The surging Rolls-Royce (LSE:RR) share price has made many investors richer over the past two years, but many analysts are increasingly concerned about the company’s valuation.

And now, with the stock trading around 500p, those concerned voices are louder than ever.

However, I don’t think the stock’s undervalued. In fact, with supportive trends across the business, I’m expecting Rolls-Royce shares to continue pushing higher.

Should you invest £1,000 in Babcock right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Babcock made the list?

Price-to-earnings

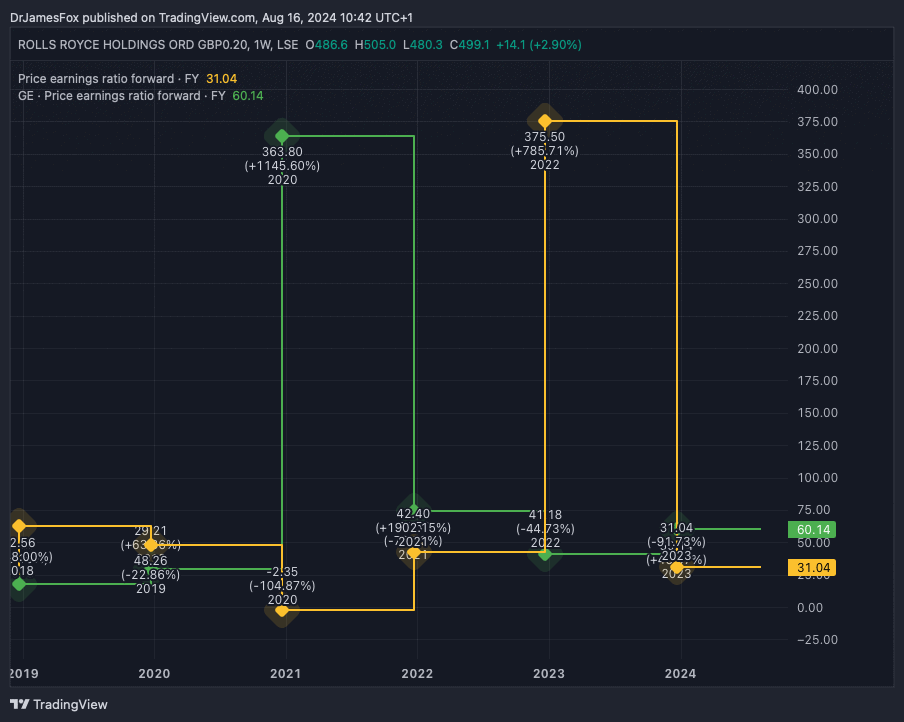

The price-to-earnings (P/E) ratio’s among the most important metrics for assessing the value of a stock and understanding whether a company’s trading at a premium or a discount to its peers.

Personally, I rarely use a trailing P/E ratio. Instead, I use the forward ratio, which is calculated using the consensus for expected earnings for the current year.

As we can see below, Rolls-Royce is trading around 31 times forward earnings. That’s expensive for the FTSE 100, but earnings ratios are always contextual.

So what’s the context. Firstly, the engineering giant’s expected to grow earnings by 29.6% annually over the next three to five years. Most companies would be happy with high single digit growth.

Secondly, Rolls-Royce operates three main business units — civil aerospace, defence, and power systems. These are industries with huge barriers to entry. You can’t simply start making aircraft engines or nuclear propulsion systems for submarines. These are essentially closed sector.

Third, it’s cheaper than its main peer in the aerospace sector, GE Aerospace.

Net debt

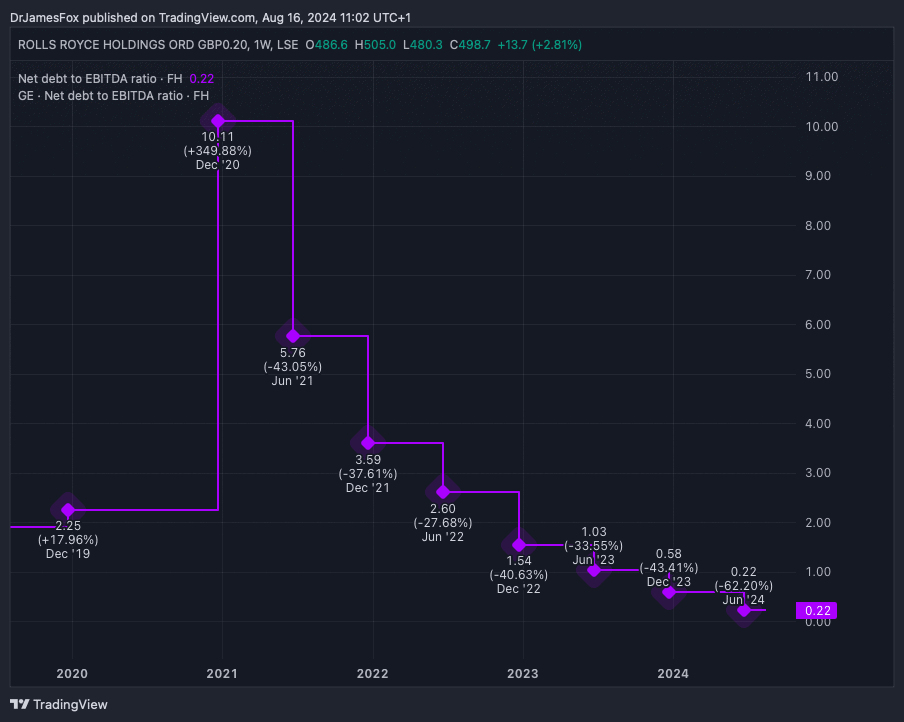

Debt’s something that isn’t taken into account by the P/E ratio, but it’s naturally very important to understand whether debt’s likely to hold the business back.

This is especially important at this moment in time with interest on variable loans pushing up, and the cost of issuing new debt’s high.

Two years ago, analysts from big institutions around the world were wondering whether Rolls-Royce would be able to survive given its indebtedness. The company took on government-backed loans during the pandemic to keep it going.

However today, the company’s in a much stronger place. According to data from TradingView, the company’s net-debt-to-EBITDA ratio’s fallen considerably in recent years. Net debt now stands at just $1.2bn.

The bottom line

While I’m bullish on Rolls-Royce, it’s worth mentioning some potential concerns. At over 30 times forward earnings, expectations are high.

The company, which has surpassed earnings expectations for the past 18 months, may need to continue doing so to maintain its momentum in the near term. That’s why some analysts argue it’s priced for perfection.

It’s also the case that near-term momentum would likely be curtailed if we were to see an end to conflicts in Ukraine and in the Levant. It’s not that Rolls directly benefits from these contracts, but as a major defence contractor, the stock would likely react negatively.

However, the bottom line is that Rolls-Royce is operating in three segments that are also experiencing supportive trends. As such, earnings growth expectations are considerable, and the stock’s average price target is now 551p. I may consider topping up my own holdings.