We all love a huge dividend yield. But many investors make the mistake of attaching too much importance to this when choosing which passive income stocks to buy.

High yields can sometimes be a red flag, indicating that the company’s stock price has dropped due to underlying issues.

Picking dividend stocks

Furthermore, while large yields can suggest big dividend income today, it’s important to find companies that increase dividends over the long term. This usually indicates a stable and growing business, and can help investors build their wealth ahead of inflation over a long period.

Should you invest £1,000 in Gsk right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Gsk made the list?

It’s also important to look at a stock’s dividend payout ratio. A company that distributes most of its profits as dividends may have little capital left over for reinvestment to grow, and therefore to pay a sustainable dividend further down the line.

With all this in mind, which FTSE 100 shares do I think investors should consider for a second income? Here is one of my favourites.

A FTSE 100 star

Bunzl (LSE:BNZL) is brilliantly boring. It makes all of the essential products that make the world go round, from food packaging and medical gloves, to cleaning products and safety helmets.

The business sells into multiple sectors, too, like healthcare, retail, foodservice, and cleaning and maintenance. And while it sources just over half (54%) of revenues from North America, it has significant operations across the globe.

These qualities are what makes it such a fine dividend stock. Hugely diverse operations and considerable sales to non-cyclical industries mean earnings remain stable at all points of the economic cycle.

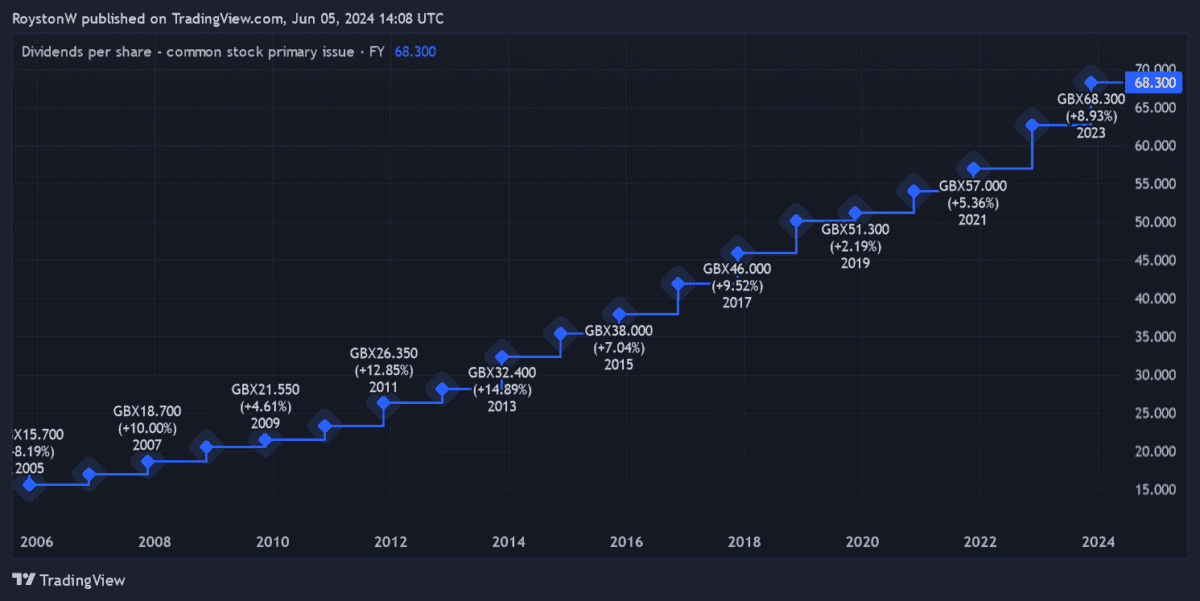

This in turn has led it to raise annual payouts for 31 straight years. A snapshot of its terrific payout record can be seen below.

With a payout ratio of around 40%, Bunzl is able to steadily raise dividends while also investing heavily to expand. The boost this has given to its long-running acquisition-based growth strategy — and by extension, to earnings — has also pushed Bunzl’s share price 539% higher over the past two decades.

More payout growth

Encouragingly for investors, City analysts expect dividends to keep rising through to 2026, too, as shown in the table below.

| Year | Total dividend per share | Forward dividend yield |

|---|---|---|

| 2023 | 68.3p | – |

| 2024 | 72p (f) | 2.4% |

| 2025 | 76p (f) | 2.6% |

| 2026 | 79.8p (f) | 2.7% |

Based on profits, Bunzl looks in good shape to meet these forecasts too. Predicted payouts for the next three years are covered between 2.5 times and 2.6 times by expected earnings.

A reminder that any reading above two times provides a wide margin in case earnings disappoint.

Of course there’s more to consider than just dividends when buying shares. A sinking share price can more than offset the benefit of a steadily rising dividend to an investor’s wealth.

In the case of Bunzl, a sudden spike in costs could hamper future performance. So could a shortage of attractive acquisition targets. But on balance, I think the potential benefits of owning its shares outweigh these risks.