The AstraZeneca (LSE:AZN) share price has fallen 8.4% over the past 12 months. It’s underperformed the wider FTSE 100. That’s certainly not something I thought I’d say a year ago. So, what’s going on with it?

Moving sideways

It’s been an underwhelming year for AstraZeneca stock, and there are no obvious reasons for this. The oncology-focused company is up 75.6% over five years, and it appears to have reached something of a plateau.

One setback was the perceived disappointing results of its datopotamab deruxtecan lung cancer trial in October. Jefferies analyst Stephen Barker suggested the trial results were “worse-than-expected,’ noting only a marginal improve in the condition of non-small cell lung cancer.

However, the US Food and Drug Administration has since been given the green light for the treatment for patients with treated advanced nonsquamous non-small cell lung cancer.

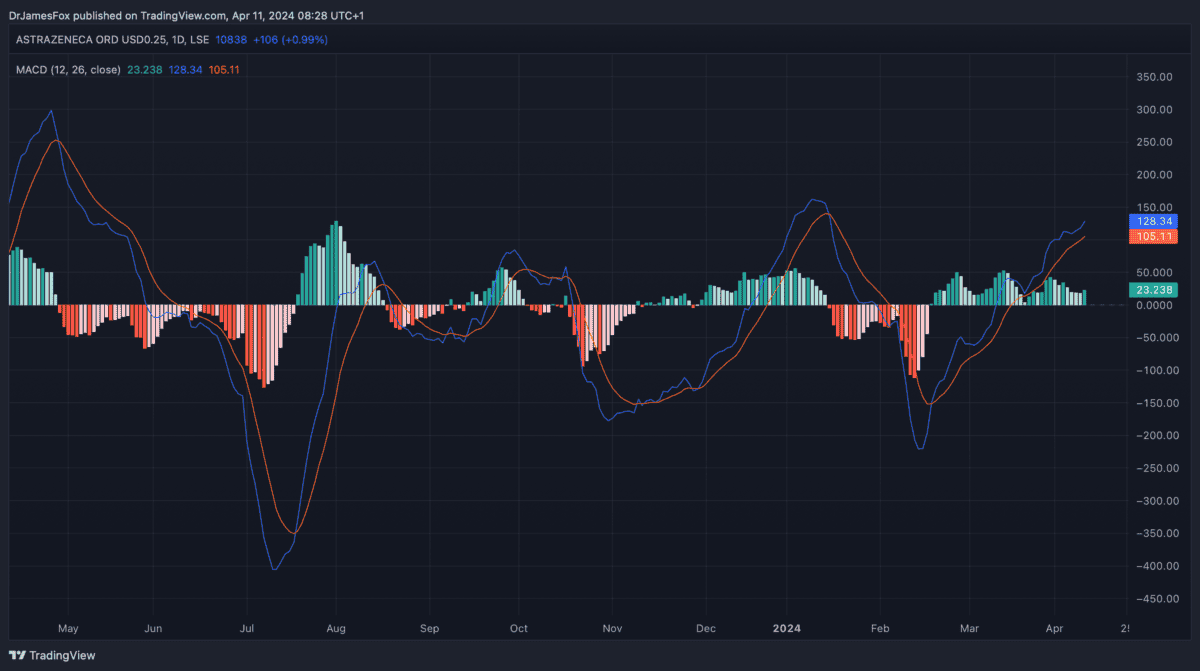

Datopotamab deruxtecan is just one of several factors that could have negatively impacted the share price. Of course, with AstraZeneca receiving a lot of attention during the pandemic, investors may have simply found better value elsewhere. The below chart tracks the company’s momentum over the past 12 months.

Possible catalysts

One possible catalyst for share price growth was announced on Thursday 11 April. Ahead of a key shareholder vote on pay for its long-standing chief executive Pascal Soriot, AstraZeneca promised to increase its dividend by 7% this year. The dividend yield currently sits at 2.12% — not particularly exciting.

The stock was up 1.1% in early trading.

There are also several catalysts in the form of drug approvals, including breast cancer treatment Truqap and nerve disorder treatment Wainua in the US. Imfinzi, which contributes an impressive 9% of the company’s revenues, was approved in China in November. Depending on the uptake in this huge market, it could be a substantial boost.

There’s also the matter of improved guidance. Management recently revised guidance upwards from the “high single-digit to low double-digit percentage.” If it can come through and start showing evidence of this, I’d expect further upward movement in the share price.

Of course, there are always ups and downs in drug and treatment development. Some treatments fail despite millions of pounds of investment.

Valuations

AstraZeneca certainly doesn’t look like bad value. The pharma giant is currently trading at 16.8 times forward earnings, representing a 14.2% discount to the wider healthcare industry. And given modest growth expectations, this forward price-to-earnings (P/E) ratio falls to 14.5 times in 2025 and 12.5 times in 2026.

For me, one of the most important metrics is the price-to-earnings-to-growth (PEG) ratio. This is essentially the forward P/E ratio divided by the expected average annualised growth rate over the medium term. AstraZeneca’s PEG ratio is 1.4. Coupled with the small but handy dividend yield, this doesn’t scream value.

However, with global populations ageing and treatment costs becoming more realistic in the developing world, a lot of the value for pharma stocks is beyond the medium term.