The era when investing in stocks was reserved for the well-heeled is long gone. Thanks to the smartphone revolution and the emergence of low-cost share-dealing accounts, people can now start investing with just a few hundred pounds.

In fact, there are actual advantages to doing so. One is that it reduces the risk of investing a sizeable lump sum right at the top of the market.

Take the S&P 500, for example. This US blue-chip index has been notching fresh records in recent days and is now at an all-time high. This means it could be due for a sharp pullback in the near term as investors look to bank profits after its strong run.

So, even if I back the world’s best companies, I may still invest at an unattractive valuation. It might take a while for the market to recover lost ground, which would probably be stressful if I’m immediately down by a few thousand pounds.

Investing small amounts regularly — a strategy known as pound-cost averaging — would smooth out these natural ups and downs.

What’s more, I’d expect my returns to improve as I find my feet and become more experienced. Avoiding obvious rookie errors should come more naturally.

Get that ball rolling

My first move would be to open a Stocks and Shares ISA. Then I’d set out what my investing goals are and note my own risk tolerance.

Do I want to invest in growth companies to really try and grow my portfolio? Or do dividends from more established businesses appeal to me? Perhaps a balanced mixture of both?

Whatever strategy I plump for, I’d need to commit to diversifying my portfolio over time. This is crucial.

Timeless brands

If I was just starting out today, I’d lay solid portfolio foundations by investing in established companies that are profitable and pay dividends.

A good example would be Coca-Cola HBC (LSE: CCH). This isn’t the iconic US beverage giant itself, but its bottling partner operating across 28 countries in Europe and parts of Africa.

The Coca-Cola Company manages the overall brand strategy and supplies concentrates, while the FTSE 100 bottler produces and sells the products. These include Coke, Sprite, Schweppes, energy drinks from Monster Beverage, as well as various snacks.

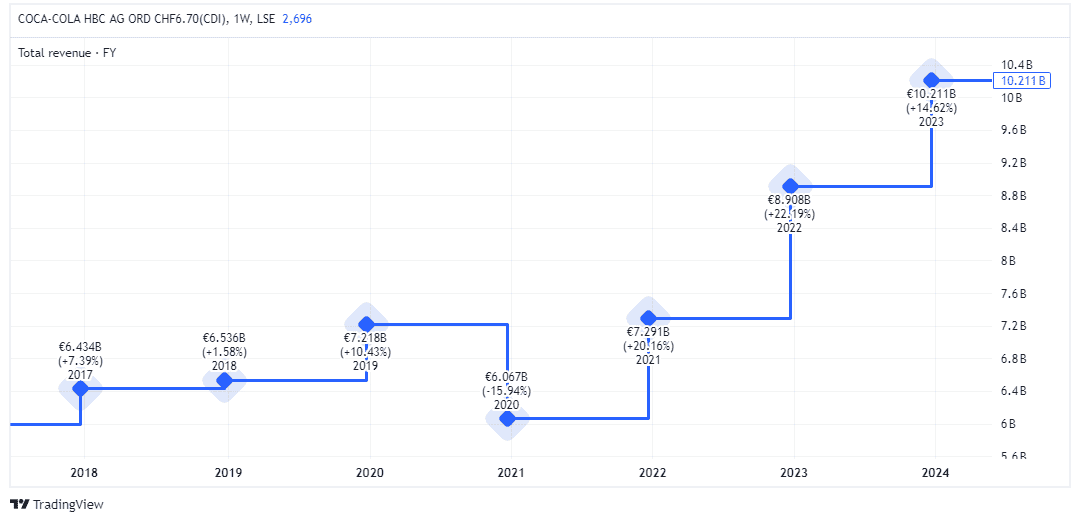

Growth has been strong for years, with revenue rising from €6.5bn in 2018 to more than €10bn last year.

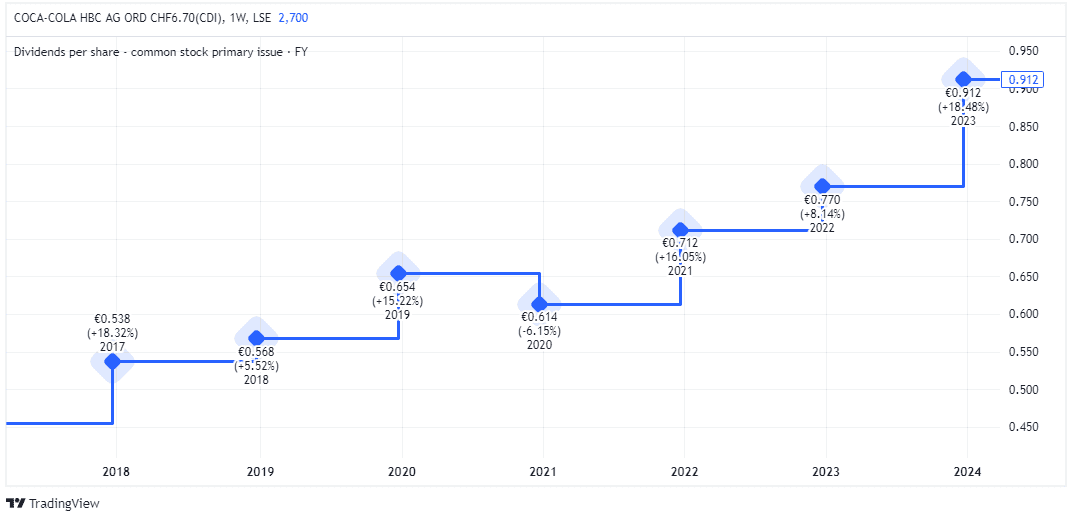

The firms is also solidly profitable, which has allowed it to grow its dividend by an annual rate of 10% over the past few years. The yield is currently just under 3%.

One risk is that inflation is still running high in many of Coca-Cola HBC’s geographies. This means penny-pinching consumers could trade down to cheaper alternatives or avoid some of the places where its brands are sold (restaurants, for example).

Despite this risk, I remain bullish. The company enjoys a very strong competitive position in its markets due to its exclusive relationship with Coca-Cola. And the deep portfolio of brands is tipped for steady long-term growth in emerging markets like Egypt, Nigeria, and Bulgaria.

Plus, as Coca-Cola inevitably adds more brands to its portfolio over time, this bottling partner is well-positioned for further success. I’d happily consider investing in the stock if I was just starting out.