Unless readers have been living under a rock, they’ve probably heard of passive income – that elusive workhorse that tops up a bank account while we’re sleeping. It’s a dream I imagine everyone shares (besides those who genuinely want to work until they die).

But how does one achieve this dream? That’s the real question.

Investors tend to earn passive income through growth shares that enjoy high price appreciation, or value shares that pay dividends. Usually, it’s a combination of both. A well-diversified portfolio of growth shares and value shares delivers the best of both worlds.

But if I had to choose just one growth and one value share to go all in on, it would be the following two.

Legal & General

Legal & General (LSE:LGEN) is one of the oldest and longest-running insurance and asset management firms in the UK, having been in the game since 1836. Its price growth is nothing to write home about – it’s risen a bit in the past 10 years but is down 12% in the past five. Insurance simply isn’t a high-growth market, often stifled by strict regulations and economic uncertainty. That’s another thing – if inflation doesn’t settle down soon, premium insurance brokers could struggle to attract new customers.

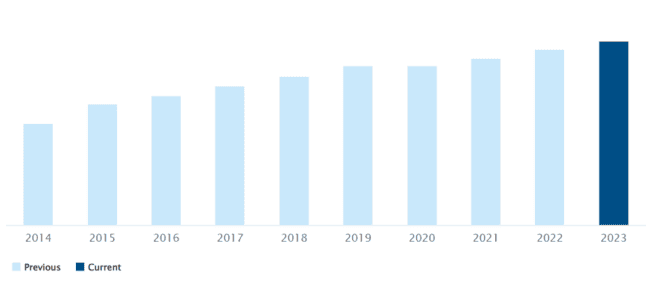

But it’s a dividend powerhouse, pumping out a full 8.4% of extra dividend value to shareholders annually. Last year its dividend per share was 20.3p and it’s forecast to grow to 22.6p by 2025. Its track record of paying dividends is nothing short of spectacular. Since 2014 the yield has doubled and has paid out consistently every April and August without missing a beat.

Legal & General dividend yield growth:

For example, £10k invested in L&G shares could grow to £120,300 in 20 years with current conditions. That would pay a tasty annual dividend of £8,756 – or even more if the dividend yield increases.

London Stock Exchange Group

London Stock Exchange Group (LSE:LSEG) would be my pick for a solid and reliable growth stock. As the company that owns and manages the London Stock Exchange (LSE), it’s well-positioned to ensure consistent growth for decades to come. Assuming, of course, that the UK market in general remains profitable. Apparently, Shell feels so undervalued it wouldn’t rule out a move to the New York Stock Exchange.

As the second-largest listing on the FTSE 100, that could certainly hit our local market hard.

But move or not, the LSE would survive and the group should remain profitable. Besides managing the exchange, it provides real-time financial data to investors and companies through its recent acquisition Refinitiv. That, combined with a 10-year Microsoft deal for AI integration, has helped catapult the company into the 21st century.

Its share price has grown to £91.30 in the past 20 years, up from only £4.12 in April 2004. That’s an annualised return of 16.5% per year. But with the growth pumping up its price-to-earnings (P/E) ratio, it’s no longer the bargain it used to be. At 66, the P/E is way above the industry average of 15.2. Unless a big injection of income suddenly appears out of nowhere, the price could start dropping in the short term.

That’s OK though, because I’m only looking at the long term, and it looks good to me.