Legal & General Group‘s (LSE:LGEN) one of my favourite UK shares. It’s currently the second largest holding in my portfolio, just behind fellow FTSE 100 share Ashtead Group.

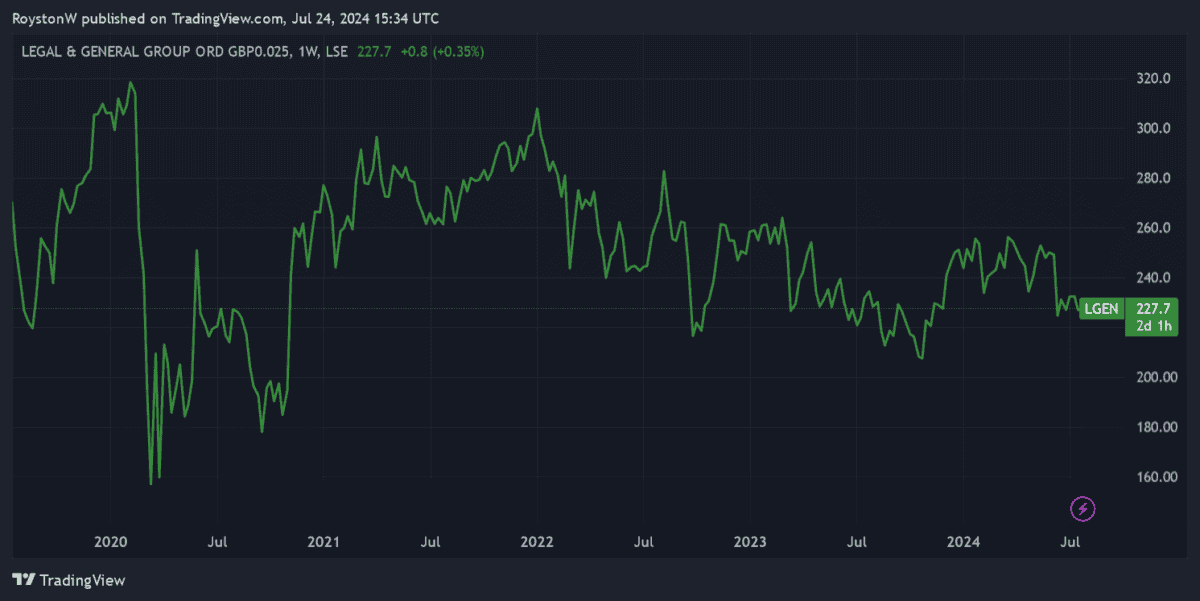

The financial services giant’s recently slumped in value. Falling expectations concerning interest rate cuts have understandably spooked investors. So has news that the business plans to raise dividends at a slower rate between 2025 and 2027.

I think this represents a great time for value investors to consider buying in. The company now trades on a mega-low price-to-earnings (P/E) ratio of 10.5 times. Meanwhile, its dividend yield‘s a gigantic 9.3%.

If I didn’t already own Legal & General shares, I’d be filling my boots right now. Here are three reasons why I love this Footsie company.

1. Huge market opportunity

Demand for financial products like pensions, life insurance and investment and savings products is booming. And as life expectancies steadily increase, and the number of middle-aged and older citizens grows, the need for retirement planning looks set to continue soaring.

This is the case all over the globe. However, the rate of growth’s tipped to be especially high in emerging markets, given low product penetration and soaring wealth levels in such regions.

This is where Legal & General has an advantage over many of its UK-listed rivals. It has operations in major developing economies such as China, Hong Kong and Singapore, and is looking to boost its presence in other high-growth Asian markets.

2. Robust cash generation

Its strong financial foundations gives it the firepower to fully exploit this opportunity too. Under Solvency II rules, its capital ratio stood at a formidable 224% as of 7 June.

The business also has impressive cash generation for a number of reasons. Low capital expenditure versus other industries, and being able to scale up its business efficiently, help boost the balance sheet. So do the recurring revenues it receives from insurance premiums and management fees, as well as the income from its investment portfolio.

Encouragingly, Legal & General expects to maintain its crown as an excellent cash generator too. It has targeted Solvency II operational surplus generation of £5bn-£6bn for the three years to 2027. These sums are beyond what the firm needs for regulatory purposes.

3. Dividend potential

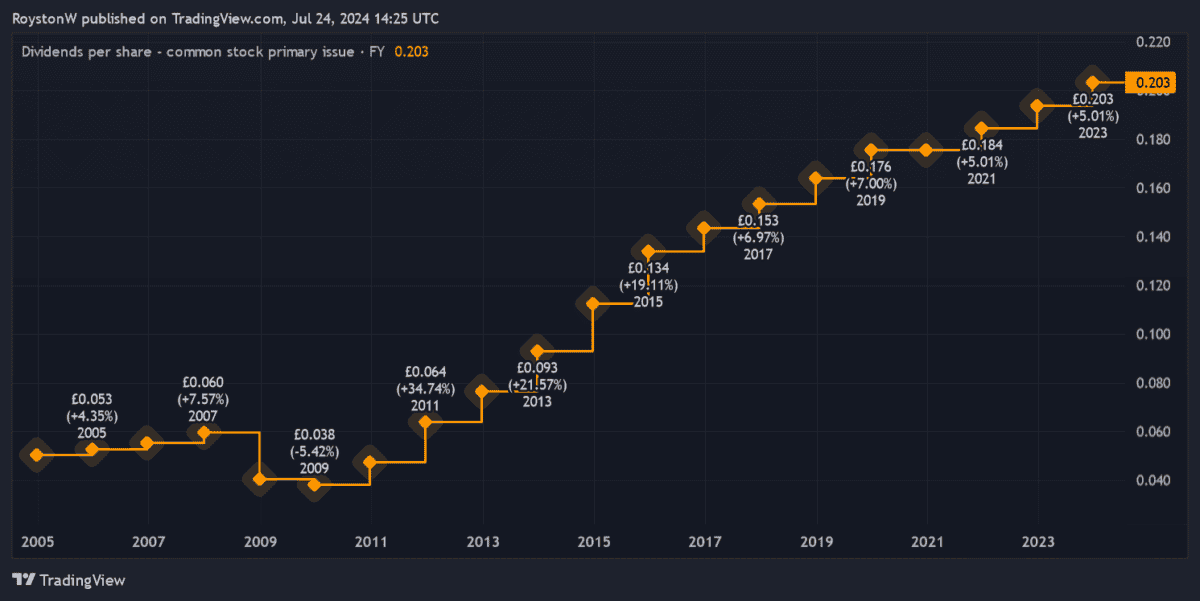

As mentioned, the yield on the shares is running close to double-digit percentages. This makes it potentially one of the best dividend payers on the FTSE 100, and is one reason why I love the company.

But I’m not just interested in large dividends today. I’m looking for shares that will provide a growing and sustainable dividend over time. And I believe Legal & General fits the bill perfectly.

As the graph above shows, Legal & General has a long history of raising the dividends year after year. Payouts were frozen during the Covid-19 crisis, but unlike many other income shares it didn’t slash dividends.

The business is determined to continue lifting the dividend too. It has earmarked payout growth of 2% in the three years to 2027.

Dividends are never guaranteed. But given its strong balance sheet and abundant market opportunities, I think Legal & General can hit these payout targets, and to continue raising them long into the future.