The Diageo (LSE:DGE) share price has been trading below £30 since dropping below the key price level in November last year.

The situation mimics similar movements in 2019, when the price remained above £30 briefly before falling below it. The shares then struggled to break back above £30 until April 2021. If the price level proves to be as growth-resistant this time, it could be a long time before Diageo makes significant gains.

But things are different now. In 2020, markets were battered by the pandemic. In 2021, they were shored up by stimulus cheques. Now, neither factor exists. So where’s the price headed?

How are the books looking?

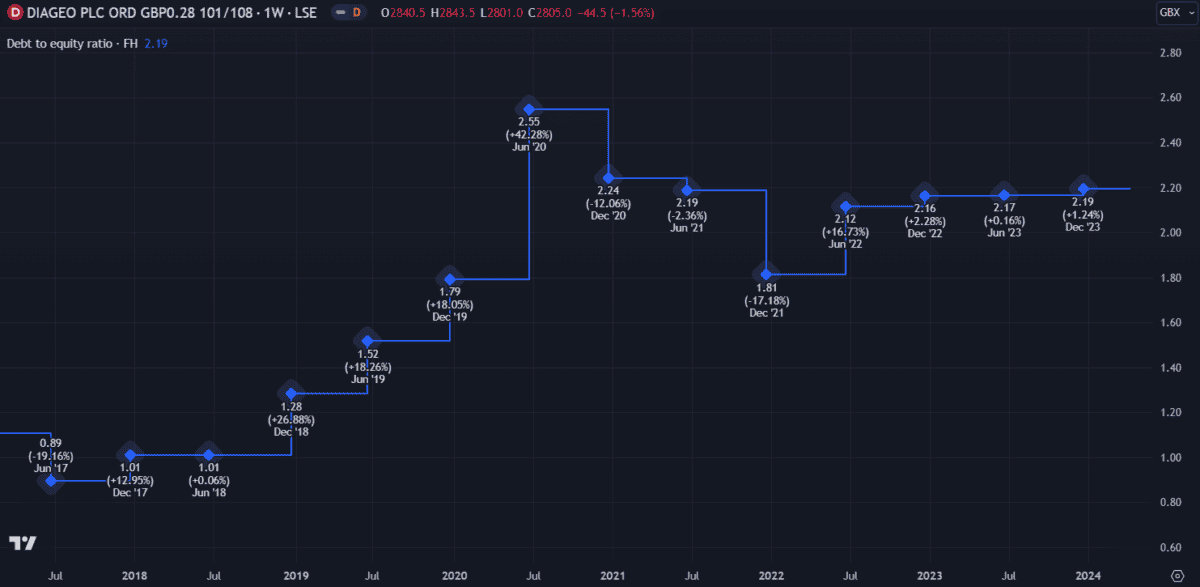

Diageo has a fairly clean balance sheet despite high debt. Its debt-to-equity (D/E) ratio shot up during the pandemic but has recovered and remained stable since. Although it’s high, it’s well-covered by operating cash flow and interest payments have a coverage ratio of 7.2.

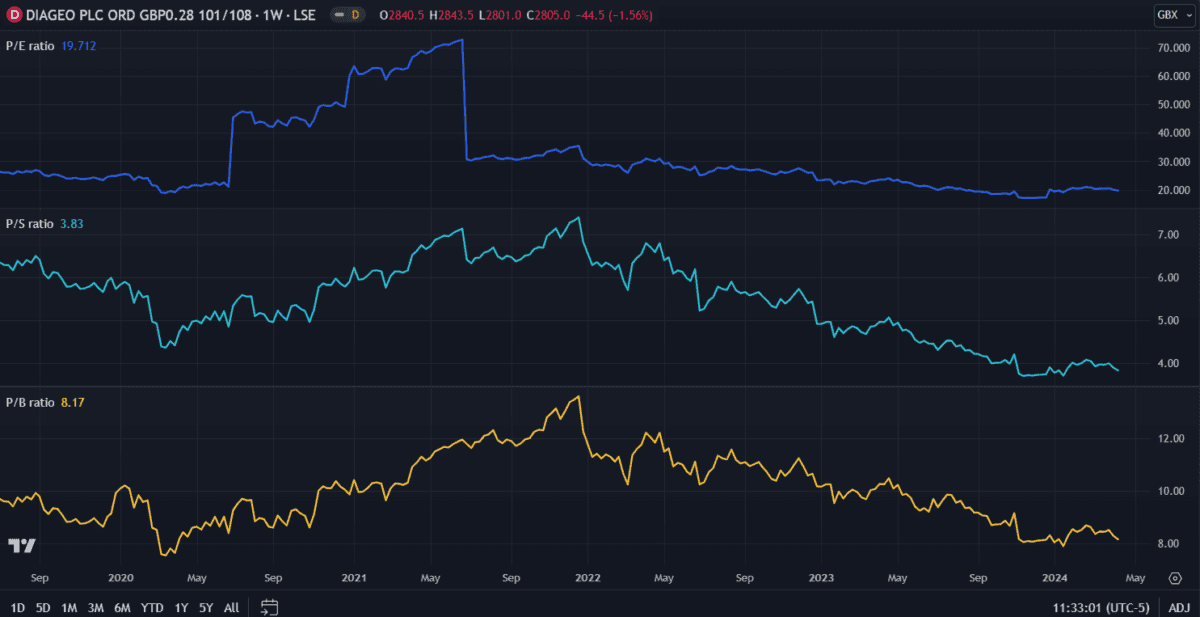

With a £78.8bn market cap and £4.26bn in earnings, Diageo has a relatively high price-to-earnings (P/E) ratio of 18.5. This is a trailing (that is, based on past figures) ratio, but with earnings expected to remain stable, the forward P/E ratio is only slightly higher.

Industry peers like Associated British Foods and Coca-Cola HBC have slightly lower P/E ratios, on 17.4 and 16, respectively. Diageo is slightly above the industry average of 17.7. This supports a thesis of limited price growth going forward. A price-to-sales (P/S) ratio of 3.85 and price-to-book (P/B) ratio of 8.2 further support this thesis.

But Diageo is a multinational retail giant with top brands like Smirnoff, Guinness and Johnnie Walker – what’s holding it back?

Economic tightening and fewer drinkers

Last year, premium alcohol sales figures in Latin and South America came in signifcantly lower than expected. But that’s not the only region slowing down. European sales have also been sluggish as ongoing economic uncertainty has led to reduced spending on premium goods.

Alcohol expenditure among younger generations has been declining for some time now too, particularly in the UK. A recent health survey found fewer young people drink alcohol for both health reasons and affordability. A similar trend is evident in the US, where only 62% of adults under 35 say they drink, compared to 72% two decades ago.

That said, restaurants and bars worldwide continue to stock Diageo’s brands – and will likely continue to do so for the indefinite future. Let’s be honest, while lower alcohol consumption may hurt sales, it’s a net positive for society overall.

Future prospects

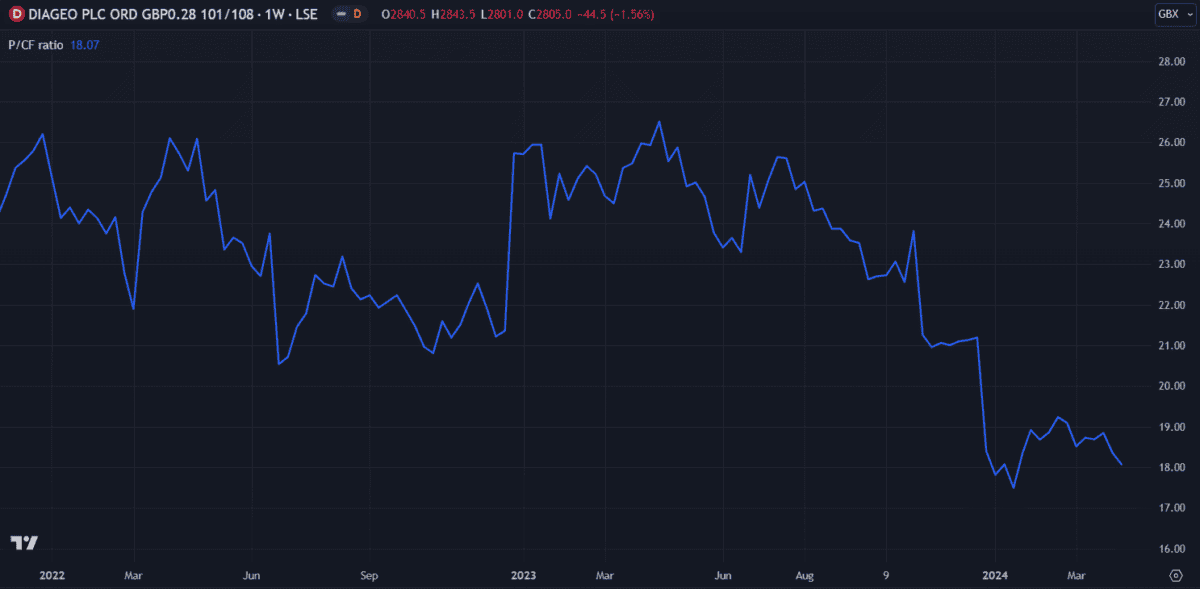

The price-to-cash flow (P/CF) ratio has declined with the price, indicating stable cash flow. Using a discounted cash flow model, analysts estimate the shares are now undervalued by around 28%.

But this doesn’t necessarily equate to much price growth in the near future.

Independent analysis estimates an average 12-month price target of £30 – an 8% rise from current levels. It seems to me the price could trade sideways in the current £26 to £30 range for the rest of the year.

While Diageo remains a strong industry leader, I don’t expect the share price to break £30 until the weakened economic outlook improves. However, I’ll hold my shares for now as I believe the company has long-term value.