A Stocks and Shares ISA is the perfect place to build wealth over the long run. The keys are consistency, patience, and finding the right investments.

With this in mind, here are two shares that I’ve added to my portfolio in the past few days.

FTSE 250 dividend stock

First up is BBGI Global Infrastructure (LSE: BBGI). This is a FTSE 250 investment company that focuses on owning and managing infrastructure projects through public-private partnerships.

Should you invest £1,000 in Nostrum Oil & Gas Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Nostrum Oil & Gas Plc made the list?

Its portfolio is made of up 56 assets, including roads, hospitals, and schools across Europe, North America, and Australia. From these, BBGI generates stable income via long-term, government-backed contracts.

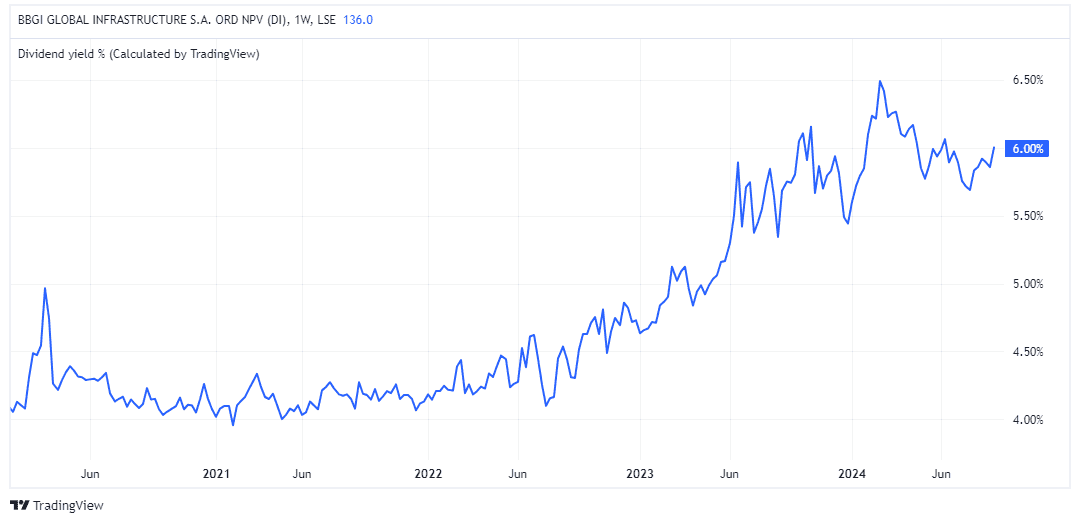

For this year, the dividend is 8.4p per share, which is 6% higher than last year. The forward yield is 6.2%, which is comfortably above the FTSE 250 average.

While no dividend is bullet-proof, I’d say this one is very much on the safer side of things.

Moreover, I reckon the share price, which is down 22% over the past two years, could bounce back strongly as interest rates fall and infrastructure projects start to pick back up.

That’s not guaranteed, mind you. A resurgence of inflation could quickly put the handbrake on falling interest rates while negatively impacting the trust’s portfolio value.

However, right now, the trust is trading at a 10% discount to the value of its underlying assets. That’s against a five-year average premium of 12.8%.

With a well-supported 6%+ yield, I like the risk-reward ratio here.

US growth stock

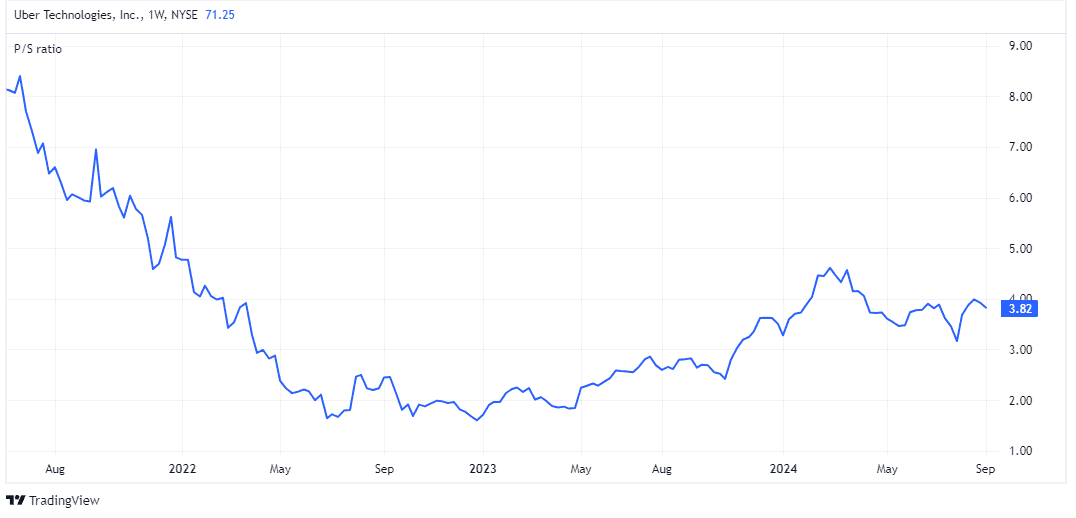

Next, I invested in a very different stock: Uber Technologies (NYSE: UBER). The share price has risen 22% so far in 2024, but I think it could rise much higher over the next decade.

The reason is that the ride-hailing and food delivery firm is quickly becoming a cash machine. From negative cash flow in 2021, the company’s free cash flow is expected to approach $10bn in 2026.

Talk about scaling up!

This is being driven by efficiency savings and ongoing global adoption of the Uber app, which is displacing local taxi firms at a rapid clip.

In Q2, gross bookings grew 21% year on year at constant currency. For Q3, management sees gross bookings of $40.2bn-$41.7bn, representing 18%-23% growth on a constant currency basis.

CEO Dara Khosrowshahi commented: “Uber’s growth engine continues to hum, delivering our sixth consecutive quarter of trip growth above 20%, alongside record profitability…more people are using the platform, and more frequently, than ever before.”

For the full year, Wall Street is forecasting revenue growth of at least 16%. I find that very impressive given how weak consumer spending is worldwide today.

Now, I appreciate that I’m taking on regulatory risk with Uber, particularly relating to whether drivers are classed as independent contractors or employees. There might even be bans in some countries.

However, the stock is trading on a price-to-sales multiple of 3.8. It’s been much higher than this in previous years.

Looking ahead, I think the likelihood of ongoing double-digit revenue growth and surging profitability make this a top tech stock.