For me, the point of investing is to earn extra income in retirement. And both growth stocks and dividend shares can be part of that project.

I own a number of stocks that don’t pay dividends, including Amazon and JD Wetherspoon. But they’re a key part of my plan to earn £10,000 a year in passive income.

A working example

If I were getting ready to retire today, I’d want to be in a position to earn as much income as possible. And sometimes, investing in growth stocks can be the best way to get to that position.

If I’d invested £1,000 in Unilever shares five years ago, I’d have an investment worth £882, plus £138 in dividends. Investing the same amount in Bunzl would have returned £1,491 in market value alone.

If I’d bought Bunzl shares five years ago, I could sell them and buy more Unilever shares today than I’d have if I’d invested in the company half a decade ago. Crucially, I’d receive more income as a result.

Of course, I could have reinvested my dividends to compound my returns. But while that narrows the gap, it doesn’t change the fact I’d be in a better position if I’d bought the growth stock five years ago.

An alternative

My long-term aim is passive income, but I’m not ruling out growth stocks as a means for getting there. But I’m also open to buying dividend shares that I think can perform well.

Take British American Tobacco, for example. The stock currently has a 9.43% dividend yield, but the company’s share price has been falling fairly sharply since 2017.

To some extent, this might not matter. If – and it might be a big ‘if’ – the dividend is secure for the long term, a 9.43% yield’s a golden opportunity.

A £1,000 investment compounded at 9.43% a year returns £135 after five years, £212 after 10 years, and £522 after 20 years. With that kind of dividend income, I probably won’t care what the stock does.

A stock I’m buying

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

One stock I’ve been buying is Primary Health Properties (LSE:PHP). The company’s a FTSE 250 real estate investment trust (REIT) that leases a portfolio of GP surgeries – mostly to the NHS.

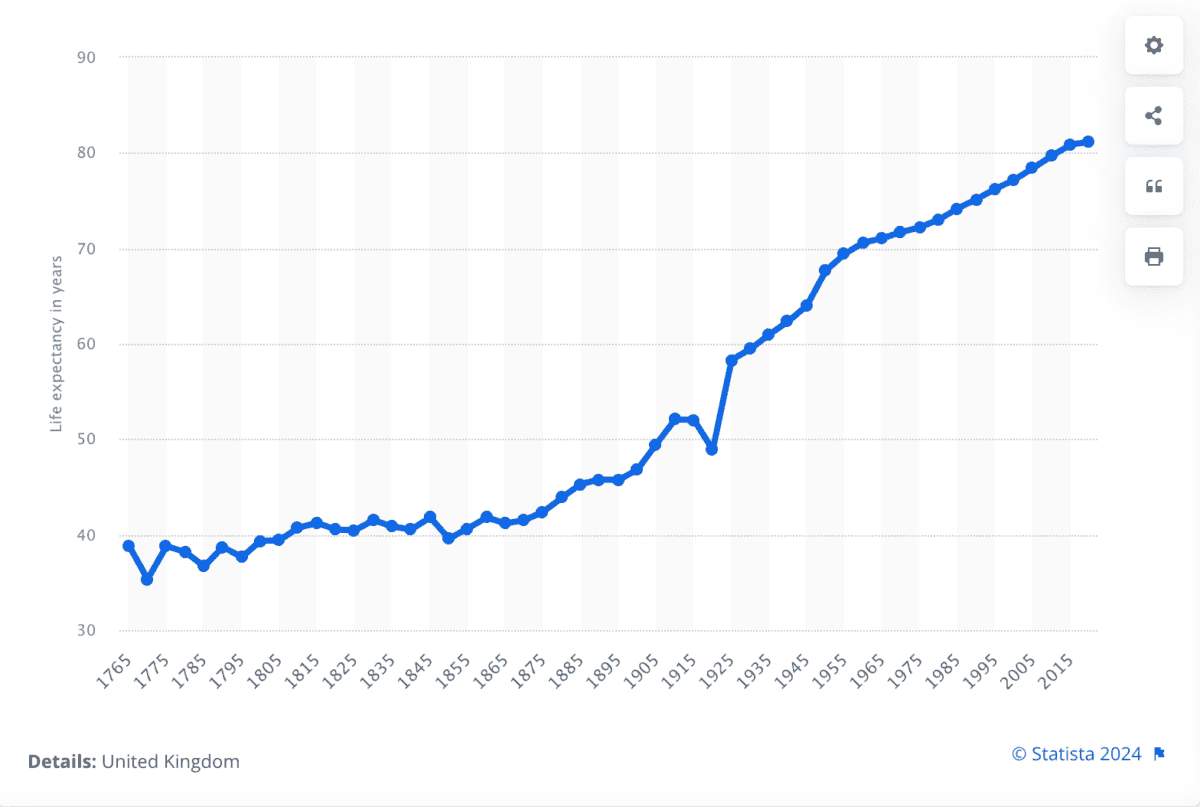

The steady trend of increasing life expectancy in the UK should mean strong demand for its buildings in future. However, as is always the case with investing, there are risks for investors to think about.

UK life expectancy 1765-2020

Source: Statista

Primary Health Properties has a record of increasing its dividend each year for over 25 years. But the amount of debt on its balance sheet might make maintaining this impossible in the future.

From an income perspective, any disruption to the dividend (which currently amounts to a 6% yield) would be unwelcome. But the company’s improving its financial position and could be a good long-term pick.

Aiming for £10,000

At an average dividend yield of 4%, I’ll need around £250,000 invested to earn £10,000 a year in passive income. I think that’s achievable, over time.

In terms of where to invest, my plan for the time being is simple. I’m aiming to buy whatever will generate the best return over time – whether that’s growth stocks or dividend shares.