Tesco (LSE:TSCO) shares performed remarkably well in 2023, far outpacing the rest of the FTSE 100. However, the stock’s flat in 2024 and there appears to be very little momentum despite some improving macroeconomic factors. So is Tesco stock now overvalued?

Share price targets

A good place to start to work out how much a stock should be worth is by looking at share price targets. These are the published targets issued by City and Wall Street analysts and the consensus of their estimates can be very useful.

The average Tesco share price target’s currently £3.29 and that infers the supermarket giant’s undervalued by around 12.1%. That’s not a bad sign, but I’ve seen clearer examples of stocks trading at a discount.

It’s always worth remembering that analysts don’t update their share price targets all the time. So sometimes they’re just not that relevant. As such, it’s often worth disregarding those that were published more than three months ago. However, this is often more useful when we’re looking at faster-moving sectors like tech and AI.

Not clearly overvalued

Tesco’s trading at 12.1 times forward earnings. That makes it cheaper than the average price-to-earnings ratio for FTSE 100. Moving forward, the grocer’s trading at 11.8 times forecast earnings for 2025 and 11.2 times earnings for 2026. This puts it broadly in line with its peers. In fact, there isn’t a huge amount to separate the biggest names in the sector.

From a price-to-earnings-to-growth (PEG) ratio, Tesco isn’t overly exciting. The company’s earnings are growing by around 3% annually, leading to a PEG ratio of four. However, PEG ratios aren’t always that useful for companies paying a dividend. And Tesco’s 3.8% yield is nothing to be sniffed at.

The bottom line

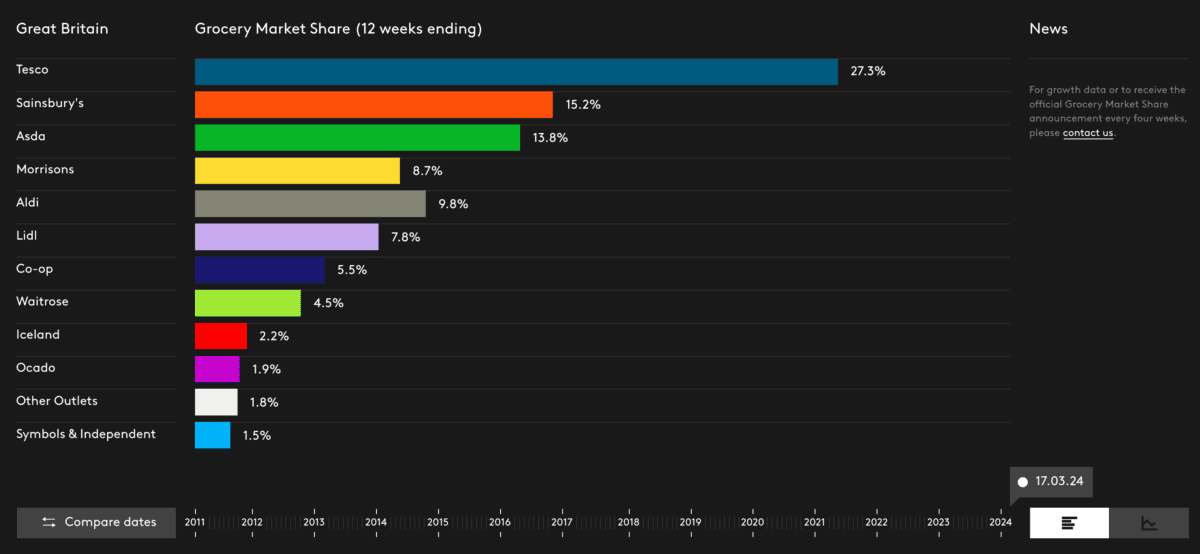

The pandemic and cost-of-living crisis have reshaped consumer shopping habits in the UK, with low-cost brands Aldi and Lidl emerging as major winners. The two companies have taken market share away from legacy grocers in the UK, but not Tesco.

Either due to its positioning in the market — serving that large middle income part of our community — or because it was truly able to leverage its scale and lower prices where necessary, Tesco has maintained its dominance in the market.

As we can see from the below Kantar data, Tesco is by far the largest grocer in the UK still.

While the cost-of-living crisis appears to be fading, there are still economic challenges that may favour Aldi and Lidl in the near term. However, looking at the bigger picture, I’m impressed by Tesco’s performance in recent years and I think it will remain in pole position to dominate as the UK emerges from this economic slumber. I don’t think the stock’s overvalued.