today.

The Franklin FTSE India ETF invests in more than 230 large- and mid-capitalisation stocks, a strategy that helps me to manage risk.

The fund’s delivered an impressive average annual return of 15.45% over the past five years. Major names here include conglomerate Reliance Industries, financial services provider HDFC Bank, and information technology specialist Infosys.

While ETFs help reduce risk, they don’t eliminate dangers entirely. Share prices could go down or up, and threats to India’s economy include its high fiscal deficit, poor job creation, and the impact of climate change on its huge agricultural sector.

But on balance, I believe the fund has excellent investment potential. And with a total expense ratio of 0.19%, it is one of the cheapest ETFs to get exposure to India.

M&G

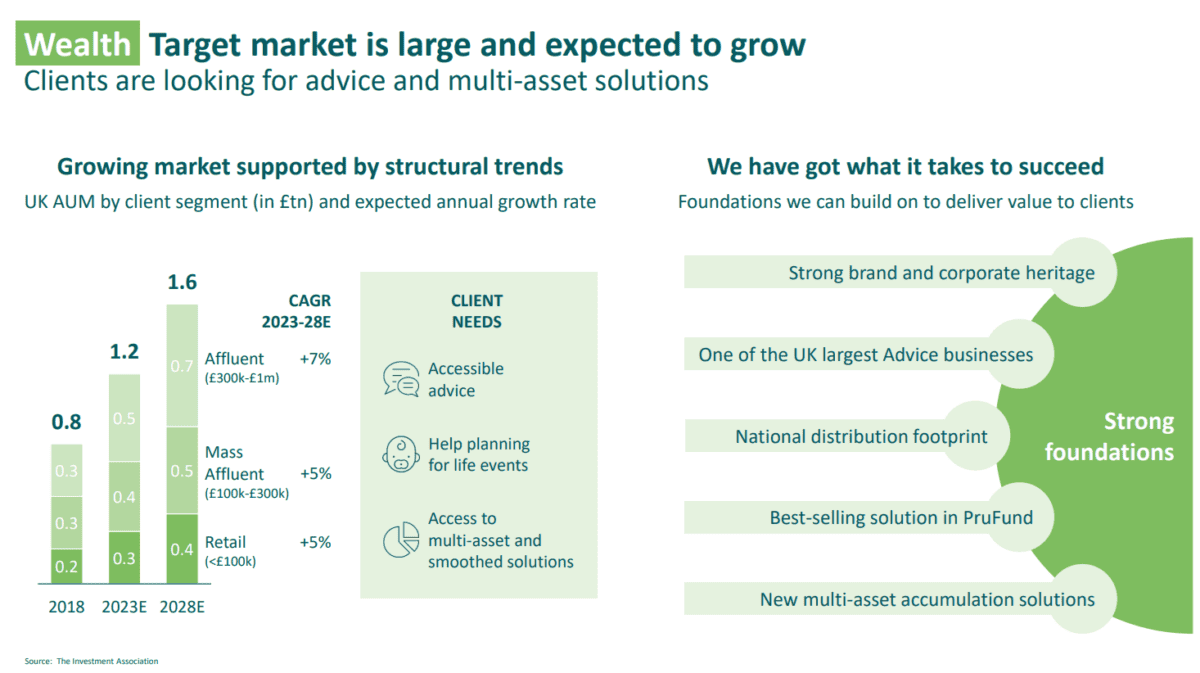

M&G’s (LSE:MNG) a FTSE 100 share that also has substantial growth potential. While it’s focused on the slow-growing UK economy, the country’s booming older population provides excellent earnings opportunities.

This isn’t the only reason why I’m pretty excited here. Demand for savings and investment products are also accelerating as worries over the future of the State Pension increase.

Helped by falling interest rates, City brokers expect M&G’s earnings to rebound from 2024. A 119% rise is currently predicted this year, which leaves the company trading on a price-to-earnings (P/E) ratio of just 7.6 times.

The company also carries a vast 9.7% dividend yield for 2024. This is one of the highest on the FTSE 100.

With a Solvency II ratio of 210%, M&G has formidable financial strength to pay large dividends in the future while also investing for growth.

On the downside, business faces significant competitive pressure from industry heavyweights like Legal & General and Aviva. But all things considered, I think it’s a top stock to consider at current prices.