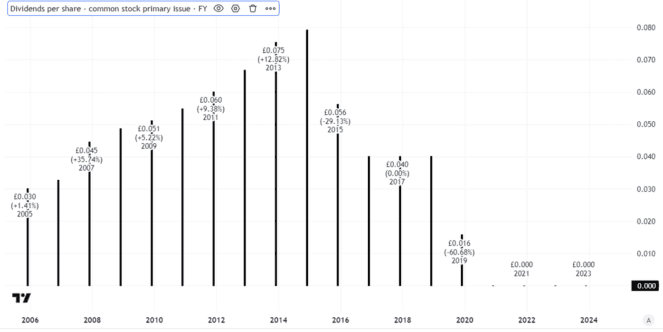

Back in the day – just five years ago – one attraction of owning Rolls-Royce (LSE: RR) shares was the aeronautical engineer’s dividend. The Rolls-Royce dividend was axed during the pandemic and has not come back.

Despite that, the shares have done well, moving up 48% in the past five years. Over the past year alone, the share price has soared 182%.

No immediate dividend prospect

The dividend history of Rolls-Royce was uneven even before the pandemic.

Should you invest £1,000 in Admiral right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Admiral made the list?

Created using TradingView

The lack of a payout in recent years can be pinned on several reasons. The first was large losses and growing debt after the pandemic started. The dividend was not a priority as the company focused on regaining financial health.

But the current chief executive also seemed to place little emphasis on a dividend when starting in the role. It merited little or no mention in company results announcements.

Both factors have now changed. Rolls’ financial performance has improved markedly, Management has set out ambitious medium-term targets that would equate to further improvement from current levels.

The company has now also set out its plan when it comes to bringing back the Rolls-Royce dividend: “Once we are comfortably within an investment grade profile and the strength of our balance sheet is assured, we are committed to reinstating and growing shareholder distributions.”

Potential for the payout to come back

How long it takes for the company to be “comfortably within an investment grade profile” is subjective.

But with S&P having restored Rolls’ investment-grade rating this year, I think that criterion could well be met over the next couple of years.

What about the balance sheet?

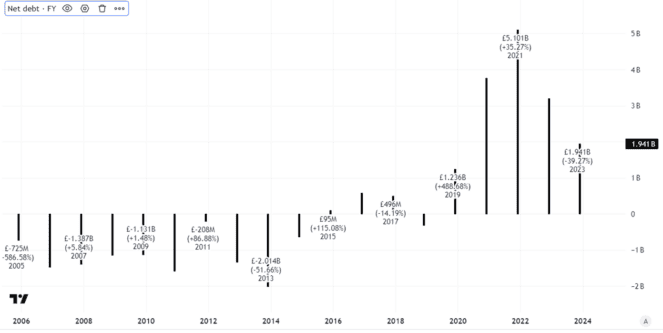

Net debt has been heading in the right direction recently, as the chart below shows. I expect that to continue as the company’s free cash flow generation has improved markedly.

Created using TradingView

Still, net debt remains well above where it typically stood in the years leading up to the pandemic. So I think it may take several more years for the company to feel confident that the strength of its balance sheet is “assured”.

Sizeable free cash flow potential

So, I do not expect a Rolls-Royce dividend for 2024 and would be surprised if there is one in 2025 although it could happen.

I reckon the payout will likely make a comeback in or around 2026, unless business performance changes. That could happen for reasons outside Rolls’ control, such as another sudden slowdown in civil aviation demand. That is why at the current share price I am not investing.

How big might that dividend be? Past performance is not necessarily an indicator of what happens in future. I expect the company may want to start any dividend restoration on a conservative basis.

On a 2027 timeline, Rolls is forecasting free cash flow of £2.8bn — £3.1bn. At the low end and presuming no further share dilution from today, that would mean around 33p per share in free cash flow.

That could comfortably support a dividend of 15p-20p per share, equivalent to a 3.4%-4.5% yield at the current share price.

With a strong brand, large customer base and improving performance that could yet happen. Whether it does remains to be seen, however.