I’m looking for the best dividend shares to buy for a four-figure passive income in 2025. But I’m not just targeting short-term returns. I’m seeking companies that could pay a large and growing dividend income over time.

Here are two from the FTSE 100 and FTSE 250 on my radar today:

| FTSE 100/FTSE 250 stock | 2025 dividend per share (f) | Dividend yield |

|---|---|---|

| Rio Tinto (LSE:RIO) | 310.4p | 6.5% |

| Supermarket Income REIT (LSE:SUPR) | 6.13p | 8.2% |

If forecasts are correct, a £20,000 lump sum investment spread equally across these shares will provide £1,480 worth of dividends in 2025 alone.

Should you invest £1,000 in HSBC right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if HSBC made the list?

Here’s why I’d buy them for my portfolio if I had cash to invest today.

Rio Tinto

Rio Tinto’s a share I already hold in my Stocks and Shares ISA. And following recent heavy share price weakness I’m considering increasing my stake.

As well as boasting that huge 6.5% dividend yield, the mega miner also now trades on a low price-to-earnings (P/E) ratio of 8.9 times.

Profits are in danger as China’s economy — which gobbles up swathes of the planet’s raw materials — experiences as extended slump. But I think the cheapness of Rio Tinto’s shares currently reflects this threat.

I certainly believe earnings here will rise strongly over the long term as commodities demand booms. This will be driven by themes like the growth of artificial intelligence (AI), the renewable energy boom, and ongoing urbanisation and infrastructure spending across the globe.

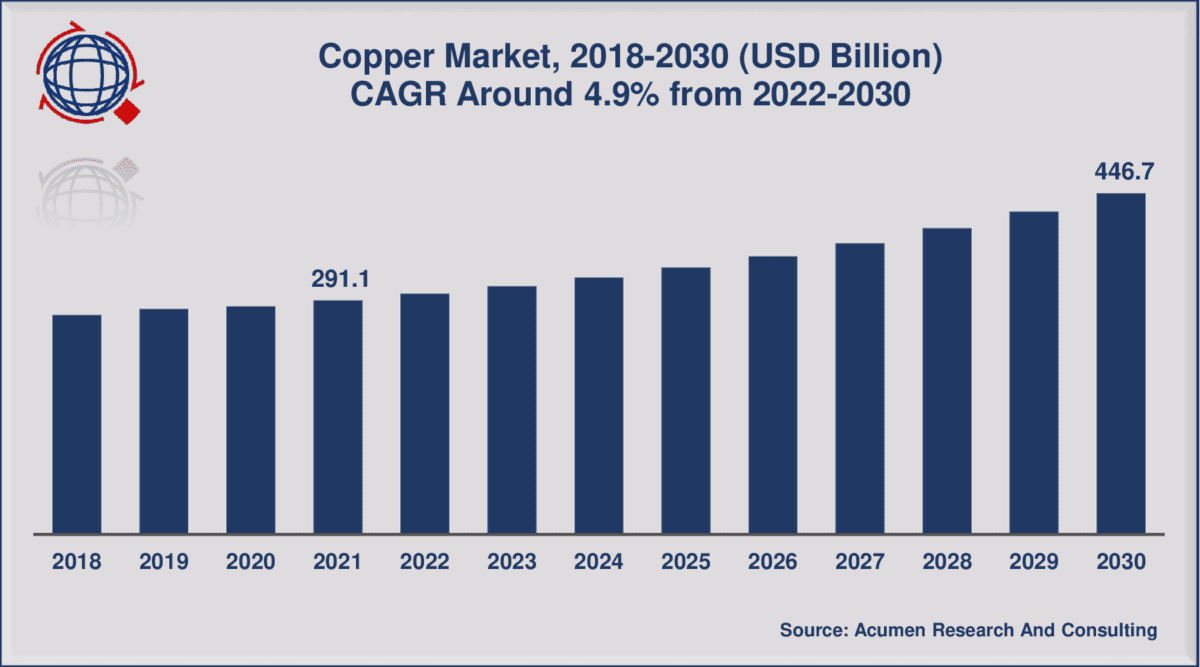

And so now could be a great dip-buying opportunity. As the chart below shows, demand for Rio’s copper alone could be set to rise strongly through to 2030 at least.

In the meantime, I think the robustness of Rio’s balance sheet should help it continue paying large dividends even if earnings underwhelm. Its net-debt-to-EBITDA ratio was just 0.4 times as of June.

Supermarket Income REIT

Rio’s dividend yield for next year sails above the FTSE 100’s 3.5% forward average. Supermarket Income REIT’s even more impressive for the financial year ending next June, at north of 8%.

Property stocks like these can be great ways to source a second income. Under REIT rules, these firms must pay a minimum of 90% of annual rental profits out in the form of dividends. This is in exchange for certain tax advantages.

Real estate stocks like this aren’t always exceptional buys for passive income though. As interest rates rise, earnings come under pressure as net asset values drop and borrowing costs increase. This can in turn put dividends under pressure.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Still, with a raft of rate cuts tipped for the next 12 months, now could be a good time to consider Supermarket Income REIT. I especially like it because of its focus on an ultra-stable part of the property market which, in turn, provides it with stability at all points of the economic cycle.

It also has its heavyweight tenants (inlcing Tesco and Sainsbury’s) locked on long-running contracts, providing earnings with additional visibility. The firm’s weighted average unexpired lease term (WAULT) is around 12 years.