This week will see the annual Stocks and Shares ISA deadline for contributions. That ought to focus the mind of investors!

But while I cannot add new money to this year’s ISA after the end of the current year (when a new year’s allowance will kick in), I also do not need to invest the money immediately. I could park it in my Stocks and Shares ISA for the tax benefits of such a move, then invest it at a later date when I am ready.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

In fact, even if I had no investing ideas right now, that is what I would do. After all, there are lots of shares I would happily buy – but not today.

Let me explain why.

Price and value

As famed investor Warren Buffett says, price is what you pay and value is what you get.

One common mistake people make when they start investing is confusing a good business with a good investment. Apple is clearly a good business, with a huge customer base, premium brand and attractive profit margins.

It has also been a brilliant investment for Buffett over the past eight years.

But whether it is a good investment for me now depends in part on what I pay for it. Apple shares have comfortably more than tripled in the past five years.

Good for Buffett. But what about me? The shares now trade on a price-to-earnings (P/E) ratio of 27. That does not look like compelling value for me.

UK share with Buffett-style business model

Looking closer to home, I also see zero likelihood of me buying Judges Scientific (LSE: JDG) before next week’s ISA deadline.

Its P/E ratio of 72 is far too high for my liking.

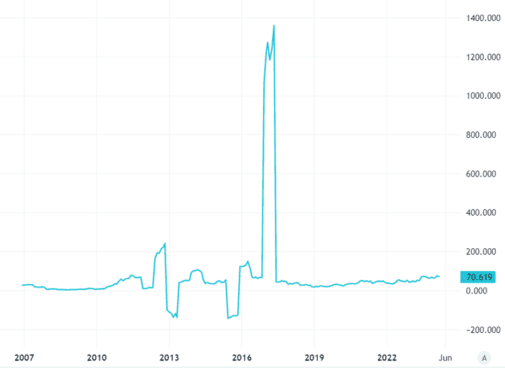

Source: TradingView

However, the business looks wonderful to me. It operates a bit like Buffett’s own conglomerate, Berkshire Hathaway. By buying businesses, Judges can offer centralised services like financing, letting the acquired companies focus on what they do best.

In the case of Judges, that is making instruments like lab measurement tools. As accuracy is crucial, customers are willing to pay premium prices.

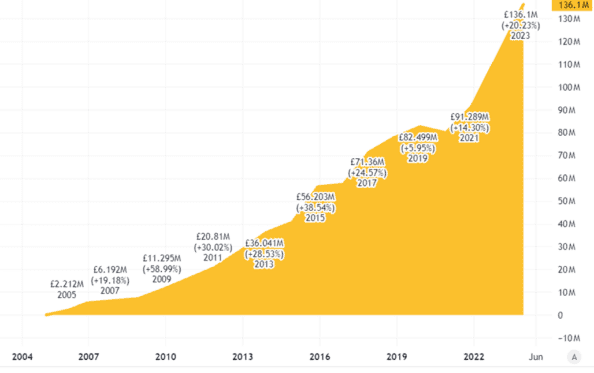

The firm has been growing sales quickly.

Source: TradingView

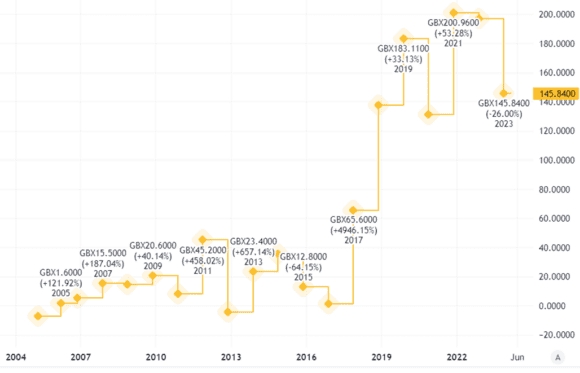

But by taking a disciplined approach to acquisition prices, its profits have also soared. This chart shows earnings per share.

Source: TradingView

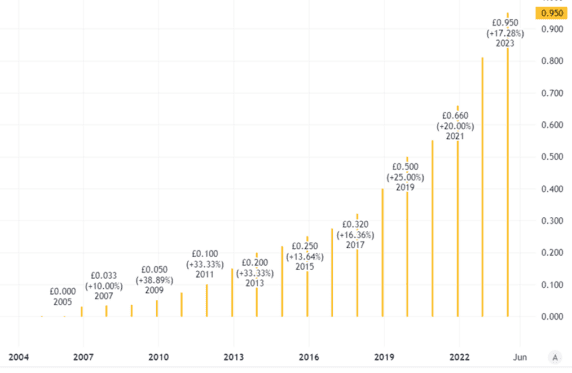

Even better for income investors, that has allowed for very strong dividend growth.

Source: TradingView

There are risks.

Other companies could try to ape Judges’ success, pushing up acquisition costs and hurting profitability. Quality from low-cost manufacturing countries might improve, hurting Judges’ pricing power.

For now though, Judges looks like a brilliant business to me.

Patient long-term investing

So why would I put money in my Stocks and Shares ISA before the looming deadline with a view to possibly buying shares like Judges in future, but not now?

In a word: valuation. Judges is a brilliant company but it is too expensive for my tastes.

So it is on my shopping list for moments when the P/E ratio falls suddenly, like some shown in the chart above.

For now though, I will be watching without yet buying.