Penny stocks can be famously exciting investments. And not necessarily in a good way.

These small-cap shares are often young companies that have significant growth potential. If things go right, they can experience blockbuster profits growth that drives their share prices through the roof.

However, penny stocks can also often experience significant price volatility, a reflection of weak liquidity and high levels of speculative trading. They can fall especially sharply when economic conditions worsen and fears over their balance sheet strength increase.

Buying cheap

This is why it can be a good idea to buy penny stocks that carry low valuations. The risk of a sharp share price fall can be limited, as the market has already taken a pessimistic view of the company’s prospects.

Buying any cheap stock has other advantages as well. If the company performs strongly, the share price can explode as investors recognise the true value of the business.

With this in mind, here are two top growth shares I think are worth a close look today.

Gold star

Purchasing commodities stocks can be a wild ride. Prices of raw materials are often volatile, which means these shares can soar or sink at a moment’s notice.

But a bright outlook for precious metals means investing in gold producers could be a good idea. Serabi Gold (LSE:SRB), which trades at 66.5p per share and has a market cap of £50.4m, is one such company on my radar.

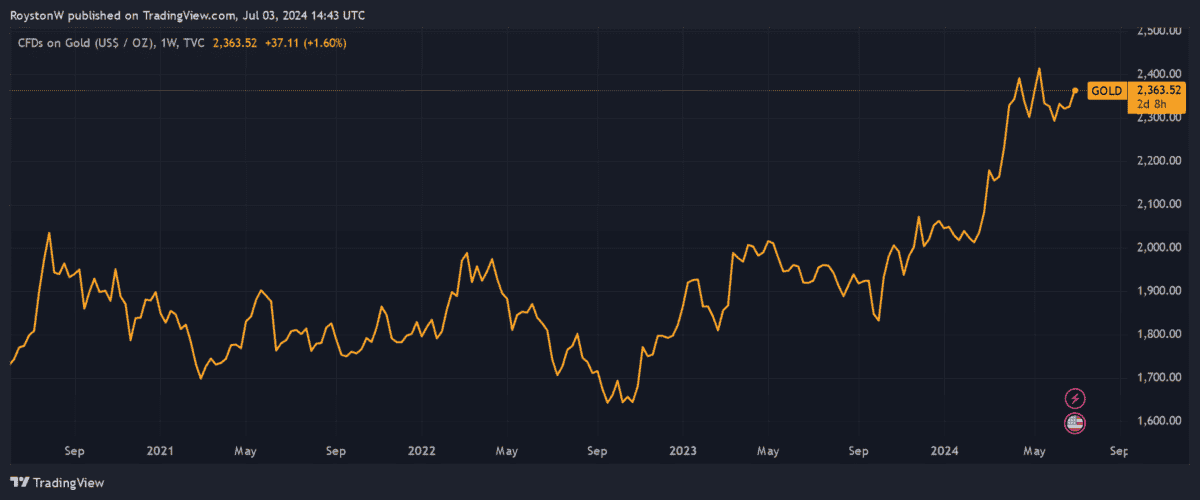

There’s no guarantee that gold prices will rise beyond May’s record peaks around $2,450 per ounce. But a ‘perfect storm’ of factors exists that might drive metal prices much higher. These include:

- Stubborn global inflation

- Major electoral shifts in Europe (and especially France)

- Significant government debt, particularly in the US

- Continued weakness in China’s economy

- Growing Western tensions with Russia and China

But why buy Serabi Gold shares to capitalise on this? For one thing, its shares offer good value today. The Brazilian miner trades on a rock-bottom forward price-to-earnings (P/E) ratio of 4 times.

Gold production is also rising as the business ramps up output at its Coringa asset. Group production rose 12.5% between January and March, representing the highest quarterly total since 2021.

Block party

Michelmersh Brick Holdings (LSE:MBH) is another good value penny stock to consider today.

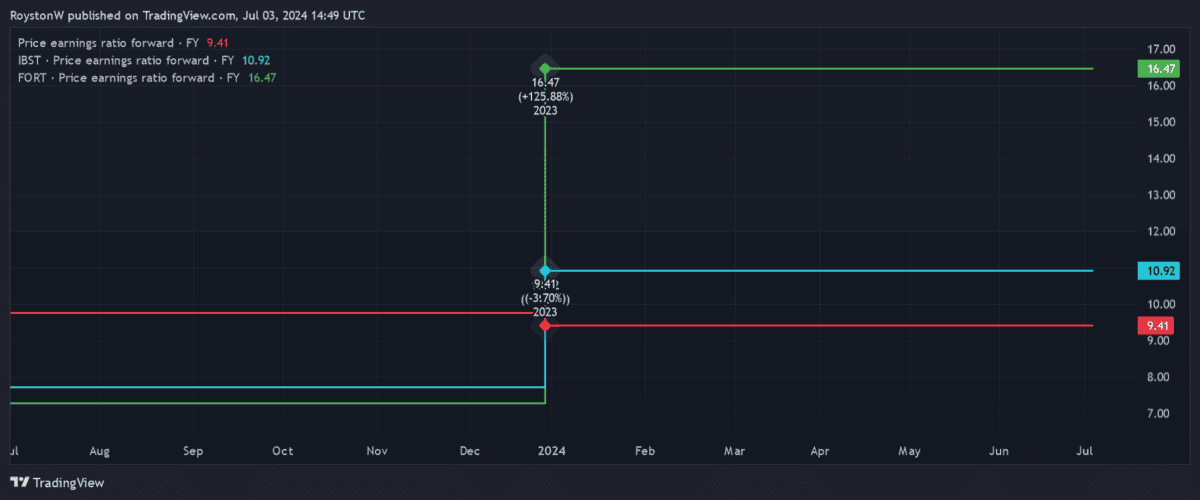

At the current price of 95.4p, the £93.7m cap business looks significantly undervalued compared to some of its peers. The gap between its forward P/E ratio of 9.4 times, and those of rivals Ibstock (in blue) and Forterra (in green), is shown below.

What makes brickmakers like this such an attractive investment though? Admittedly, demand for homes in the UK is currently weak due to higher-than-usual interest rates. This will remain a threat if inflation fails to stay low.

However, the long-term outlook for the housing market remains robust. Britain will need to ramp up housebuilding activity substantially in the coming years to meet the accommodation needs of its growing population. So sales of all kinds of construction products could be set for lift-off.

Michelmersh can also expect brick demand from the repair, maintenance and improvement (RMI) market to remain robust. Britain’s ancient housing stock requires constant renewal to stay standing.