Owning shares to try and earn some extra income has a number of attractions for me. When people talk about passive income, some of the schemes sound anything but passive to me. By contrast, if I buy the right dividend shares I can simply sit back and hopefully let the extra income pile up.

As an example, consider Legal & General (LSE: LGEN).

The FTSE 100 financial services company is well known thanks to its iconic colourful umbrella logo appearing in marketing over the course of decades.

It has a large customer base and is focused on a lucrative market sector: retirement planning. Demand for that is high and likely to stay so. Clients often stay with the same provider for decades, making for a potentially lucrative business model.

Proven earning potential

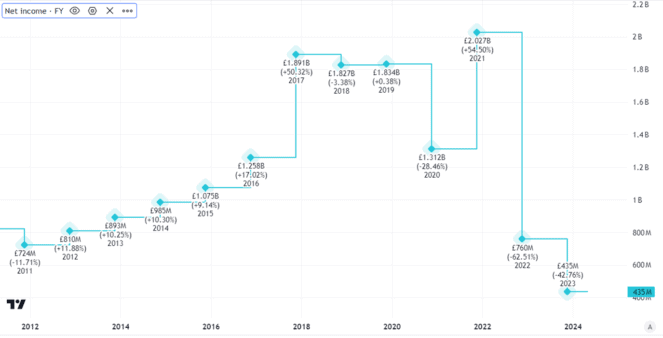

This is the case at Legal & General. Net income is substantial.

Created using TradingView

Last year, profit after tax came in at £443m. Set against a market capitalisation of £15bn, that means the firm trades on a price-to-earnings ratio of around 34. I think that is expensive. On a longer-term basis, though, I think the valuation is more attractive than it seems.

Earnings fell in the last two years, but the years prior to that demonstrate the profit potential offered by the company. The current market capitalisation is less than eight times 2021 earnings, for example.

Growing dividend

What does Legal & General do with the money it makes?

The past few years have seen it return a lot to shareholders in the form of dividends. Owning the shares could therefore give me some extra income. In the period from 2020 to this year, the company expects to have paid out £5.6bn–£5.9bn in total dividends.

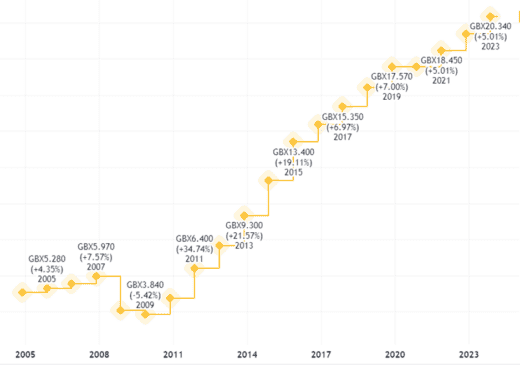

It set out a clear strategy that aimed for annual dividend increases of around 5% and has delivered on this in recent years.

In fact, the dividend was only held flat in one year recently, and that was during the pandemic. Prior to that, we have to go back to the aftermath of the 2007-08 financial crisis for the last time the company cut its payout.

Created using TradingView

Passive income potential

Could that happen again?

It could. For example, if another financial crisis leads policyholders to pull funds, Legal & General’s cash flows could suffer and that may lead to another dividend cut.

Over the long term though, I think the proven business has substantial cash generation potential. If I put £1,000 into the shares now, I should be able to buy 399.

The current annual dividend per share is 20.34p, so that £1,000 investment would hopefully give me extra income of over £81 per year. If the dividend keeps growing, that number would be higher in future.

If I had spare cash to invest in my ISA, this is one income share I would happily buy for it.