Last year was a phenomenal one for shareholders in Rolls-Royce Holdings (LSE: RR). The share price more than tripled. Indeed, Rolls-Royce shares were the best-performing in the entire FTSE 100 index in 2023.

Has that led to a hangover in 2024? Not at all.

In fact, the shares are already up another 43% so far this year. Can such momentum keep going?

Up 1,000% since 2020!

When a blue-chip share more than triples in a year there is often a clear set of reasons.

Rolls-Royce shares have risen dramatically partly because they had fallen a long way in recent years. Having a low base always flatters subsequent performance.

Still, a rise is a rise. If I had invested £1,000 in autumn 2020, I could now have a stake valued at around £11,000.

What has driven the rise

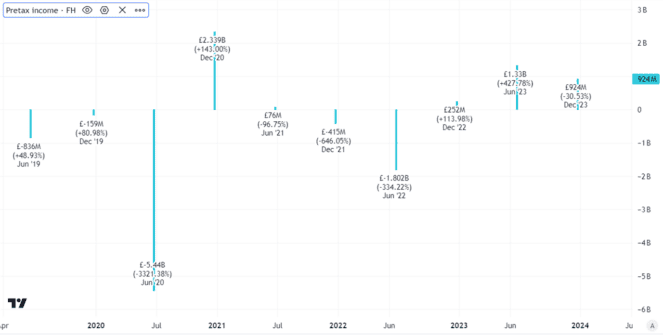

There are two drivers for the rise. One has been improving business performance at the company. Last year, for example, it turned a sizeable loss into a pre-tax profit.

The earnings improvement has been driven by a cost-cutting programme boosting the bottom line, combined with top line growth, thanks to demand recovery. That follows the pandemic years when fewer large engine flying hours for civil aircraft led to lower revenues.

Source: TradingView

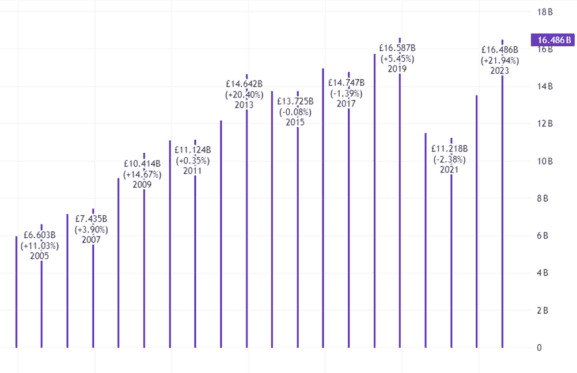

But although it has been cheering to see revenue grow again at Rolls-Royce, as the chart above shows, it is simply back to roughly where its historical growth trend suggested it would be by now.

Last year’s total earnings of £2.4bn were certainly strong, but still well below record levels for the company.

So why else have Rolls-Royce shares been soaring? I think the answer is not just that business has been improving sharply, but that the City expects dramatic further improvement in future.

Ambitious medium-term targets

That expectation has been driven by the company’s chief executive setting out an ambitious set of goals for the business.

By 2027, those include underlying operating profit of £2.5bn-£2.8bn and free cash flows of £2.8bn-£3.1bn.

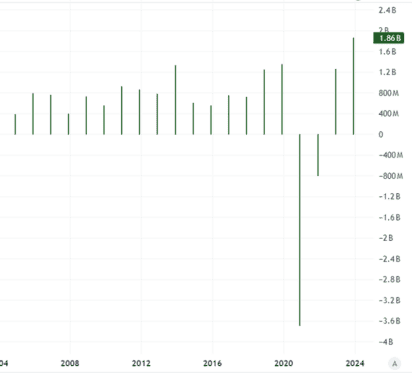

Compared to the company’s historical free cash flows, that would be a very impressive performance.

Source: TradingView

Could the shares keep going?

The mid-point of that target would mean free cash flows 130% higher than last year.

That would mean, even after their recent incredible run, Rolls-Royce shares trade at around 18 times prospective 2027 free cash flow.

As a valuation, that is not cheap. But it is not necessarily expensive.

With its unique expertise, installed base of engines requiring decades of costly servicing and a sizeable order book, Rolls looks well-positioned to try and achieve even stretching financial targets.

If it shows ongoing progress in coming months and years, I think the shares could move even higher from here.

Those targets are demanding though. Rolls has few competitors but there are some and for new orders especially. If prices rise, customers may be forced to look at alternatives.

Meanwhile, the plans could be sunk by a sudden unexpected drop in aviation demand outside the company’s control, as we saw four years ago.

Given those risks, Rolls-Royce shares do not now look like great value to me. I will not be buying them.