Brokers and fund managers typically love growth shares, but the more savvy among them know a good dividend share when they see one. The following three UK stocks have had a tough few years — but are on the lists of pros in the know. I decided to see what all the fuss is about.

GSK

GSK (LSE: GSK) is one of the largest pharmaceutical companies in the UK, currently sporting a dividend yield of 3.9%. It had a good start to the year. On 15 May, the share price was up 22% year to date (YTD) — but things have gone downhill since.

A boost early in the year came after a positive FY 2023 earnings report, outlining growth across several metrics. Revenue and earnings grew 3.4% and 11%, respectively, from 2022. But the Q1 report in May was less positive, with earnings per share (EPS) missing analysts’ expectations by 19%.

Should you invest £1,000 in Lloyds Banking Group right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Lloyds Banking Group made the list?

Two months later, the price is back down to £15, where it started the year. But at least one broker doesn’t think it’ll fall any further. Major US bank Citi put in a ‘buy’ rating on the stock on 5 July. Does it know something we don’t? Possibly. Based on cash flow forecasts, I can see the current price is estimated to be undervalued by 64%. Sounds like growth potential to me.

Diageo

Diageo (LSE: DGE) is a part of world-famous investor Warren Buffett’s Berkshire Hathaway portfolio, although it holds the US-listed version. It’s one of few international companies the fund is invested in. Other notable ones include the Japanese conglomerate Mitsubishi Corp and the Chinese EV manufacturer BYD.

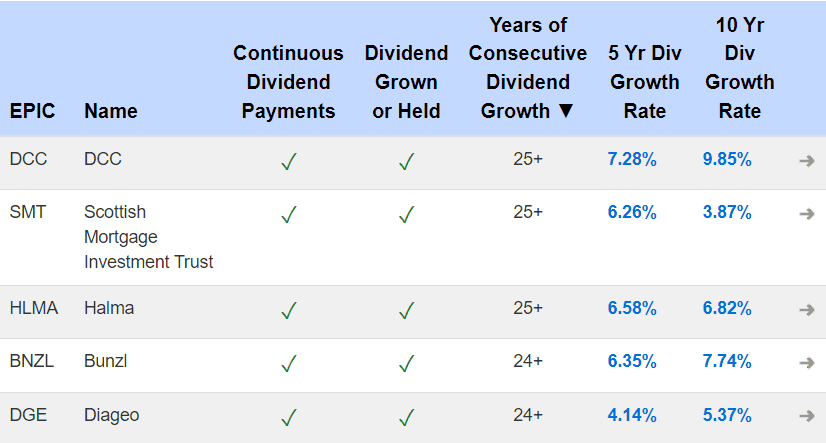

Looking at the share price today, one might question the Oracle of Omaha’s sanity — it’s down 24% in the past year! But this is a long-term investment and a solid dividend payer at that. With a 3.2% yield, it’s the fifth-most consistent dividend payer on the FTSE 100, with 24+ years of consecutive growth at a rate of 5.37% over 10 years.

However, its main product is alcohol, which may explain recent declines. Not only are younger people drinking less but economic strife has limited consumer spending on luxury items. Diageo may need to introduce more low-cost, non-alcoholic options to its brand portfolio if it hopes to remain relevant.

Unilever

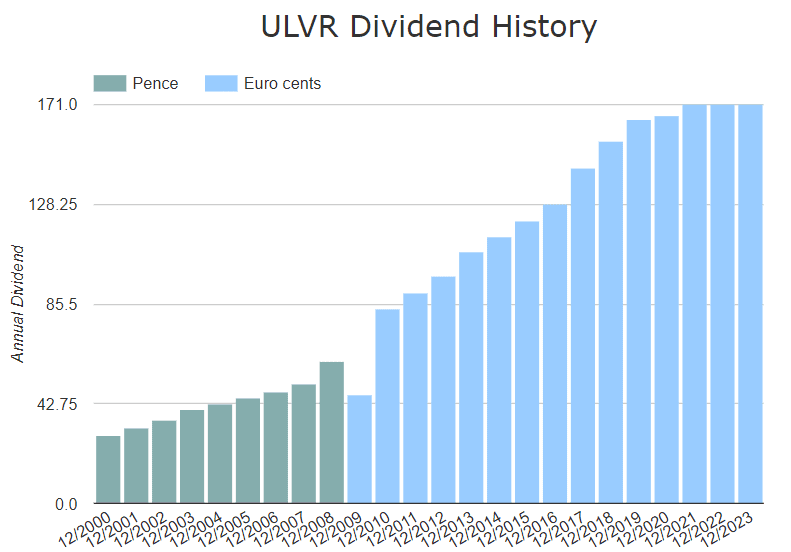

Unilever (LSE: ULVR) is a dividend stalwart in the UK market, with near-uninterrupted growth between 2000 and 2020. In recent years, payments have been capped at 170c but still represent good value with a 3.4% yield.

The price traded around £39 for most of Q1 but recently jumped above £42 after a positive Q1 earnings report. Underlying sales grew 4.4% with turnover up 1.4%. Based on profit margins and earnings forecasts, analysts estimate a fair price-to-earnings (P/E) ratio of 30, yet it’s currently 19.7. This suggests the price is cheap and may be one reason major broker JPMorgan put in an ‘overweight’ rating on the stock this week.

But like many popular brand retailers, Unilever is facing pressure from high interest rates. Consumers are increasingly turning to low-cost alternatives as belts tighten. With only 6% growth in the past year, it underperformed the FTSE 100. The dividends may pick up some of that slack but if things don’t improve, shareholders may start looking elsewhere.